This report will be abbreviated since we are traveling this week, but we wanted to offer quick thoughts post today’s FOMC meeting.

There weren’t many surprises in today’s FOMC meeting. If you’ve been following our reports, we’ve consistently emphasized the need for policy shifts out of Washington to ignite a sustainable rally. Did today’s meeting provide that catalyst? We doubt it.

The biggest takeaway from Powell’s press conference was that the FOMC seems just as uncertain as the rest of us. The rising uncertainty we’ve been discussing—reflected in the recent stock market decline—is also clouding the Fed’s decision-making. While they acknowledged slowing economic growth, the risks of higher unemployment, and persistent inflation, they struggled to quantify the impact of Trump’s tariff strategy. Sound familiar? The stock market is grappling with the same uncertainty, as forward estimates continue to be revised lower and multiples compress in response. Uncertainty breeds volatility, which explains why equities are struggling to stabilize after one of the sharpest sell-offs in modern history.

If the Fed is confused, how can anyone else confidently determine the economy’s trajectory? This uncertainty was reflected in their decision to leave the Dot Plot unchanged, explicitly stating that they lack sufficient information to adjust policy guidance at this time. However, they did announce a slowdown in the pace of QT, a marginally dovish signal.

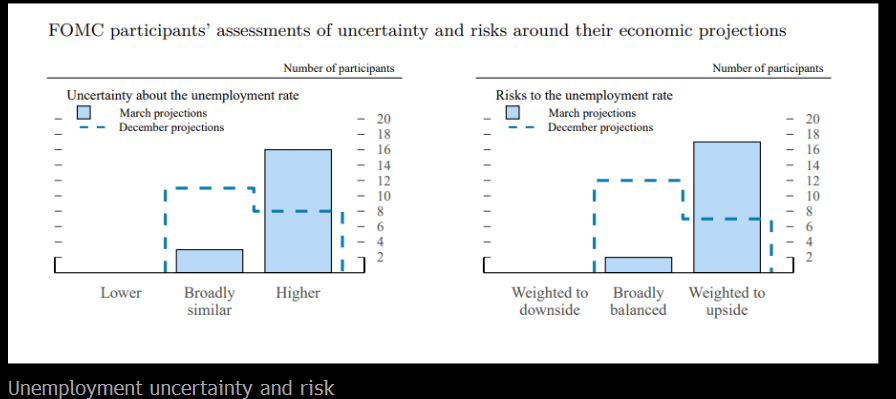

One notable shift from today’s meeting was the Fed’s increased emphasis on unemployment risks. Just three months ago, they viewed these risks as balanced—today, they are clearly more concerned. This shift in tone is significant and something to watch closely in the coming months.

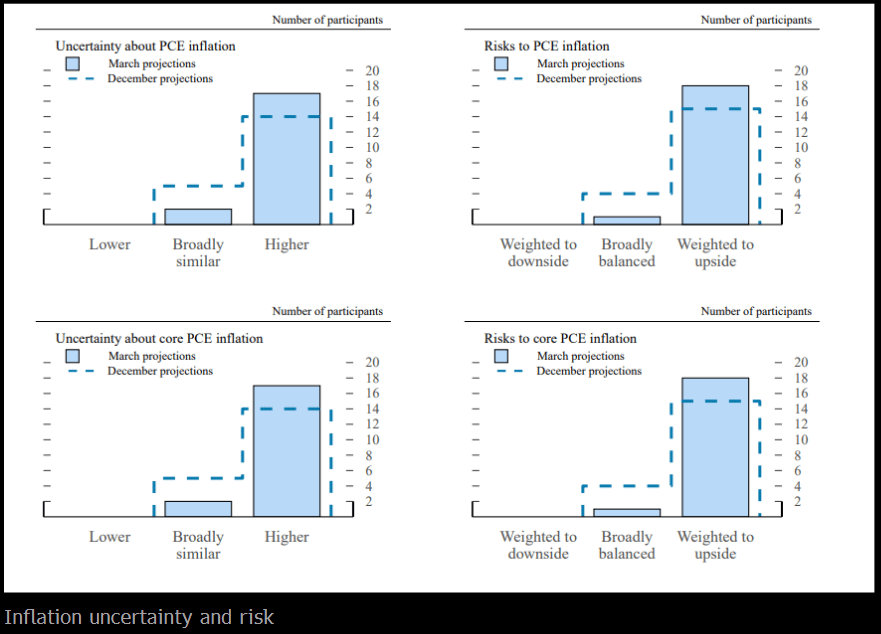

As it pertains to inflation, it was universal that tariffs pose an inflationary risk.

The stock market initially interpreted today’s FOMC decision as a dovish pause, responding positively. But is the Fed’s uncertainty about the future truly bullish for equities? We’d argue otherwise. However, the biggest immediate risk—a more hawkish-than-expected message—did not materialize. With that overhang lifted, the market can now reprice accordingly.

Some may view today’s meeting as a reintroduction of the "Powell put," believing the Fed signaled a willingness to cut rates more aggressively if economic data warrants it. But is the Fed slashing rates to counter a rapidly slowing economy really a positive? Historically, they’ve been late in these situations, cutting only after markets have already priced in the slowdown.

With stock valuations still elevated by historical standards, is this the right environment to take on significant risk?

As we’ve said many times, opinions are interesting but don’t pay. Price is the only thing that matters, and we’ll continue to let it guide our approach.

Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade