The market appeared to be pricing in progress on tariffs following last week’s pause, but with little substantive movement and tensions with China heating up again, the investing environment remains treacherous. We wrote over the weekend that more upside was likely, and while Monday’s open looked promising, it ended up being the high for the week.

Our first resistance zone was tagged on the Nasdaq, while the SPX came within 50 points. The VIX hit our downside target and quickly bounced. Tactically, our calls have been spot on—but the level of speed and precision required in this market isn’t for the faint of heart. When uncertainty reigns, the best strategy is often to do less, trade smaller, and stay nimble.

We continue to believe a tradeable low was established last week, and that buying weakness to sell into strength can work—but entries need to be carefully selected. More on that shortly.

Selling pressure picked up on Wednesday following Powell’s remarks that the Fed is in a holding pattern, waiting for more clarity before acting. In other words, no urgency to cut rates. That message feels oddly disconnected from the data, particularly last Friday’s alarming University of Michigan sentiment survey, which showed consumer confidence plunging to the second-lowest reading on record—while both short- and long-term inflation expectations surged to multi-decade highs.

What’s particularly concerning is that the bulk of the University of Michigan survey was conducted before Trump’s latest tariff announcements—suggesting the data may worsen in the next reading. Respondents are also increasingly pessimistic about the job market outlook, which only adds to the growing unease.

When consumers fear the future, they tighten their wallets—and that’s when economic momentum can stall quickly. The macro backdrop continues to deteriorate as the U.S. and China volley economic punches, seemingly more focused on inflicting damage than resolving the impasse. When this ends is anyone’s guess.

Powell’s tone in Wednesday’s speech felt out of step with the reality—the economy appears to be slowing more rapidly than the Fed acknowledges. Yes, jobs data remains firm and inflation is trending lower—but these are lagging indicators. The Michigan survey reflects what matters most: how people feel about what’s ahead.

Some debate exists around political bias in the survey results, but as the chart below illustrates, pessimism is rising across the board—regardless of political affiliation.

Could Powell’s muted tone be influenced by the recent reports that the Trump administration is exploring options to remove him? It’s certainly within the realm of possibility. Regardless of the motive, the absence of any supportive messaging for equity markets landed poorly—stocks responded ending the day with a 2–3% decline.

Bottom line: the situation is messy—and it's only gotten messier since “Liberation Day.”

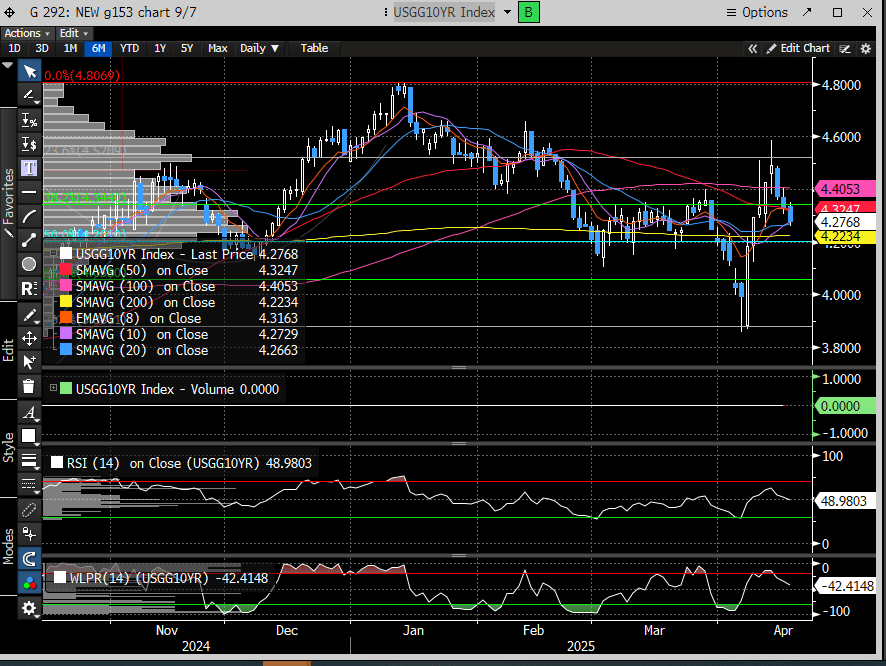

One silver lining? Bonds appear to have reclaimed their traditional safe-haven role, with yields retreating since the weekend. It’s a modest positive in an otherwise turbulent sea of negatives.

We had hoped this report would dive into other markets—and we will—but truthfully, there’s not much good news to cover. The global economy is effectively caught in a standoff between two stubborn leaders, neither of whom appears willing to yield. The longer this impasse drags on without resolution, the greater the damage to the global economy. Unfortunately, that likely means lower equity prices ahead.

Let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade