Introduction

If you’ve seen The Naked Gun, you remember the famous scene: chaos everywhere, explosions in the background, and Leslie Nielsen calmly telling the crowd, “Please disperse, there’s nothing to see here.”

Of course, the joke is that everything is on fire — and that’s exactly what this market feels like right now.

Under the surface, there’s been utter carnage. Growth stocks and key subsectors have seen the floor fall out, with many names down 25–50% just since the start of the year. These are the kinds of moves typically associated with bear markets, and the speed and velocity have been staggering. For the average investor, it feels like getting caught in headlights — one minute things look stable, the next several positions are down 15–20% as a violent rotation sweeps through the tape.

This is what happens in today’s market structure. Risk builds slowly… and then reprices all at once.

It’s also exactly what we’ve been warning about for weeks.

We never claimed to know the precise catalyst or timing. We simply knew risk was building beneath the surface. We highlighted that internal deterioration was worsening. We flagged that the seasonal window of weakness began in February. The message was consistent: be more selective and more tactical.

In our February 1st report, we wrote:

*“The major indexes have not yet confirmed the internal weakness we are observing across positioning, leadership, and risk-sensitive areas of the market. That doesn’t mean confirmation won’t come — only that, for now, the stress is being masked by index-level stability.

Markets often hold together at the surface longer than participants expect, even as internal deterioration quietly builds. When that divergence resolves, it tends to do so quickly.”*

At the time, the indexes hadn’t broken. But the title of that report was Get Worried — and we meant it.

We laid out numerous reasons for our growing caution (see prior reports for the full framework), but the key takeaway is this: our tactical guidance this year has been aligned with the market’s major inflection points.

We recommended rotating into small caps in December (+10% to start the year).

We advised trimming that exposure into the highs (-5% since our signal to sell).

We warned of a violent correction in gold days before it occurred (Gold dropped 20% in one day).

We repeatedly flagged worsening internals and urged selective capital deployment (Nasdaq off ~6% in the last week).

That’s not prediction — that’s process.

Which brings us to this week’s theme: dispersion.

While parts of the market look like a wrecking ball went through them, the major indexes are still only a few percentage points from their highs. That disconnect is being driven by extreme dispersion beneath the surface.

Technology, Media, and Telecom make up roughly 40% of the S&P 500. When leadership there falters, index progress becomes difficult. But that doesn’t mean there’s no strength elsewhere. In fact, according to Ned Davis Research, this is only the second time in history that more than 62% of S&P 500 stocks are outperforming the index itself.

In other words:

There’s a lot to see here — just not where most people are looking.

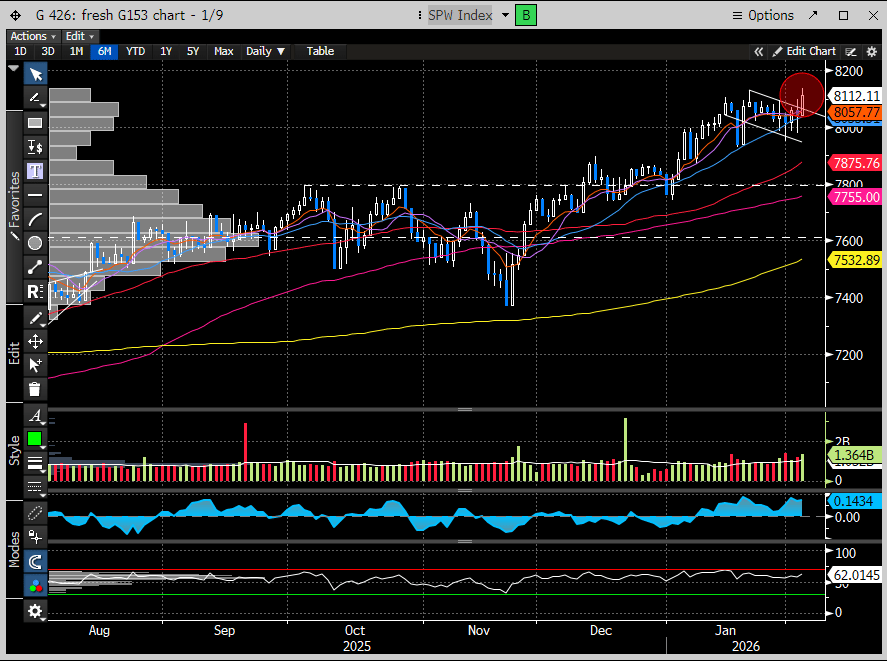

This dynamic is best captured by the S&P 500 Equal Weight Index (SPW), which made a new all-time high today. That’s not a trivial development — it’s one of the clearest hallmarks of a healthy bull market: broad participation.

So, while retail favorites and the most overcrowded technology names are getting hit hard, a majority of stocks are quietly pushing to new highs.

Don’t believe us? The chart below just recorded the highest percentage of S&P 500 stocks hitting new 52-week highs since November 2024.

Remember the chart we’ve been highlighting — the cyclical rotation is real. Meanwhile, the technology sector is now down roughly 5% on the year.

That trend is likely to persist if the yield curve continues to steepen. Long-duration assets typically face multiple compression when long-term yields rise — a key reason the rotation out of tech has been so sharp.

No one said this market would be easy — and many retail investors are likely learning that the hard way. What worked over the past two years has flipped, with leadership now favoring more value-oriented and cyclical areas.

This rotation can persist longer than most expect. Timing the turn is difficult, but a valuation reset in technology may be necessary before leadership shifts back.

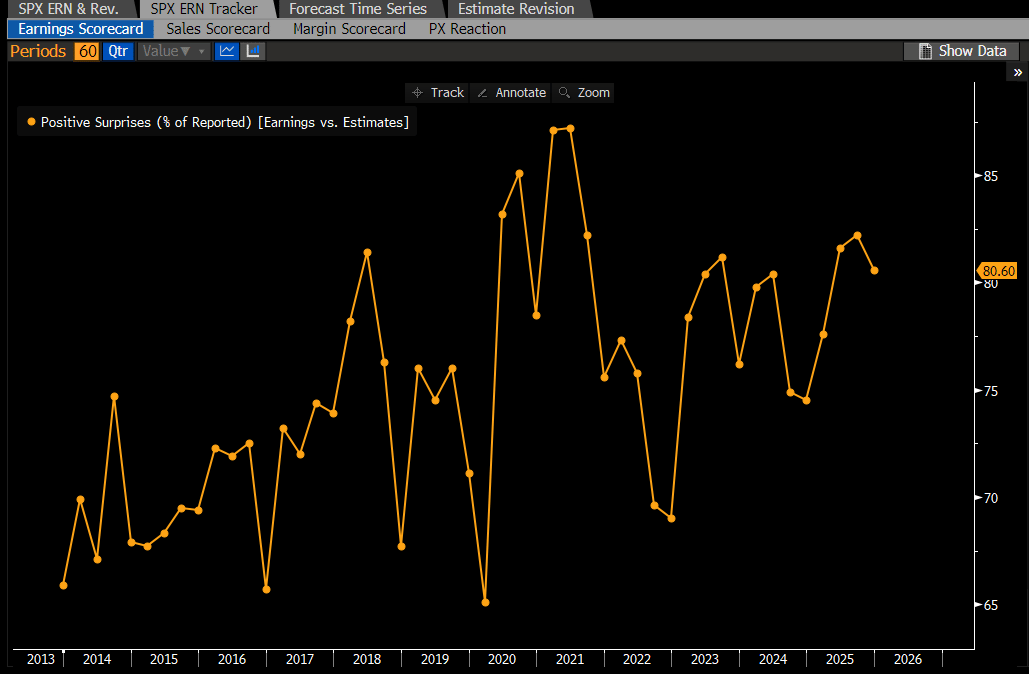

Meanwhile, earnings have been solid. Roughly one-third of companies have reported, and about 80% have beaten expectations.

Forward earnings are still projected to grow at a healthy pace year over year (around +16%). If that holds, fears of an imminent economic slowdown may be overstated, and the damage in certain areas of the market likely reflects a necessary valuation reset rather than something more ominous.

What we’re seeing looks more like classic rotation — and rotation, at its core, is a bullish characteristic of durable markets.

That said, rotation doesn’t prevent corrections — and that’s clearly what we’re seeing in the Nasdaq Composite and growth-heavy sectors. If the weakness deepens materially, it could become more problematic, but for now it appears corrective rather than structural.

Let’s turn to the charts to see what the price action is telling us.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade