“Stupid is as stupid does.” – Forrest Gump

This iconic line reminds us that intelligence isn’t about what you say, it’s about what you do. The same logic applies to markets — price action speaks louder than forecasts, opinions, or economic models. Yet week after week, we watch seasoned investors, economists, and strategists fight the tape, calling for a top, citing stretched valuations, weak breadth, or macro headwinds… all while the indexes continue to grind higher.

The market doesn’t move based on what should happen — it moves based on positioning, liquidity, and momentum. Fighting a tape that's rising simply because it "doesn’t make sense" isn’t insight — it’s stubbornness.

We’re not ignoring risks. We’re just not letting them blind us to the trend. The market is telling a story — the question is, are you listening to it, or arguing with it?

Over the last three weeks, we’ve maintained a tactical “sell strength, buy weakness” approach, anticipating resistance near key levels. Specifically, we highlighted 6060 on the SPX as a likely pivot high — and until Monday, that level held, with the SPX grinding about 2% lower in the interim.

While we expected a deeper pullback, the fact that the SPX barely budged despite a Middle East escalation involving the U.S., a Fed still reluctant to cut rates, and stretched equity valuations says a lot. When markets shrug off bad news, they’re telling you something: they're looking beyond the noise toward a brighter horizon.

This behavior is classic market psychology — when stocks rally in the face of adversity and break out on resolution, it’s time to close the finance textbooks and start listening to the market’s heartbeat.

Monday’s ceasefire headlines sparked the move. After weeks of tight, sideways action, the SPX launched higher, gapping above the 6060 level and finishing less than 1% from all-time highs. As we’ve noted before: when instruments gap over meaningful resistance, it often signals something more is unfolding.

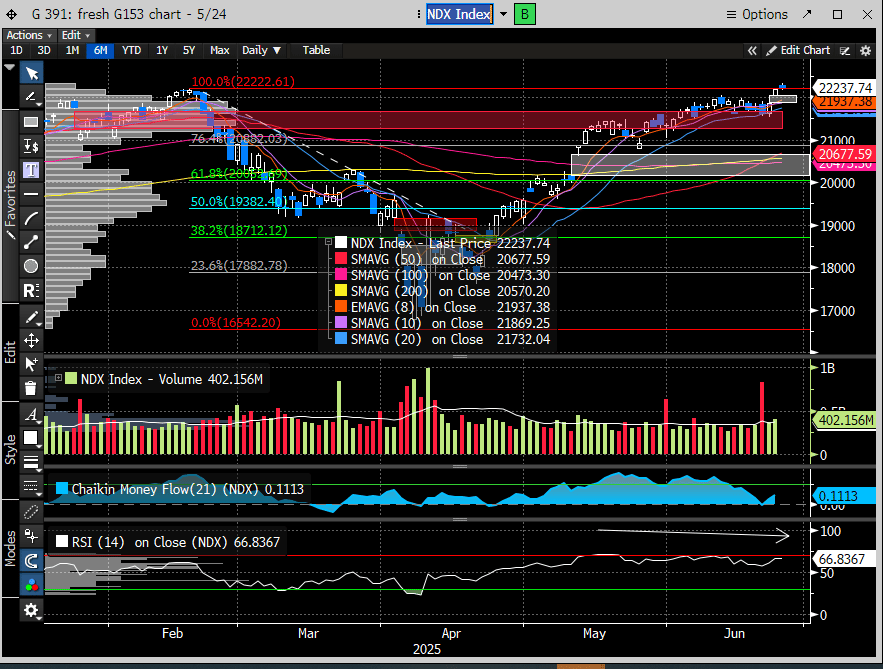

Even more encouraging is that growth stocks are spearheading the rally, with the Nasdaq 100 breaking out to new all-time highs—an unmistakable sign of risk appetite returning in force.

Bull markets are at their healthiest when led by growth, and there’s nothing remotely bearish about the world’s most influential stock—NVIDIA—hitting a new all-time high, as it did today. It’s a clear signal that risk appetite remains strong and leadership is intact.

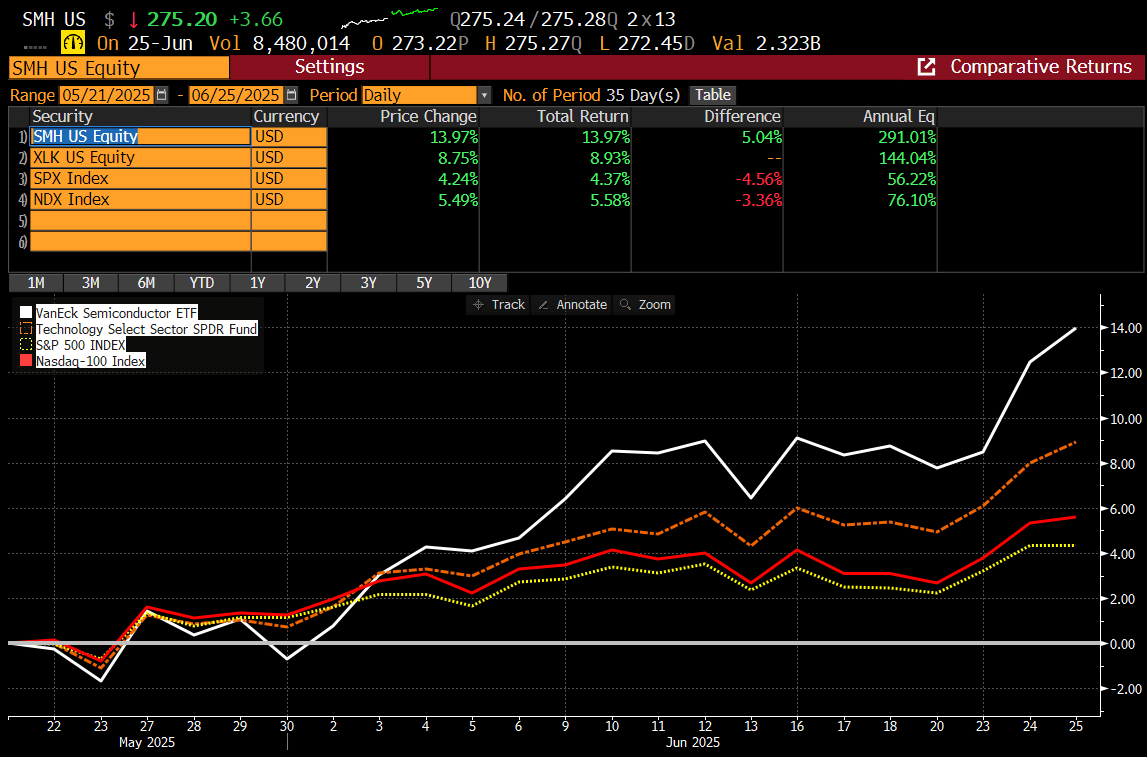

There’s also nothing bearish about one of this year’s top-performing and most critical growth sectors—Semiconductors—leading the charge. When the backbone of technological innovation is powering higher, it reinforces the strength and breadth of the rally.

For the first time in nearly a year, the $SMH (Semiconductor ETF) has reclaimed the July 2024 gap—a key technical milestone that reinforces the sector’s leadership and signals renewed momentum in one of the market’s most important growth engines.

If you had followed our call to overweight semis from our 5/21 report, you would have tripled the return of the broader market over the same period. It's a clear example of the alpha that can be generated by identifying leadership early and leaning into it.

We’re not here to gloat—well, maybe just a little—but the truth is, everyone benefits from having a skilled technician in their corner when navigating markets. Our approach is rooted in price, not opinions. You won’t find us making bold predictions about where the SPX will be a year from now. Instead, we focus on keeping readers aligned with the prevailing trend. We turned cautious in February and shifted bullish near the April lows—right when it mattered most.

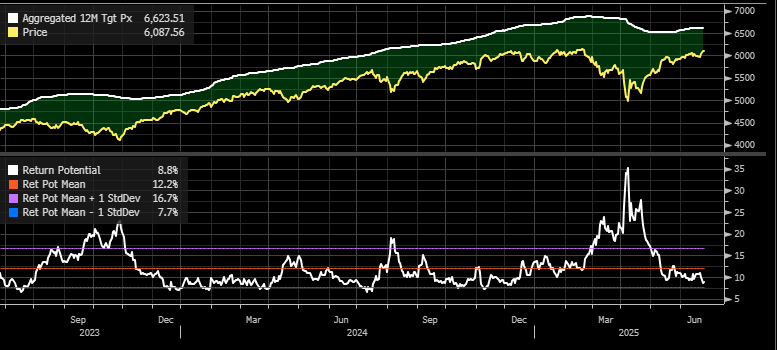

The market continues to frustrate forecasters and confound consensus. Back in April, most strategists were busy revising their SPX targets lower. Fast forward to today, and those same targets are quietly creeping higher. Funny how price has a way of rewriting the narrative. Sure, they’ll cite updated macro assumptions or new model inputs, but let’s be honest—they’re just late-stage trend followers in expensive suits. The top chart below tells the story clearly: price forecasts tend to follow price itself.

In our 6/22 report, we outlined that Monday had the makings of a "buy the dip" moment—but we misjudged the depth of that dip. Still, the market made its intentions clear with Tuesday’s move, prompting us to make swift positioning adjustments. On the bright side, we were spot-on in challenging the $100+ oil hype. Crude couldn’t even test the lower end of our resistance zone ($80-84).

Now, as we enter a seasonally strong window—and with risk appetite clearly reawakening—the next meaningful move in the market is likely underway.

Let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade