Invest Smarter with Digital ETPs

DeFi Technologies (US: DEFTF & CAD: DEFI.NE) is transforming traditional finance by offering regulated access to over 60 digital asset exchange-traded-protocols (ETPs). Empower your portfolio with secure solutions for Bitcoin, Ethereum, Solana, Ripple and beyond.

It feels eerily similar to last Wednesday as we sit down to write this report. The market gapped down after the DeepSeek release last Monday, then rallied to close the gap. Now, history repeats but with alternative reasons: Monday’s tariff-driven gap down has been erased, and we’re trading at nearly the same level as last week. All that volatility—for what? The SPX is up a mere 22 points from last Wednesday’s close. Welcome to Déjà Vu: Part Deux.

The beauty of this volatility is that we’ve been positioned tactically from the start, recommending to sell strength before the DeepSeek drop and then buy the gap-down into our identified support levels. We followed the same playbook this week and once again advised buying Monday’s dip. While the index itself has been choppy, our tactical trading approach has delivered meaningful alpha against the benchmarks.

Here’s what we wrote in our 2/2 report, reinforcing an opportunistic approach:

Those gap-down reversals led to 2%+ bounces, and the current one remains ongoing. The key question now: Is this bottom durable? We’ll explore that shortly.

Beyond calling for a Monday reversal, we also advised favoring the Russell 2000 (RTY) over the major indexes.

Here are those excerpts outlining the strategy:

The RTY bottomed at 2229—right at the lower end of our support range. Since Monday’s open, RTY is up over 3%, while the SPX has gained just 1.5%—a 2x outperformance.

Was it luck? No. The RTY is highly sensitive to rate movements, and as our readers know, we’ve been warning of bearish pressure on yields.

Here are those excerpts:

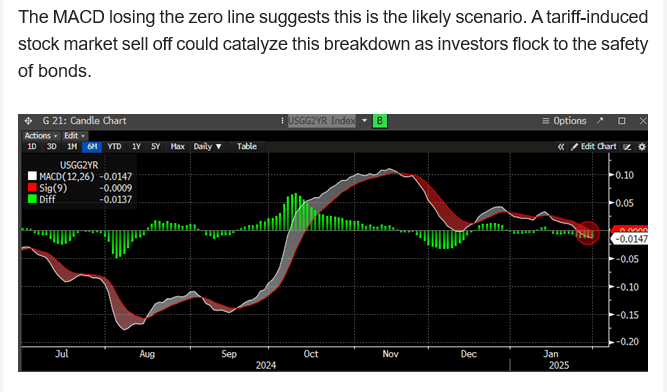

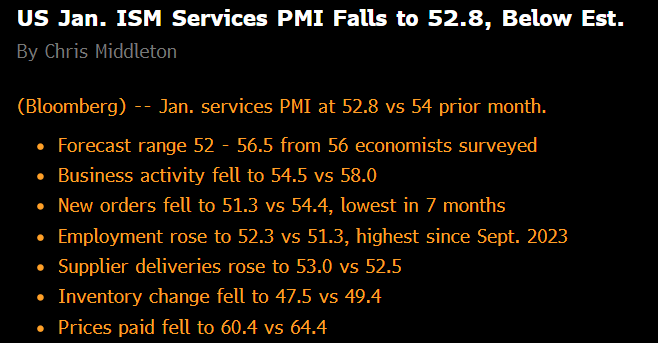

While our thesis for the yield breakdown was incorrect, our lower-yield thesis was spot-on. Today’s softer-than-expected ISM Services PMI sent yields tumbling. New orders dropped to their lowest level since June, marking the third month out of four of cooling demand growth. Interestingly, this contrasts with the ISM Manufacturing Index, which just posted its first expansion since 2022.

While the rationale behind the move is useful for context, we remain price-driven, not opinion-driven. We identified the weakness in the yield complex before today’s report—this is why we follow price, not narratives.

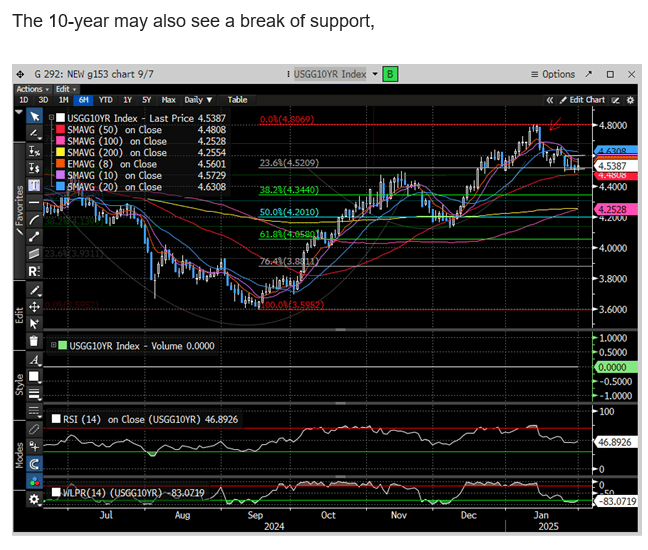

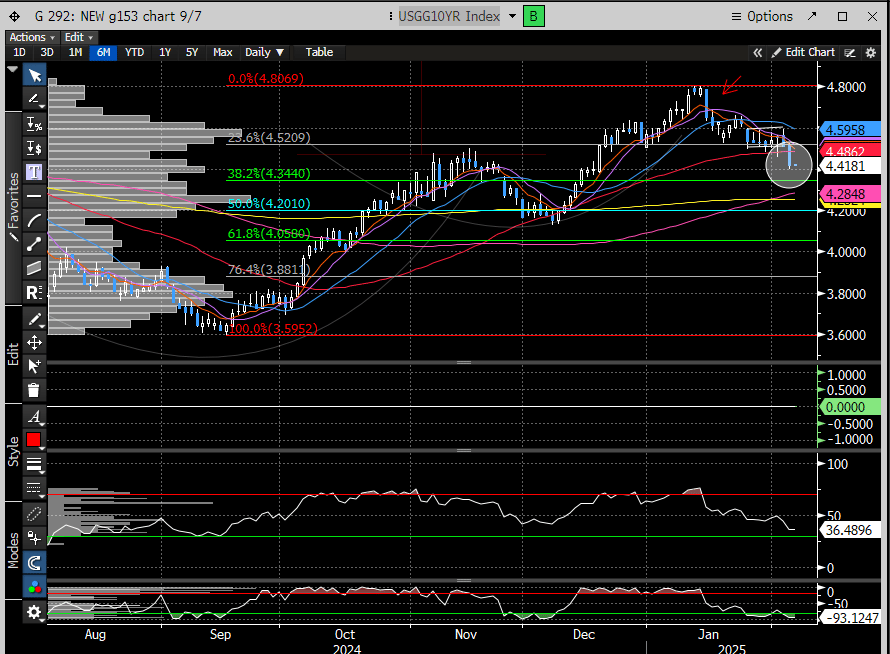

Today, the 10-year Treasury broke Fibonacci support and lost the 50-day moving average.

The 30-year Treasury suffered a similar fate.

The bottom line: A declining yield environment benefits risk assets, particularly SMID caps. But there’s always a wrinkle—Friday’s payroll report has the power to undo this week’s goodwill.

Sound familiar? Gap-down Mondays, followed by key macro events on Friday?

It’s Déjà Vu: Part Deux!

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade