Our time-based correction continues to play out as expected. Dips have been shallow and buyable, and now the SPX sits just ~3% below its all-time high—something the bearish camp dismissed as improbable. Admittedly, even we had our doubts at moments. But our role isn’t to rationalize market behavior; it’s to stay agnostic and adaptive in mapping the most likely path forward.

Sometimes that path is clear, other times it’s murkier. Our objective remains constant: to help sharpen conviction and keep you aligned with the prevailing trend, week in and week out.

We’ve maintained a bullish bias since the April lows (see our April 6th note calling for a substantial counter-trend rally). Most recently in our May 11th report, we highlighted the bullish breakaway gap through the 200-day moving average as a major inflection point. That gap has since been tested—but not filled—which we view as a sign of underlying strength. While some caution flags have emerged—namely DeMark signals and subtle divergences—we don’t yet see a major reason to sound the alarm.

Time-based consolidations are healthy. They digest gains, reset sentiment, and build energy for the next leg higher. Are we on the cusp of that breakout—or is more digestion needed? We’ll tackle that in a moment.

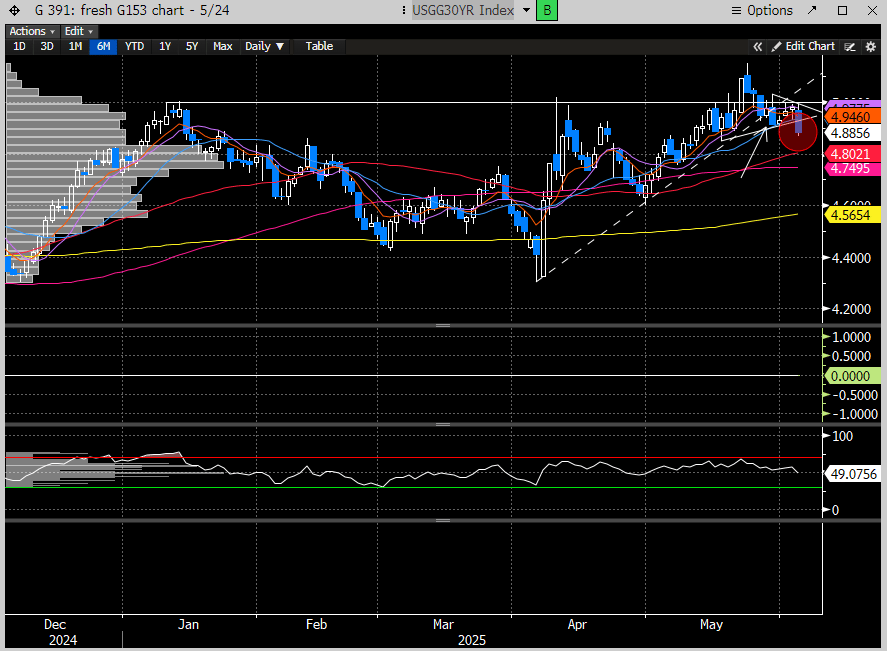

We’ve also written extensively about the biggest visible risk to equities: the rates market. Two weeks ago, 30-year Treasury yields threatened to break out of a multi-year range. The last time yields were at this level was just before the Global Financial Crisis—an uncomfortable comparison, especially with the SPX hovering near highs back then too.

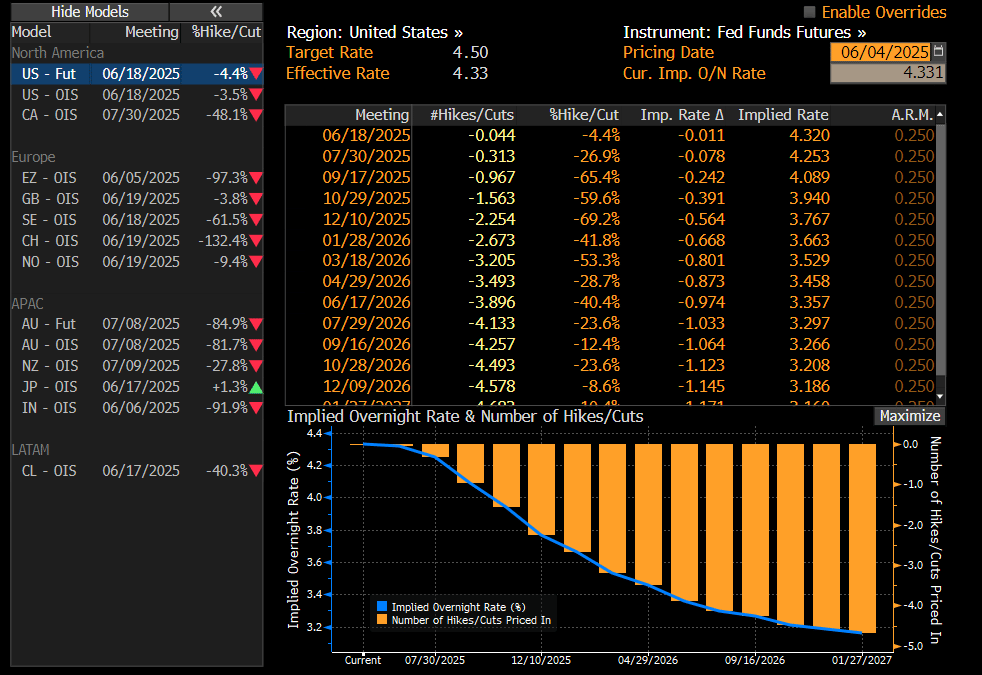

Recent macro data has come in soft, with today’s ADP report showing a notable slowdown in job creation. The weakness wasn’t lost on Trump, who quickly took to Truth Social to criticize Powell for moving too slowly on rate cuts. Meanwhile, both ISM prints came in below expectations, pointing to continued contraction. The bond market responded swiftly—yields are tumbling as expectations for a September rate cut gain traction.

Fed Funds Futures are now pricing in nearly a 100% probability of a rate cut by September. The dovish repricing has accelerated in response to the weak labor and ISM data, reinforcing the bond market’s move and giving further fuel to the “policy pivot” narrative. Whether or not the Fed follows through remains to be seen—but markets are clearly betting they will.

The 30-year yield broke down from its bear flag today after clinging to trend support through late last week. This breakdown confirms the recent shift in momentum, aligning with weaker macro data and accelerating expectations for rate cuts. It also reinforces the broader view that the peak in long-end yields may be in for now—supportive for risk assets.

The 30-year yield’s MACD has also turned decisively lower, reinforcing the technical breakdown and signaling potential for further downside in yields. Notably, this move comes just ahead of Friday’s payroll report, suggesting the bond market may be bracing for more evidence of labor market softening.

If yields continue to drift lower, it should provide support for growth stock valuations and help sustain the overall stock market rally.

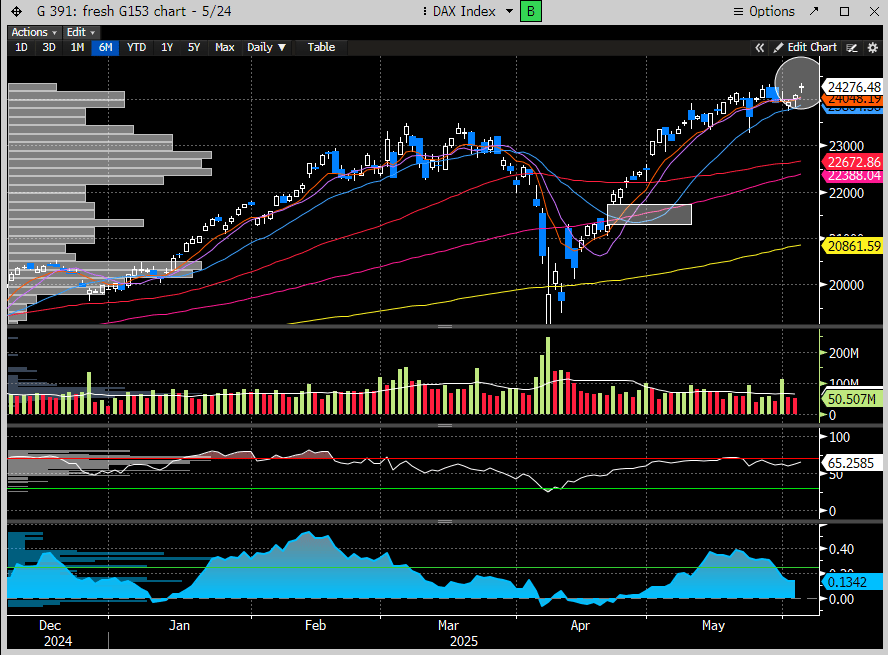

At the same time, it’s crucial to keep an eye on global markets. While concerns about a major US economic slowdown persist, this caution isn’t reflected elsewhere. For example, the German DAX is hitting new all-time highs today, signaling strength abroad despite domestic uncertainties.

The FTSE 100 Index is forming a bull flag right underneath its ATH.

The Euro Stoxx 50 Index is forming a bullish inverse head and shoulders pattern and is within 3% of an ATH. A break higher would argue for much higher prices.

The MSCI World Index is testing its ATH today.

The bottom line: it’s hard to believe that U.S. tariff policy will be so economically damaging as to derail global markets when major indexes are hovering near all-time highs. Maybe the “TACO” trade has merit — perhaps all the U.S. saber rattling will amount to little, allowing major economies to keep chugging along while the bull market expansion continues.

The reality is, we don’t care why global markets move — only what they do. Our sole focus is helping clients make money, not providing explanations.

Investing isn’t about having the “right” opinions; it’s about generating returns. That’s our mission.

Now, let’s dive into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade