End-of-month markup? Positive tariff headlines from the Trump administration? Or just dumb retail money chasing stocks higher? Call it whatever you want. We don’t care about the narrative — we care about making money.

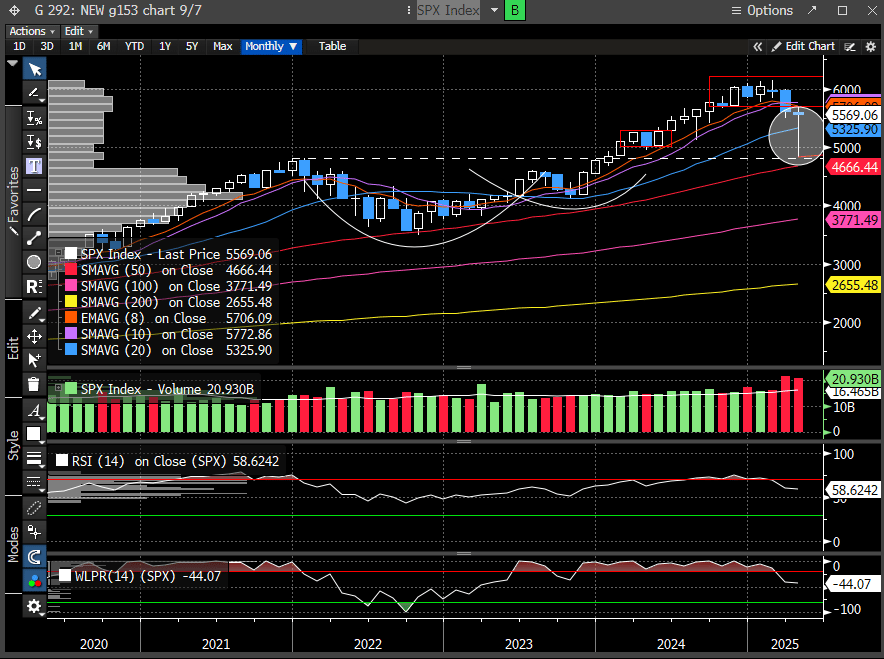

If you’ve been listening to the mainstream media or the parade of bearish "experts" on TV, you’ve probably been frozen since “Liberation Day” in early April, while the stock market ripped higher and completed a full round trip. For those keeping score, that’s a 1500-point swing in the SPX — in under 30 days.

Historically, a full recovery after such a steep decline is almost unheard of. The closest comparisons are October 1987 (33% drop, 12% rebound), October 2008 (40% drop, 6.7% rebound), and March 2020 (34% drop, 24.7% rebound). Each had wild intra-month swings, but none managed a full V-shaped return to the starting point within a single month.

This rally is a rare feat — and what a ride it’s been.

The exact retest of the 2021 peak in early April carved out a massive monthly hammer reversal candle. If you follow our work, you already know: we don't take hammer reversals lightly.

Over the past month, we outlined numerous reasons to consider adding long exposure — no need to rehash them all here. Please review our April reports for full details.

Below are a few snapshots that captured our evolving view throughout the month:

4/6:

"While we can't predict with certainty when this will end, we can confidently say the market is positioned for a meaningful reversal... we expect a sizable counter-trend rally to begin this week and are adding long risk for a tactical bounce."

4/9:

"...we believe a tradeable low has been established, meaning dips should now be seen as tactical buying opportunities. How stocks react to earnings will provide more insight into the rally’s sustainability, but we suspect much of the bad news is already priced in — earnings could even be a positive catalyst."

4/13:

"...did we just get a double dose of 'put' protection from the two most influential forces in today’s market (Trump, Fed)? This should help establish a floor under the market, reinforcing our view that a tradeable low was likely formed. We see extreme dips as opportunities, with potential for a move toward key resistance zones."

4/20:

"The probability of being rewarded on the long side is improving. For those with a longer-term horizon, much of the uncertainty now appears priced in, setting the stage for asymmetric upside from these levels."

4/23:

"The repricing of risk that began with the April 9th tariff pause continues to unfold in a stronger tape. We cautioned not to underestimate the importance of that shift."

4/27:

"Significant structural shifts — including island reversals, follow-through days, and breadth thrusts — suggest the worst of the uncertainty may be behind us. We continue to expect weakness to be buyable."

We don’t usually indulge in theatrics — but holy moly, the consistency and clarity of our messaging this month speaks for itself.

We follow price first. It's the foundation of our market mosaic. If the evidence had changed, we would have cut losses without hesitation. It never did — and our conviction only strengthened as April progressed.

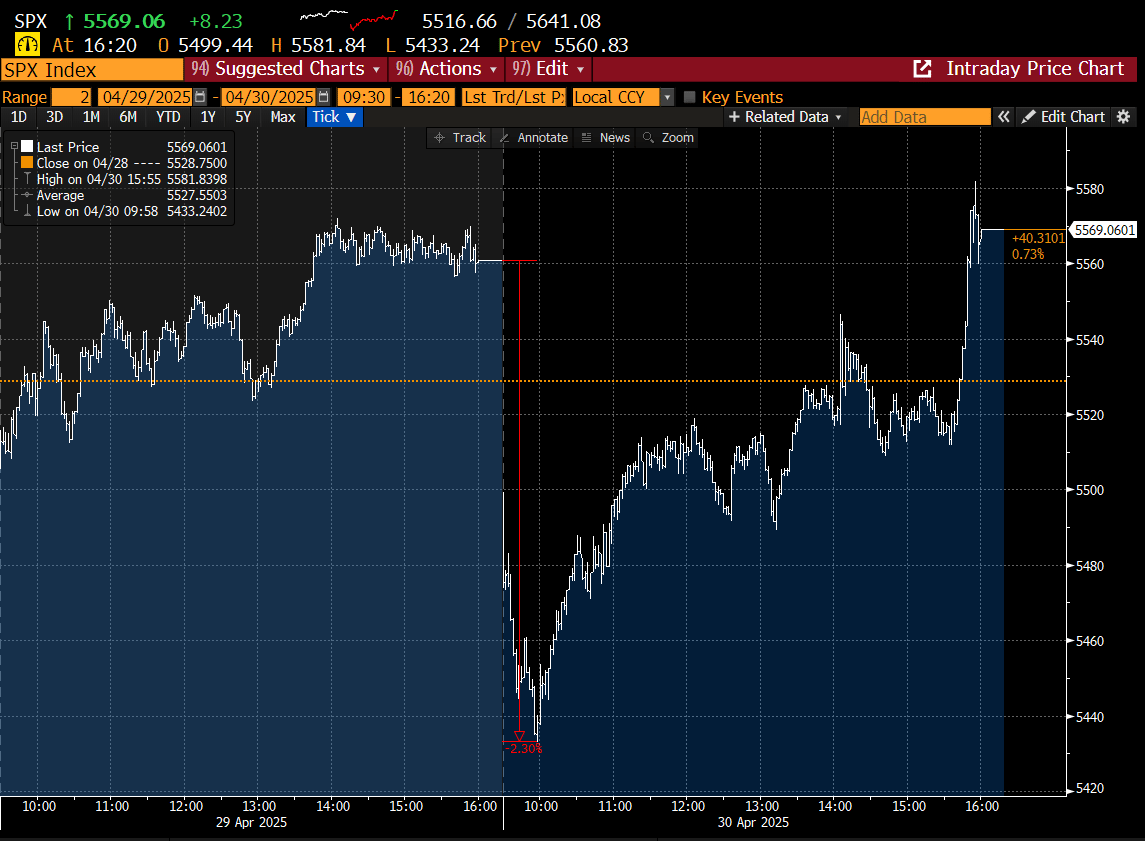

Even Wednesday’s weakness, driven by a misread GDP number, presented yet another opportunity to add on weakness.

At one point on Wednesday, the SPX was down more than 2%, yet still managed to claw back and close in positive territory — another powerful signal of underlying strength and a reminder that dips remain opportunities, not reasons to panic.

The market speaks through price.

While this morning’s GDP headlines stirred up fresh recession fears, the market looked through the noise and closed higher. This resilience has been well-telegraphed by the many positive structural changes we've highlighted since the April 9th tariff-pause reversal.

Like a good reporter who simply reports the facts, we focus on interpreting the wisdom of price to shape our conclusions about market direction. No fluff, no narrative, no opinions swaying our view — just disciplined analysis. Get the direction right, and there’s tremendous money to be made in the stock market.

Looking ahead, Thursday is set to open with another gap higher, following better-than-feared earnings results from two of the Mag 7 — META and MSFT — echoing our 4/27 commentary about TSLA and the broader Mag 7 setup. Their strong after-hours reactions were not unexpected.

This means our previously outlined SPX targets are now firmly in play for tomorrow.

Let’s review.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade