We spent 20 years living in New York City—long enough to remember the era of showing up to events Fashionably Late. Maybe it was cool then (maybe it still is), but one thing’s certain: showing up late to the stock market rarely works in your favor. Being a late buyer can be costly and significantly dilute performance.

In our 5/18 report, we explicitly warned that the market was due for a pause or retracement. Our conclusion was clear:

“…our largely quantitative analysis clearly signals a reversion is due.”

That report outlined several reasons to approach this week with increased caution:

DeMark sell signal alignment across major indexes

Overbought conditions across key indicators

Multiple resistance levels being tested

While we speculated that the Moody’s U.S. credit downgrade might serve as the catalyst for a pullback, it was Wednesday’s poor 20-year Treasury auction that ultimately did the job—sending yields sharply higher and pressuring equities.

We flagged this very risk in the 5/18 report, noting:

“…yields are likely to either stabilize or continue pushing higher from here. This remains a significant risk to the stock market rally if yields keep climbing.”

That concern played out with force: following the auction, the 30-year Treasury yield surged 12 basis points—challenging the highs of October 2023—as investor demand failed to materialize.

In our 5/18 report, we warned that higher long-term yields might be required to satisfy investors. Here’s what we wrote at the time:

While historical precedent shows markets tend to recover from these downgrades fairly quickly, there are implications worth monitoring. Most notably, such moves may put upward pressure on longer-dated yields as investors demand greater compensation for increased credit risk. This can, in turn, weigh on the U.S. dollar—and together, these forces could challenge an already overbought equity market.

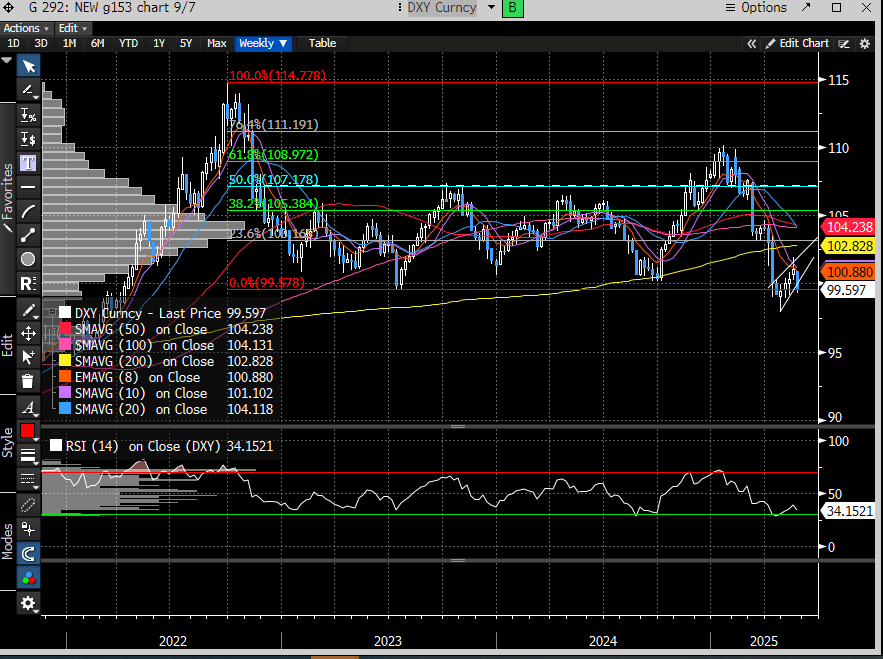

That concern materialized quickly. Yields surged, and in tandem, the U.S. dollar (DXY) broke lower, completing a bear flag pattern and closing at the key 2023 pivot zone. This technical breakdown suggests further downside for the dollar, a development that historically correlates with heightened volatility and potential equity market weakness. A declining dollar alongside rising yields is not a combination that tends to support risk assets.

The resulting aftermath left the SPX shedding 1.6%, the largest drop in a month.

We also identified the key resistance levels where the major indexes were likely to stall. Here’s what we wrote:

“The DeMark TrendFactor (DTF) level of 5952, which we outlined in our 5/14 report, has now been met. With this target reached and DeMark counts nearing completion, a more defensive posture is warranted.”

Result: The SPX topped at 5968.

“…the Nasdaq has reached its DTF level resistance…19173…”

Result: The Nasdaq topped at 19241.

“The NDX is challenging its DTF level (21505)…”

Result: The NDX topped at 21482.

How’s that for precision?

Over the weekend, our message was clear: tighten up positioning and wait for better opportunities. The market had become overextended and was due for a reset. FOMO had clearly entered the building—and FOMO, is always Fashionably Late.

Being a strong investor or trader isn’t just about identifying the direction of the market—it’s about timing. And timing, as we've shown repeatedly, is a game of precision. Based on the evidence, we think you'd agree: we’ve been on the mark.

Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade