Volatility has all but vanished as the SPX levitates toward new all-time highs. Is this the calm before a volatile, risk-off summer?

Not necessarily—but welcome to the world of trend-following quants and CTAs. The higher the indexes climb, the more volatility gets mechanically suppressed. This dynamic builds a powder keg beneath the surface, where even a modest shift in news flow could ignite sharp reversion.

So far, markets have shrugged off potential catalysts. The Trump trade salvo has faded, with the latest development being a deal with China that maintains elevated tariffs but loosens some restrictions. That may explain the muted market reaction—it hints at a slower growth path. The setup feels eerily similar to the 2018 trade war saga, which eventually blindsided markets later that year.

Could we be in for a replay? It’s certainly on the table. Today’s “resolution” feels more like a temporary pause than a lasting fix.

Today’s inflation data came in cooler than expected, with core CPI rising less than forecast. This suggests companies are, for now, absorbing higher tariff costs rather than passing them on to consumers. The print may give the Fed some breathing room to soften its tone at next week’s FOMC, possibly opening the door to future rate cuts.

That said, it’s likely premature to declare victory. Corporations may be holding the line temporarily, but as the year progresses and margin pressure builds, we expect pricing power to reassert itself. Trump wasted no time jumping on the data, calling for a 100 bps rate cut from Powell.

Bond markets responded swiftly—rates moved lower, pricing in a more dovish Fed. Notably, the 2-year Treasury yield reversed last week’s gains and failed once again at the 61.8% Fib retracement level, a key barrier it hasn’t cleared since February. Tomorrow’s PPI report could be more telling, as it’s more likely to reflect the underlying tariff cost pressures.

We’ll also get jobless claims on Thursday. While these figures can be noisy week-to-week, it’s worth noting that continuing claims have been steadily rising since April and recently hit their highest levels since the pandemic—an under-the-radar trend that shouldn't be ignored.

While last week’s employment report provided some reassurance, a deeper look reveals a more fragile picture. Outside of two key sectors—Education & Health Services and Leisure & Hospitality—job growth has largely stalled. Historically, government hiring has helped fill the gaps, but with the new administration scaling back certain departments, that support may no longer be there. Meanwhile, the rapid adoption of AI across industries poses a growing threat to white-collar employment. This dynamic presents a significant risk to the broader economic outlook and could rattle markets if jobless claims begin to surprise to the upside over the next 3–6 months.

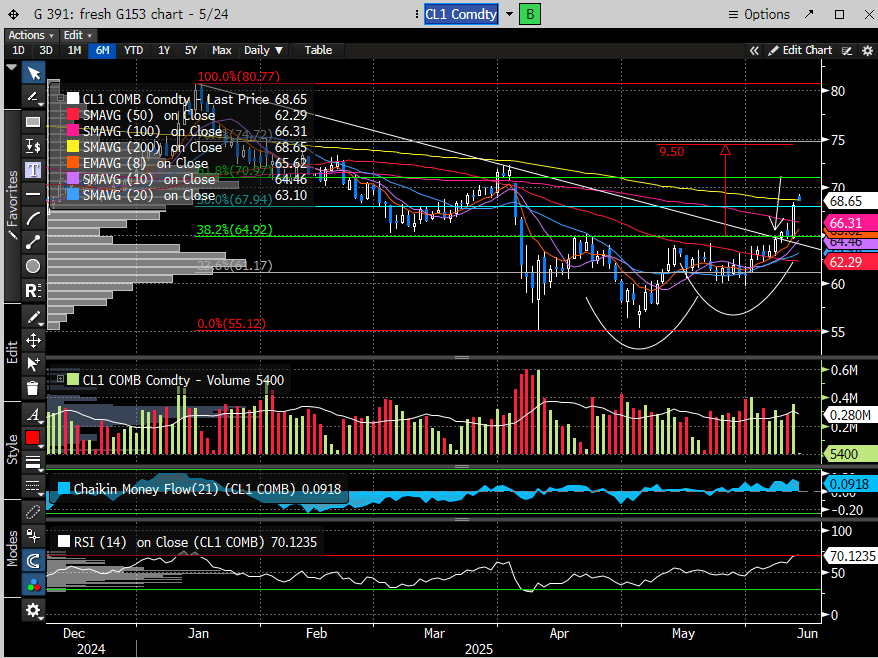

Tensions in the Middle East re-emerged today, with the U.S. ordering some staff to depart its embassy in Baghdad. A sustained rise in oil prices stemming from renewed geopolitical risk could feed back into inflation data—a key risk to monitor. Fortunately for our readers, we flagged the potential for an oil breakout in our 6/8 weekend report. Since that call, oil prices have climbed nearly 7%. More on that below.

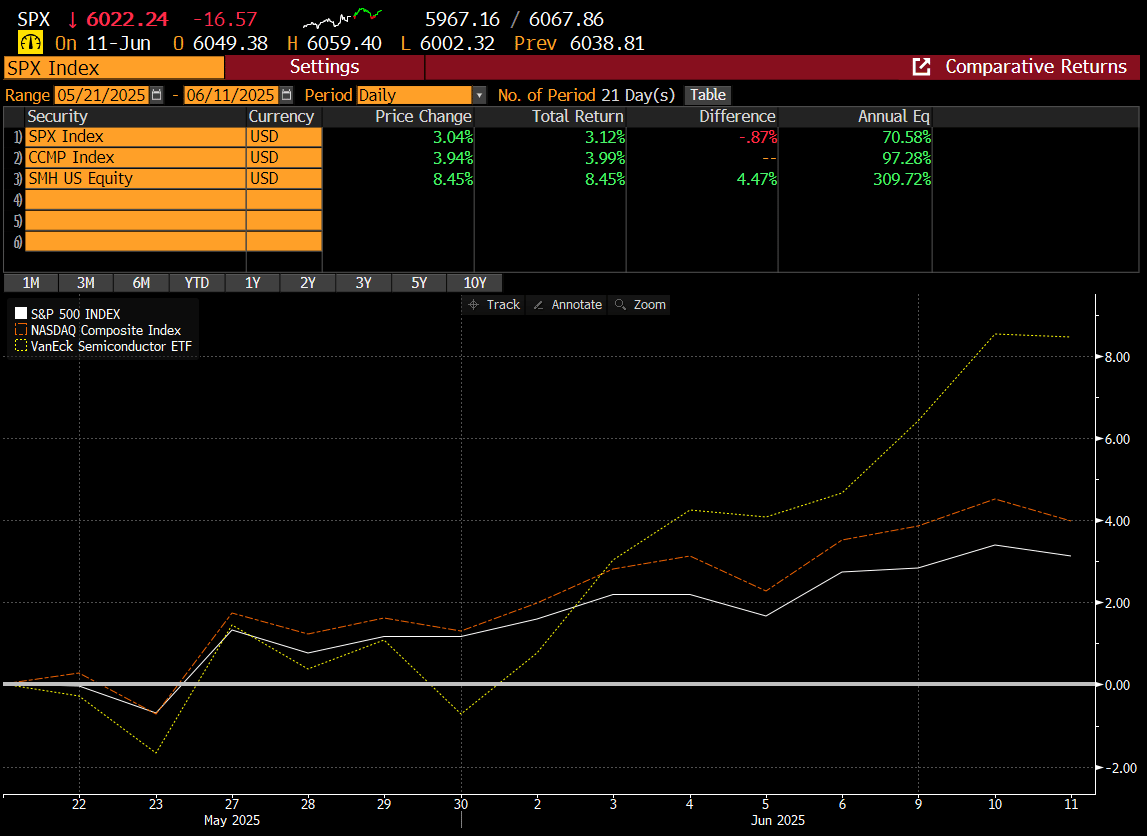

Since our 5/21 call highlighting semiconductor outperformance, the sector has nearly doubled its lead over the major indexes—accelerating further just since the weekend.

The major indexes have just reached the sell targets we outlined in prior reports. While this doesn’t guarantee an immediate reversal, it does suggest that the risk/reward from here is increasingly unfavorable. As we’ve discussed before, this is where dispersion becomes key—uncorrelated assets and individual stocks can outperform even as the broader indexes stall. This also plays out through sector rotation, with leaders cooling off and laggards catching up, potentially capping further index upside. But for stock pickers, this environment is ripe with alpha opportunities—just look at the follow-through on our semiconductor call.

We’ve been hitting it out of the park with our idea-tier over the past couple of months. If you’re looking for ways to engage with the stock market using a disciplined, risk-managed approach, this is a great place to start.

Below are the latest performance stats for both our single stock and options pages. Every trade is fully time-stamped—no fluff, just results.

Link to sign up:

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade