Being Wrong in This Business Is Inevitable. Staying Wrong Is a Choice.

Every trader or investor will get things wrong — that’s part of the game. But clinging to a failed thesis when price action is telling a different story? That’s a choice.

Over the past several weeks, price has been speaking clearly. And we’ve been listening. Since mid-April, we’ve been writing about the increasingly bullish index construction, multiple breadth thrusts, breaches of key moving averages, and trend confirmations. These were not random signals — they were clues. Clues that the market was heading higher, regardless of the news flow.

The market doesn’t trade off the headlines — it anticipates them. While the crowd waited for official resolution on tariffs, price already told the story. If you waited for the news, you missed a 20% rally off the lows.

Our analysis is built to do one thing: keep you aligned with the trend, or at least force you to challenge your bias when the evidence shifts. We’ve been doing this a long time. While we’re not perfect, we rarely miss major inflection points — and when we do, we shift quickly. That’s not bravado; it’s discipline. Everyone gets it wrong. What matters is what you do next.

This game is played at the highest level. The institutions with the deepest resources leave footprints across the market — you just have to know where to look. Our job is to decode that and deliver it to you in a clear, actionable format. For many, the past month was a disaster: selling too late, never getting back in, and now grossly underperforming. For us, it was an opportunity — one we fully capitalized on. We hope many of you did too.

If you didn’t catch it — don’t beat yourself up. There will be another opportunity. Stay aligned with us, and we’ll keep you on the path.

To be clear: we’re not here to preach. We’re here to educate. There are many ways to make money in this business. We simply offer a disciplined, evidence-based process to complement whatever approach you’re using.

In our 5/11 report, we flagged the bullish setup — the market was coiled and primed to break higher. Then Trump announced a 90-day tariff pause following weekend talks with China. That sparked a gap up Monday morning. We’d already flagged this as a possibility — and noted Bill Ackman has now accurately forecasted both key tariff pauses.

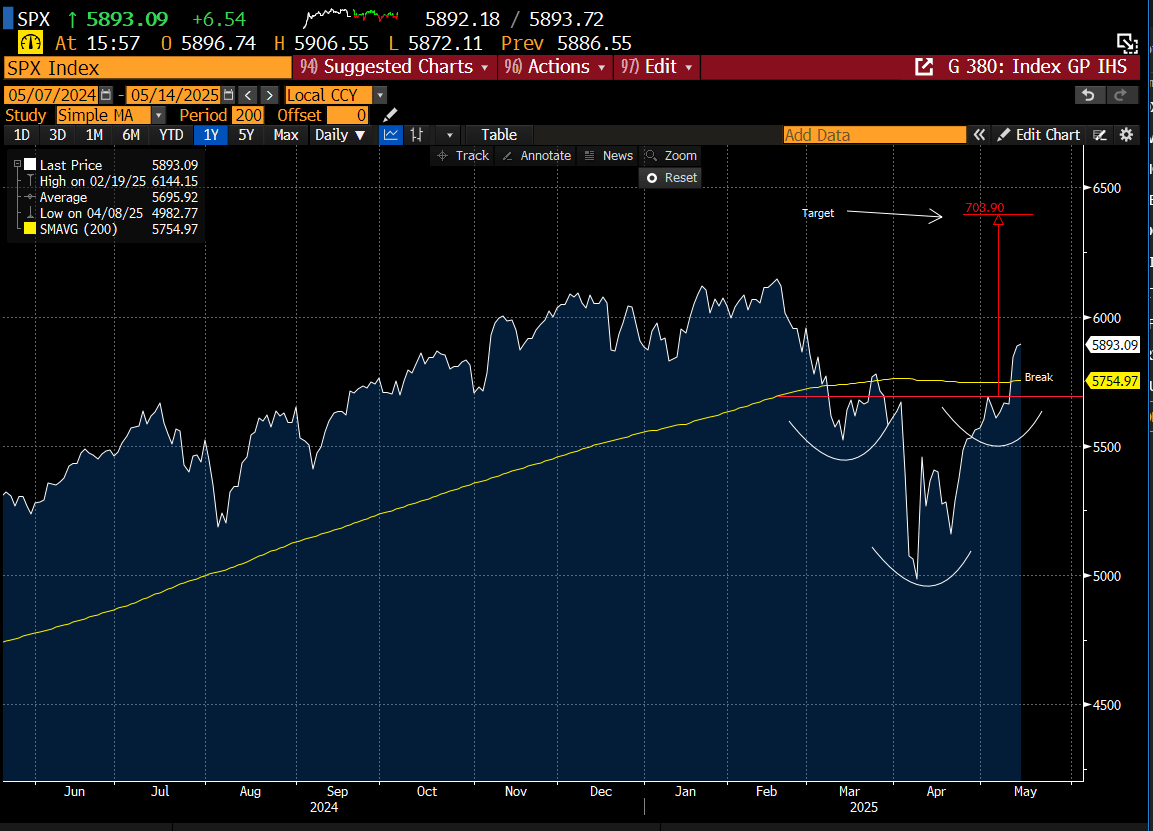

Our favorite charts from that report, were the inverse head and shoulders patterns forming across major indexes — all sitting just below the 200-day moving average, a psychologically important level. These patterns are only powerful after confirmation. Monday’s news provided that — the market gapped through resistance. And as we always say: gaps through key zones are statements. They should not be ignored.

That doesn’t mean we’re heading straight to our measured move targets — or that they must be reached. It could take weeks or even months, or they may fall short entirely. But make no mistake: these are decisive and bullish breaks. For the technical picture to turn more cautious, these patterns would need to fail and break back below their pivots. Until that happens, leaning bearish is a mistake.

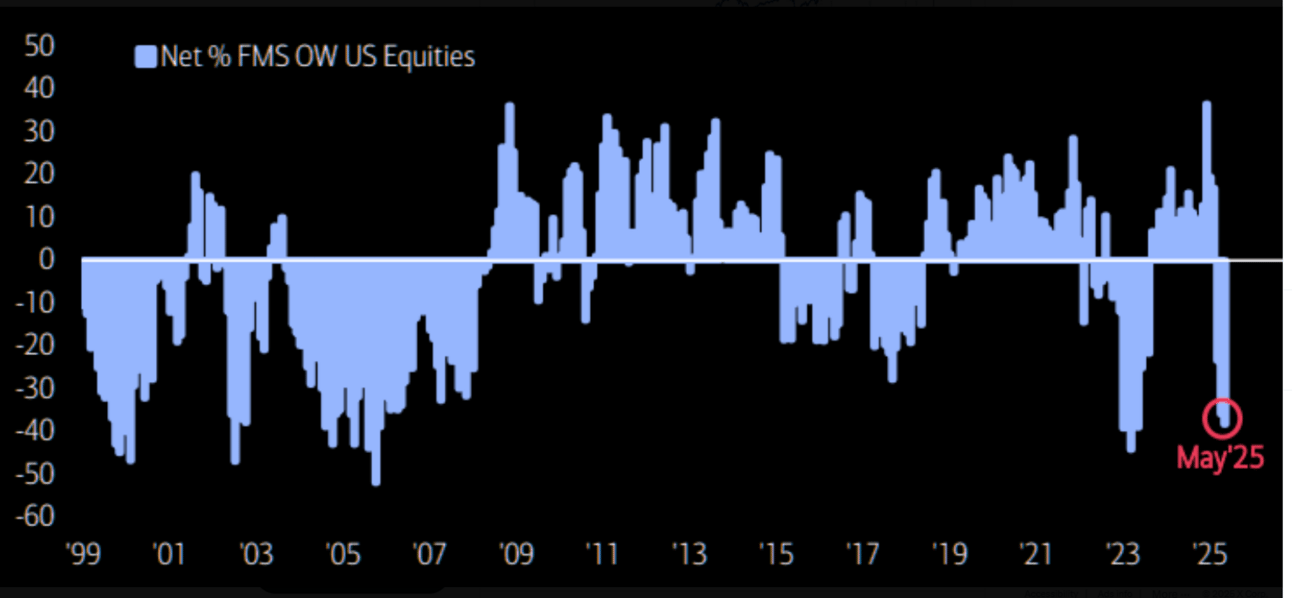

Are we extended? Yes. Could we see a pullback to reset that condition? Possibly. But keep in mind — most professional investors remain offsides, as shown in the exposure chart below. They’re still underweight and looking for a dip to buy. And when everyone’s looking to buy the dip… the dip often doesn’t come.

We’re not saying that’s definitely how it plays out — only that it’s a scenario worth keeping in mind.

With that, let’s review.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade