The news cycle out of the White House has become nothing short of astonishing. Misinformation, misdirection, and policy whiplash are the norm—like a high-stakes game of dodgeball where you need to keep your head on a swivel to avoid the daily barrage of political and geopolitical curveballs.

One day it’s Powell being fired—then not. The next, punitive tariffs are announced—then walked back. Add in Middle East bombings, rising tensions with Russia, “Big Beautiful Bills,” and mysterious lists that may not even exist. The pace and volume of potentially market-disruptive headlines are enough to make even the most seasoned market operator dizzy.

And yet… the SPX shrugs it all off, sitting less than 0.5% from all-time highs.

Can anything shake this market?

For weeks, we’ve maintained that dips would be shallow, and in our 7/13 note, we suggested any meaningful correction would come from higher levels. That outlook continues to hold true, as bulls seize on nearly every excuse to buy.

Just yesterday, the SPX printed an ugly reversal candle after a hotter CPI print hinted at a goods inflation resurgence—surely a dream setup for the bears. And today, a market drop on reports that Powell might be fired was quickly erased by the close. These sharp intraday reversals are hallmarks of a bull market—never quite giving dip buyers the clean entry they hope for.

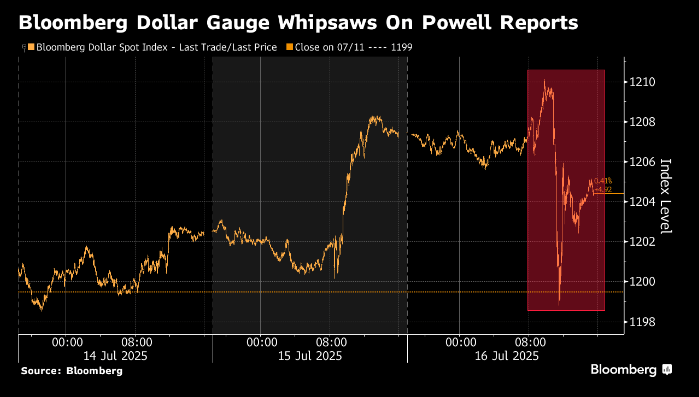

The $USD wasn’t spared either, getting whipsawed after the leak from the White House hinted that Powell’s job was in jeopardy.

Likewise, the 2-year Treasury yield dropped as much as 8 basis points during the session, only to partially recover by the close.

Whether the threat to fire Powell is credible or simply a trial balloon to gauge market reaction is anyone’s guess. What is clear, however, is that any attempt to meddle with central bank independence would likely be market-destabilizing. At best, it appears to be a pressure tactic to push Powell toward rate cuts and appease Trump’s policy agenda. Either way, it sets a troubling precedent.

But this is the market we’re dealt—and it’s precisely why price action remains the most important variable to watch.

On a brighter note, early big bank earnings have set a positive tone for the reporting season. Notably, trading revenue at the five largest banks jumped a staggering $10B from last year to a record high, spanning multiple asset classes. While investment banks had expected a wave of IPOs and M&A under a more “business-friendly” Trump administration, those hopes haven’t materialized—revenues are still 40% below 2001 levels. That said, if there's one thing trading desks thrive on, it's volatility—and few have delivered that better than this news cycle—maybe they should be thanking the Trump administration?

On the inflation front, both CPI and PPI suggest the upcoming PCE report (due later this month) could come in hotter than expected. PCE places less weight on goods like used cars (which dragged down CPI) and more emphasis on services—where pricing pressures were evident in both reports. The clear takeaway: tariff pass-through effects are showing up and are likely to persist into July, giving the FOMC more reason to stay on hold.

With earnings season heating up, OPEX week wrapping, and macro curveballs flying fast and furious from the White House, we leave you with the timeless wisdom of Dodgeball’s five rules: Dodge, Duck, Dip, Dive, and Dodge. That—and these biweekly reports—should help you navigate the chaos.

Now, let’s dig into the charts.

The major indexes have advanced nicely this month, in line with positive seasonality, even as underlying market internals have shown signs of churning—something we flagged in our recent reports as a reason for increased caution.

With the most bullish part of the month now nearing its end, the back half of July has historically proven more challenging. According to Carson Research, the peak seasonal tailwind wraps up tomorrow.

This doesn’t mean it’s time to sell everything and head for the beach. Seasonality is just one variable—this particular pattern is based on an average of the past ~75 years. But as we noted in our weekend report, our momentum breach analysis pointed to a potential Nasdaq peak next week (refer to that note for full details).

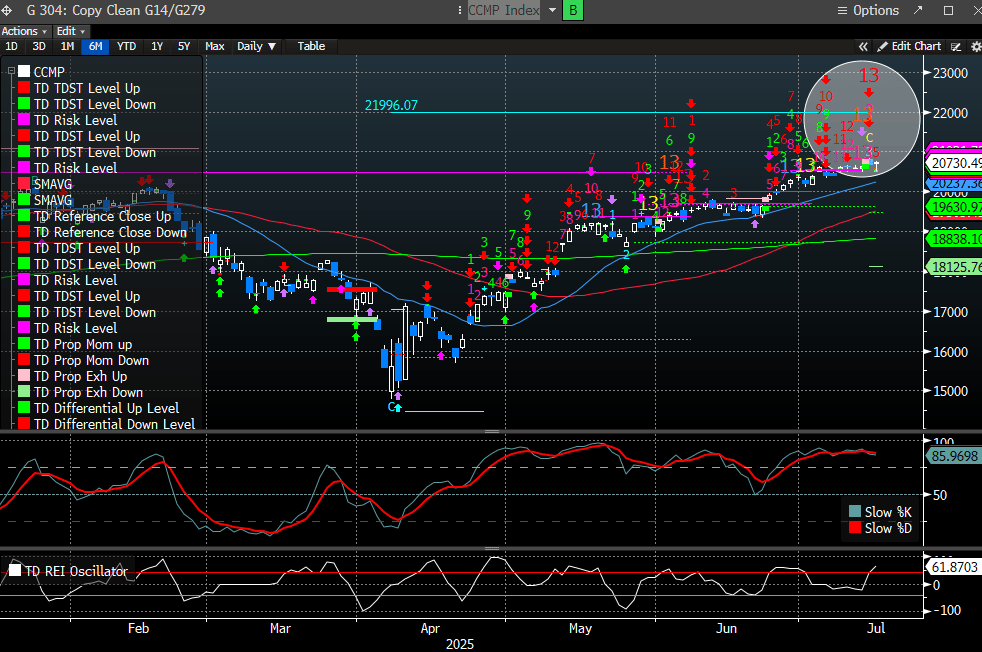

So while seasonality is turning into a headwind, it’s not a standalone sell signal. It becomes more meaningful when it aligns with other tools—like the fresh batch of DeMark sell signals that just printed across the major indexes.

Notably, the SPX completed a DeMark Combo 13 Sell on Tuesday and has since flipped down (green 1 and 2 under the bar), suggesting a potential trend reversal. Until that count flips back up, caution is warranted. The slow stochastic momentum indicator has also turned negative, adding further weight to the setup.

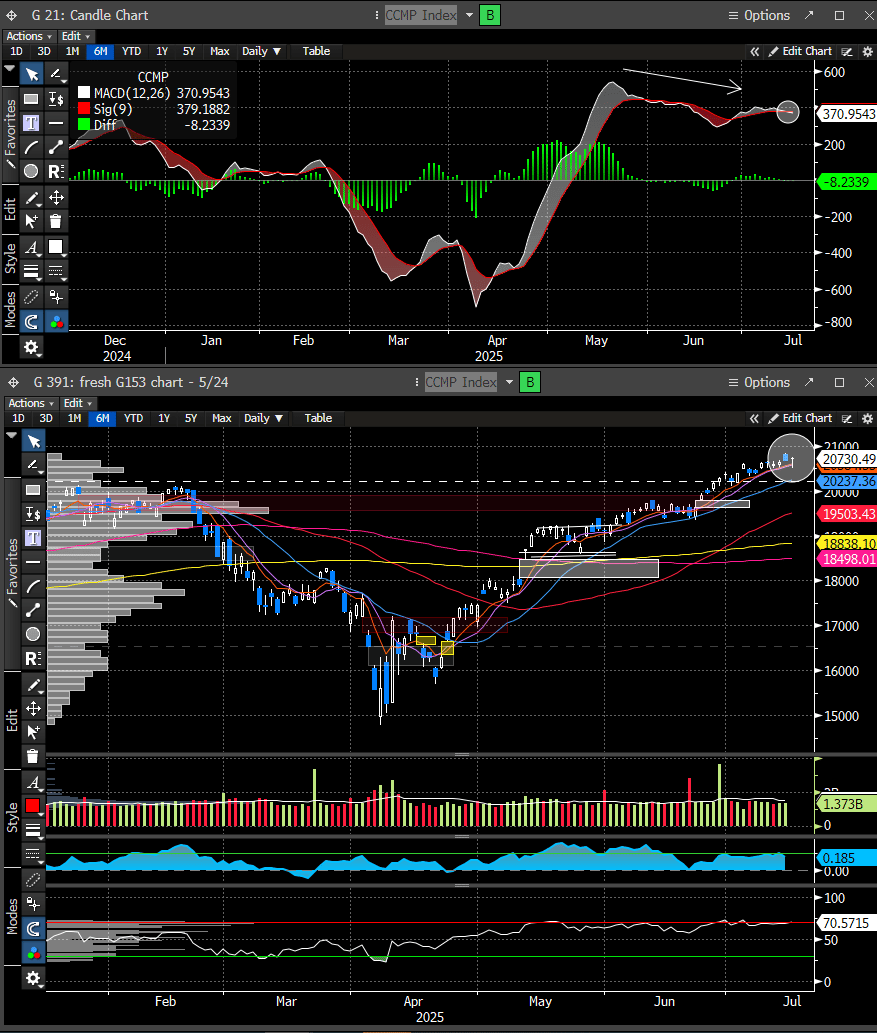

The SPX MACD has now crossed bearishly, confirming a lower high in momentum versus a higher high in price—classic negative divergence that signals waning strength on the recent rally. RSI is showing a similar divergence. The bottom line: momentum is fading, and the setup increasingly favors a market reversion.

The SPX came close to testing its 20-day moving average on Wednesday and also found support at the anchored VWAP from the June 23rd low—meaning the average buyer since that date remains in the green. If this level breaks, it would suggest sellers are gaining short-term control. For now, that’s clearly not the case.

Importantly, the SPX hasn’t closed below its 20-day MA since April 24th—a testament to the power of trend-following quants. Until that changes, getting aggressively bearish is premature.

The Nasdaq has also triggered a new DeMark Combo 13 and Sequential 13 sell signal, both of which are now aligned with weakening slow stochastic momentum—adding to the growing list of cautionary signals.

The Nasdaq successfully defended its 8-day EMA on Wednesday, reinforcing that buyers remain in control. However, the MACD has now crossed bearishly—albeit marginally—suggesting a potential loss of momentum beneath the surface.

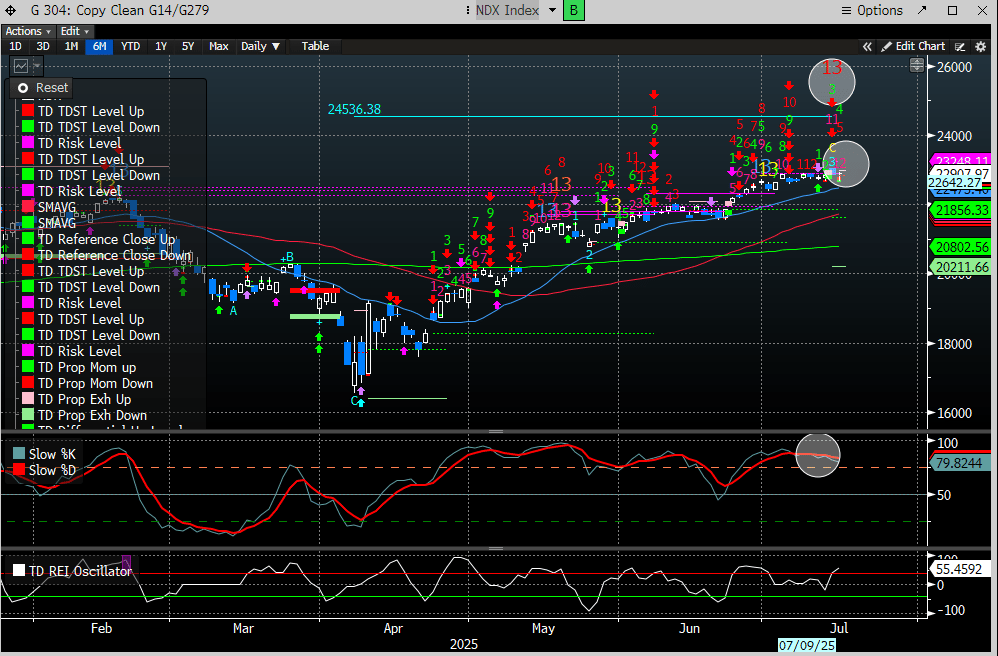

The Nasdaq 100 Index (NDX) registered a new DeMark Sequential 13 Sell signal yesterday, with a Combo 13 sell potentially printing in one day. Meanwhile, the slow stochastic is rolling over, pointing to waning momentum and increasing the odds of near-term exhaustion.

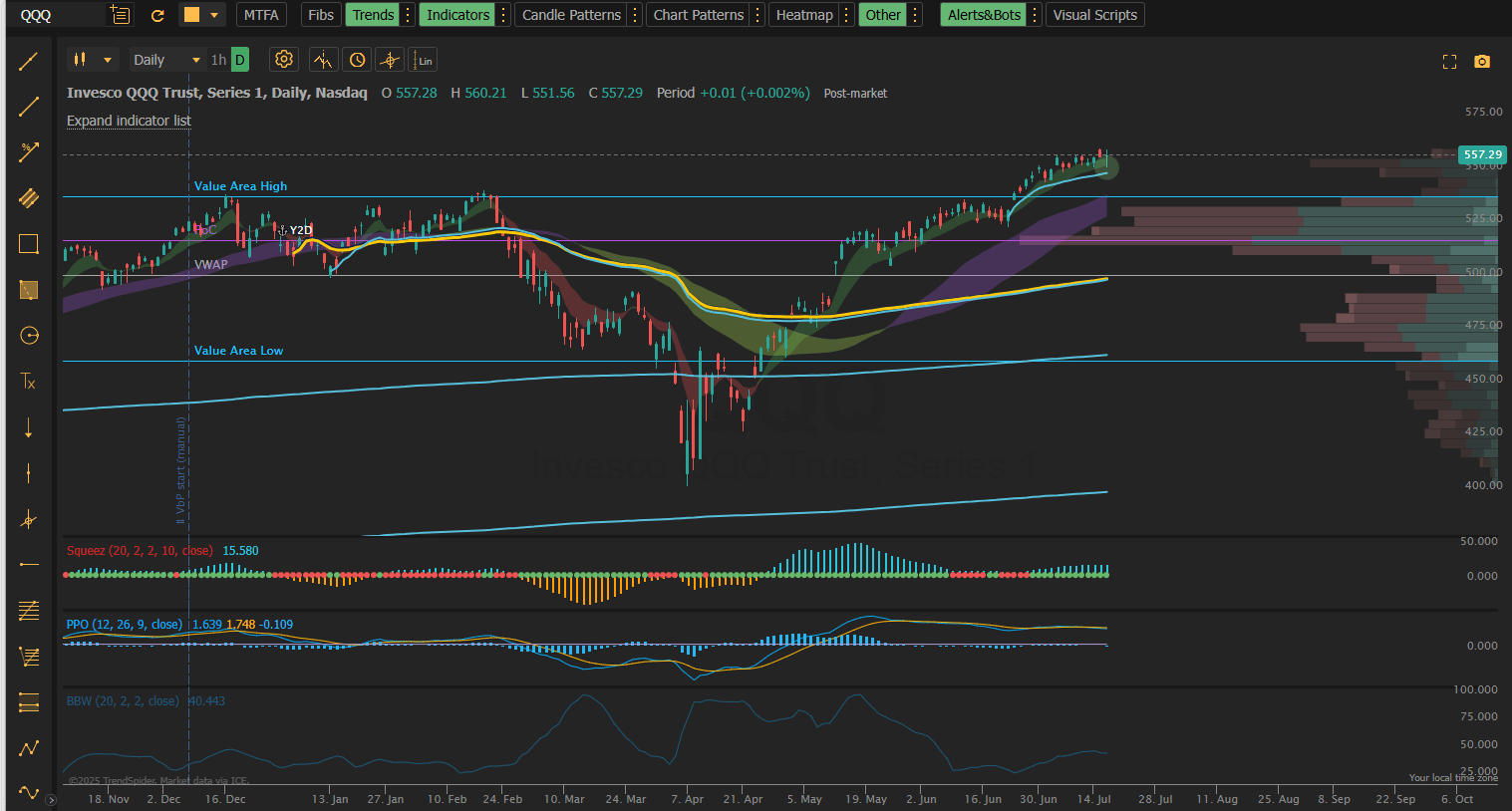

The QQQ, which tracks the NDX, rebounded before it could reach the anchored VWAP from the June 23rd low—underscoring continued strength as dip buyers remain active above key support.

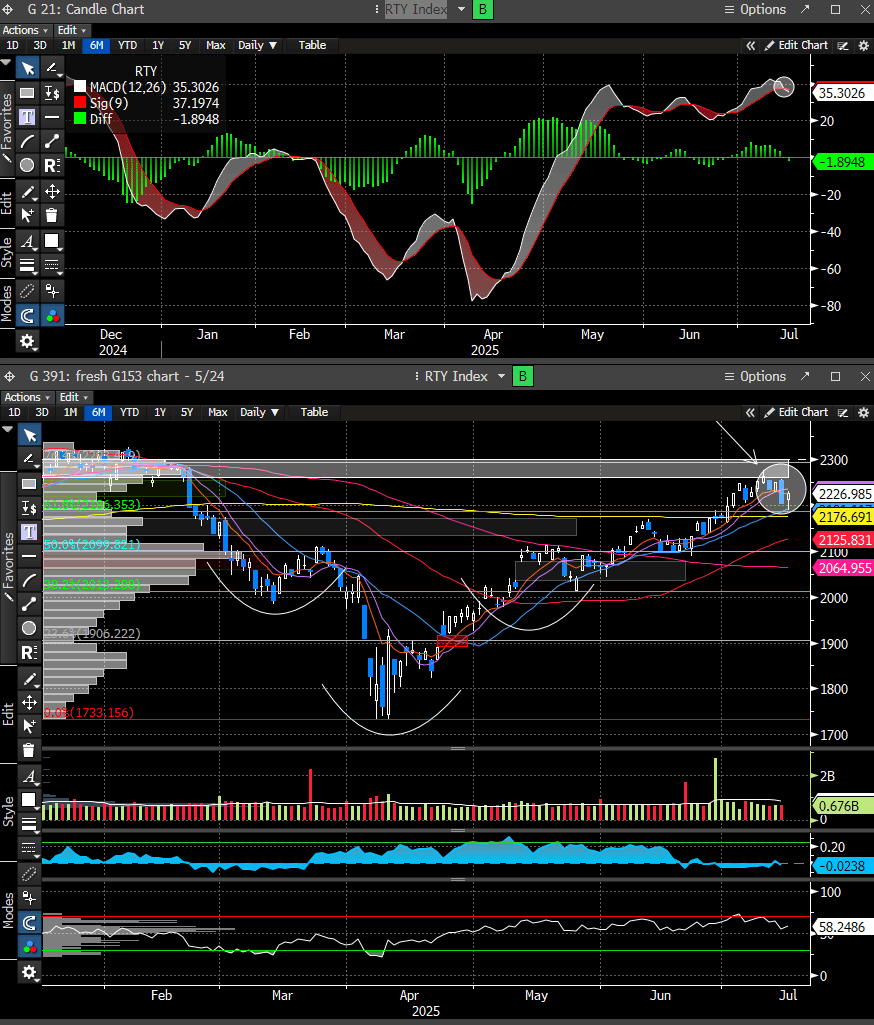

The Russell 2000 Small Cap Index (RTY), typically the most sensitive to macro developments and interest rate shifts, initially sent a bearish signal with yesterday’s bearish engulfing candle following the CPI report. However, just one day later, a bullish hammer reversal near the confluence of the 20-day and 200-day moving averages suggests dip buyers were quick to step in. That said, MACD momentum is rolling over, indicating the RTY could remain under pressure in the near term.

There’s little doubt the indexes are cooling off some of the recent enthusiasm, which aligns with our thesis that the latter half of July could prove choppy. The SPX has already registered two distribution days this month, and a few more in the coming week could pave the way for a more meaningful pullback in August.

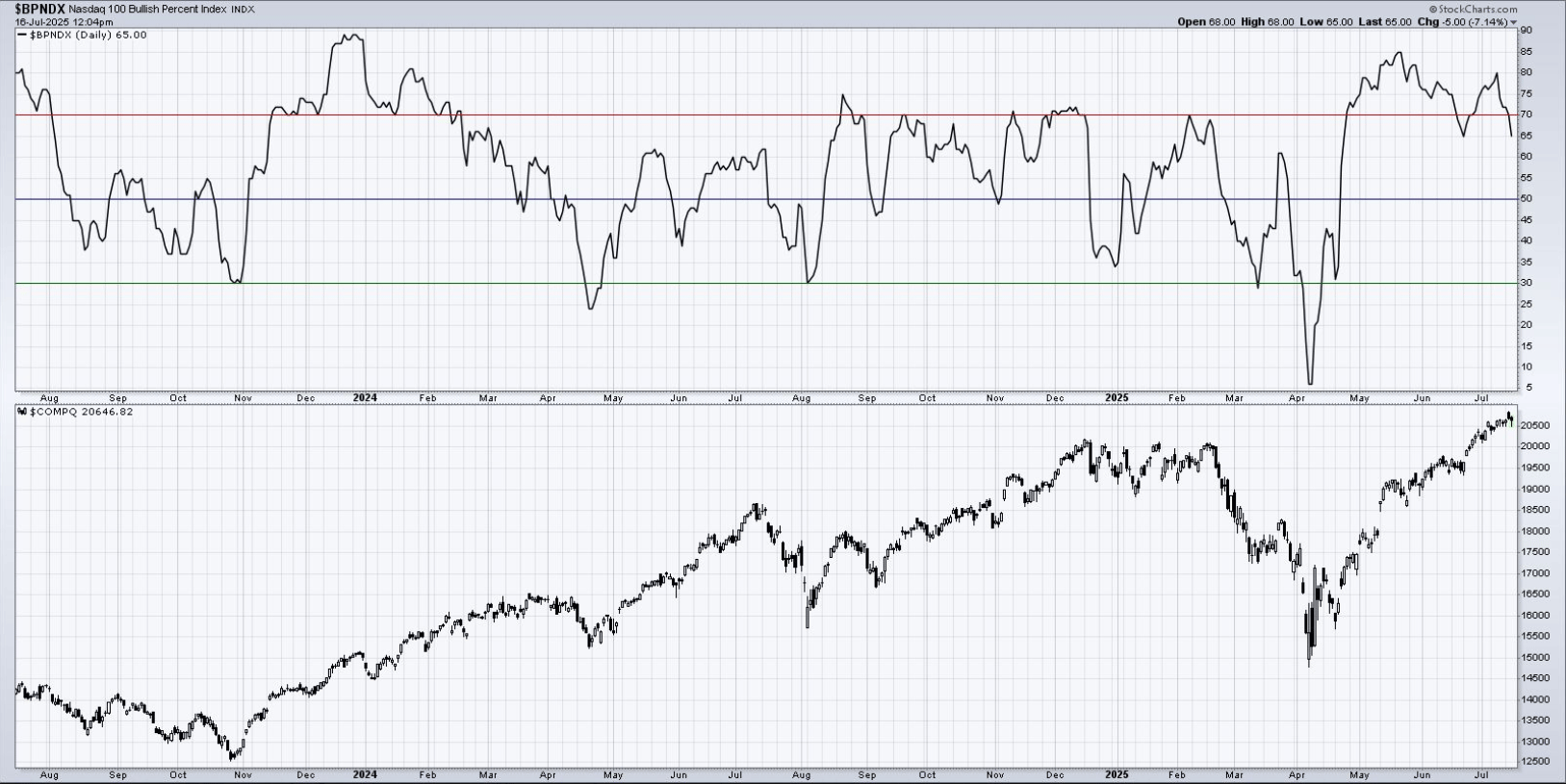

This chart of the Bullish Percent Index (BPI) for the Nasdaq reveals a weakening trend beneath the surface. The BPI measures the percentage of Nasdaq stocks with active point-and-figure buy signals. When this reading falls back below the 70% threshold, it raises concerns about the underlying strength of the uptrend.

This chart shows the number of Nasdaq members trading above their moving averages, with the yellow line specifically tracking stocks above their 50-day MA. Notice that stocks above the 50-day MA did not reach a new high alongside the index, signaling reduced participation in the recent rally—an important negative divergence.

This chart from 3Fourteen Research highlights that, as the S&P 500 reached new highs on Thursday, the median stock was still over 13% below its own 52-week high—an indication of underlying weakness beneath the surface.

While our earlier chart showed the SPX concluding its seasonal weak phase, this pattern holds true across all major indexes, according to the Stock Trader’s Almanac.

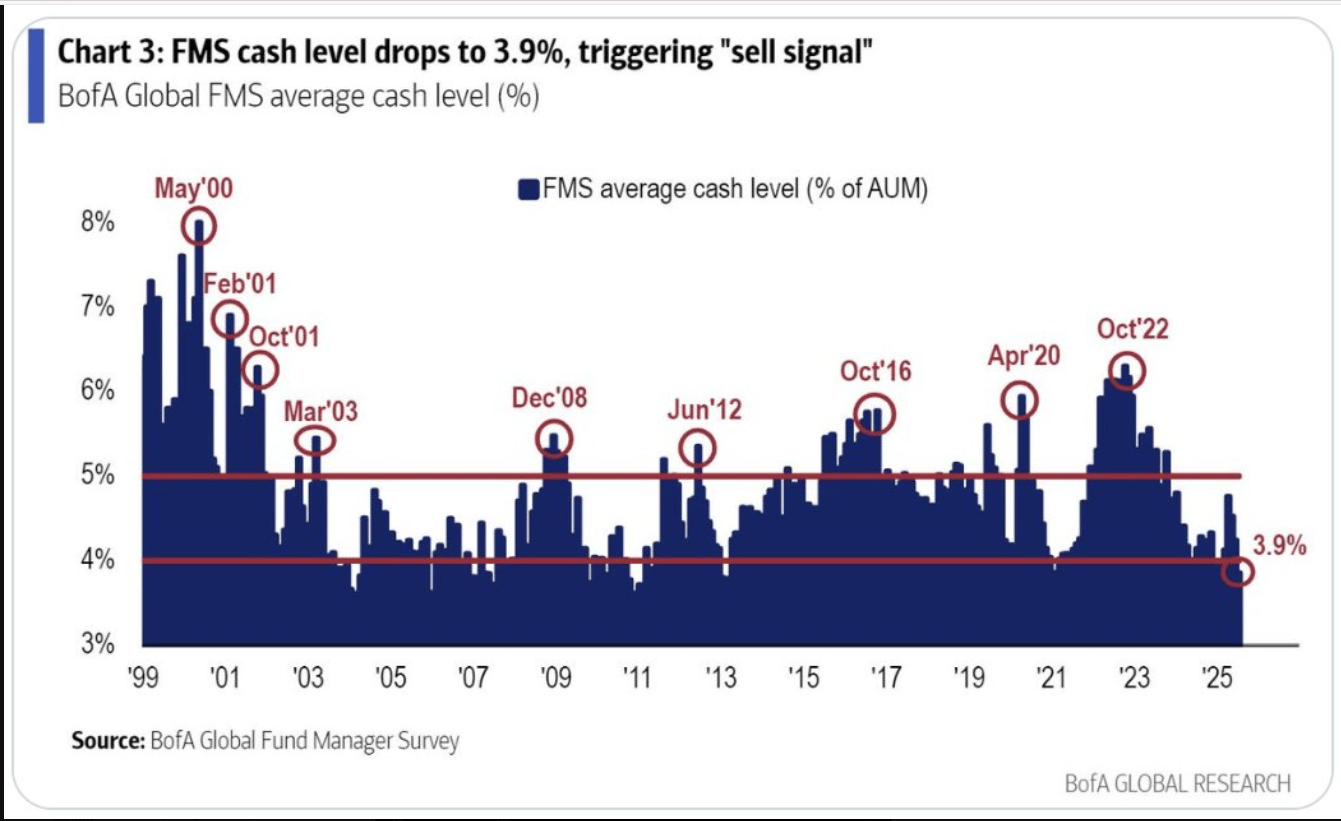

This chart from BofA indicates that when cash levels fall below the 3.9% threshold, it signals that it’s time to be cautious.

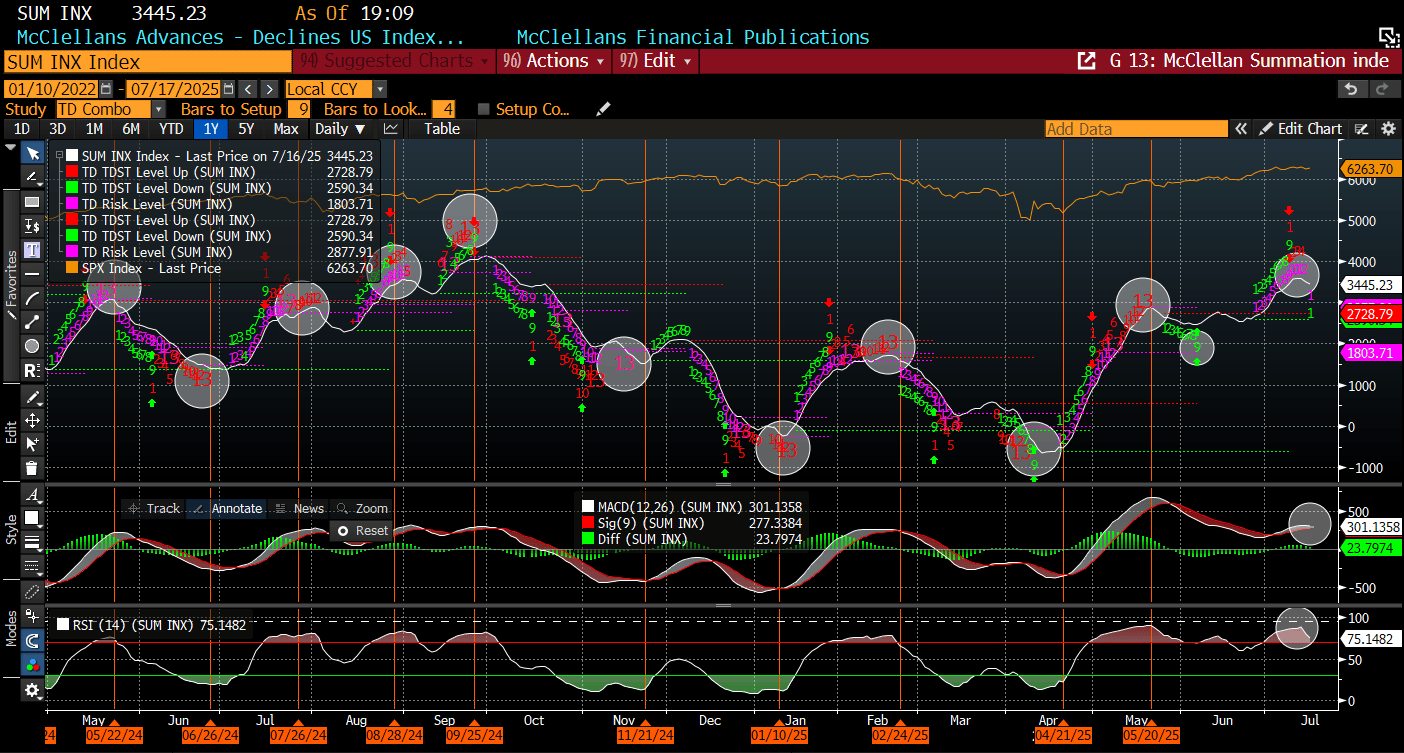

And let’s not forget our favorite timing tool for gauging market breadth shifts — the McClellan Summation Index (MSI) combined with DeMark signals. It’s just one day away from printing a combo 13 sell. Notably, it’s already showing signs of weakness, with the MACD beginning to turn lower and a price flip down (indicated by the green 1 below the bar).

The MSI’s downturn is more apparent without the distraction of count overlays. A cross below the 10-day moving average looks imminent—a move that typically signals a bearish reversal.

The evidence continues to build for a potential market retracement. Indexes remain resilient on the surface, but under the hood, more and more stocks are being sold—classic signs of institutional distribution. While this doesn’t guarantee a deeper pullback, cracks like these often foreshadow trouble, especially when paired with an unexpected macro shock.

Last August, it was the Japan market crash, but U.S. indexes had already been discounting something for weeks. Could a similar setup be unfolding now? Absolutely. August has a habit of exposing geopolitical or structural market vulnerabilities. We’re not here to predict the exact trigger—only to prepare you for the possibility.

Earnings season could push markets to new highs first, or we could begin unwinding tomorrow. Either way, the setup is ripe for a reversal. When our signals flash caution, we don’t ignore them. That means we’ll be using any residual strength to raise cash and reduce risk.

Before we wrap up, one opportunity worth flagging: uncorrelated assets may benefit if the U.S. markets stumble. One such candidate could be China.

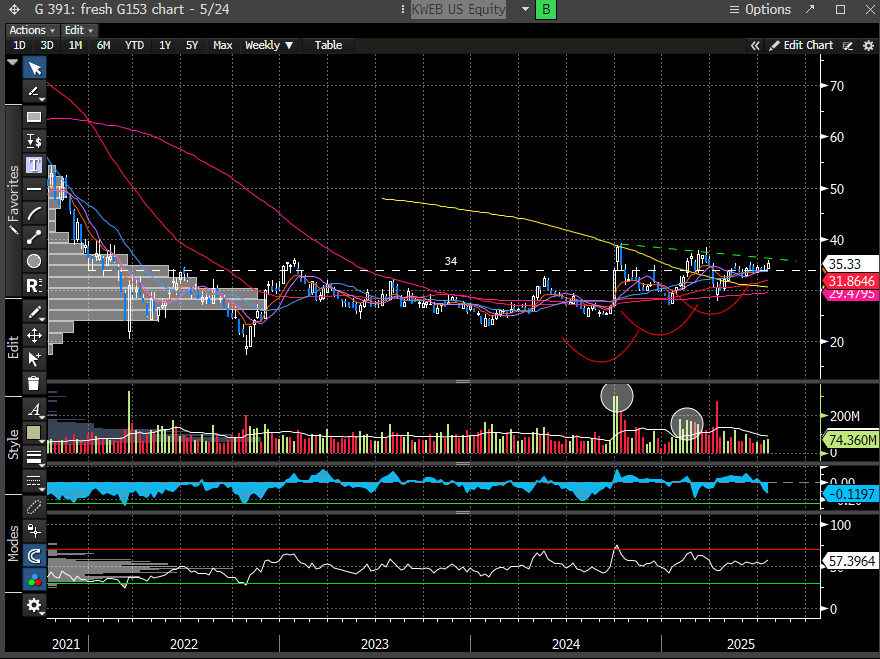

Chinese equities have largely been left out of the rally—but that may be changing. The chart below shows the ratio of KWEB (Chinese Internet stocks) vs. the Mag 7. It has just broken out of a 4-month falling wedge pattern. The MACD is turning up, and RSI is flashing a positive divergence—early signs that relative outperformance may be beginning.

KWEB gapped higher out of its own 4-month bullish consolidation pattern, a notable technical breakout supported by strong volume. The MACD is also crossing higher, reinforcing the shift in momentum. With sentiment still depressed and positioning light, China could offer uncorrelated upside if U.S. markets falter.

KWEB has struggled to hold above the key $34 pivot, but the series of higher lows into the recent breakout suggests sellers are losing control. Volume patterns also point to quiet accumulation during the base. A clean break above the weekly downtrend line would likely confirm a regime shift and set the stage for the next sustained uptrend.

Thats it for us. Have a great rest of the week.

CSC Team

Coiled Spring Capital LLC, Founder

http://www.coiledspringcapital.com

Terms of Subscription and Service of Coiled Spring Capital, LLC.

All subscribers (“You”) to Coiled Spring Capital, LLC (CSC) services hereby agree to the following terms of use of the services provided by CSC.

You acknowledge that CSC and all individuals or affiliates associated with CSC are not licensed nor serving as an investment advisor or broker dealer with respect to you. CSC does not recommend or suggest which securities You should buy or sell for yourself. You agree that CSC shall have no liability whatsoever for investment or other decisions based upon any content provided in the service or any contrarian view of any content. All investment decisions are solely made by You.

None of the information contained from time to time while You are a subscriber constitutes a recommendation of a particular security, portfolio, transaction or investment strategy is suitable for any specific person. You specifically agree by subscribing to this service that under no circumstances shall CSC be liable for any loss or damage of any kind whatsoever by your reliance upon information obtained from CSC’s website. You acknowledge the fact that stock trading involves risk and is not suitable for all investors, including You.

All opinions are based upon information considered reliable but

You acknowledge that CSC does not warrant the completeness or accuracy of such information. While efforts are made to ensure the accuracy of such information, CSC is under no obligation to update or correct any such information. All information is subject to change without notice.

CSC engages solely in general trading information and education and is not based upon any specific investment objectives of a particular subscriber. You should not rely solely on the information provided by CSC. Instead you should use the information as a starting point for doing additional independent research in order to form your own opinion regarding investments. You should always check with your licensed financial advisor, tax advisor or other professional in order to determine the suitability of any investment.

You must not assume that the information provided by CSC will be profitable or that the information will not result in losses. Past results of information provided by CSC are not indicative of future returns. Individual trading results will vary.

DISCLAIMERS AND MANDATORY ARBITRATION OF DISPUTES

CSC MAKES NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE INFORMATION PROVIDED. ALL INFORMATION PROVIDED IS ON AN “AS IS”, “AS AVAILABLE” BASIS, WITHOUT REPRESENTATIONS OR WARRANTIES OF ANY KIND WHATSOEVER TO THE FULLEST EXTENT PERMITTED BY LAW. CSC DISCLAIMS ANY AND ALL REPRESENTATIONS AND WARRANTIES, WHETHER EXPRESS, IMPLIED, ARISING BY STATUTE, CUSTOM, COURSE OF DEALING, COURSE OF PERFORMANCE OR IN ANY OTHER WAY. CSC DISCLAIM ALL REPRESENTATIONS AND WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OF THE INFORMATION PROVIDED OR THAT THE CONTENT OF THE INFORMATION PROVIDED IS ACCURATE, COMPLETE OR CURRENT. CSC DOES NOT REPRESENT OR WARRANT THAT THE INFORMATION AND ANY TRANSMISSIONS SENT FROM CSC IS FREE OF ANY HARMFUL COMPONENTS, INCLUDING BUT NOT LIMITED TO COMPUTER SOFTWARE VIRUSES. YOU HEREBY AGREE TO THE HEREINABOVE MENTIONED DISCLAIMERS.

TO THE FULLEST EXTENT PERMITTED BY LAW, CSC ON ITS OWN BEHALF AND ON BEHALF OF ITS OWNERS, DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, SUPPLIERS AND AFFILIATES EXCLUDE AND DISCLAIM LIABILITY FOR ANY LOSSES AND EXPENSES OF ANY NATURE WHATSOEVER, INCLUDING BUT NOT LIMITED TO DIRECT, INDIRECT, GENERAL, SPECIAL, PUNITIVE, INCIDENTAL OR CONSEQUENTIAL DAMAGES, LOSS OF USE, INCOME OR PROFIT, LOSS OF OR DAMAGE TO PROPERTY, CLAIMS OF THIRD PARTIES FOR INDEMNICATION OR SUBROGATION OR OTHERWISE WHETHER LIABILITY IS BASED UPON CONTRACT, TORT OR STRICT LIABILIY OR ANY OTHER BASIS. YOU AGREE TO THESE DISCLAIMERS BY USE OF THE WEBSITE SUBSCRIPTION.

APPLICABLE LAW IN SOME STATES MAY NOT ALLOW THE LIMITATION OF CERTAIN WARRANTIES, SO ALL OR PART OF THIS DISCLAIMER OF WARRANTIES MAY NOT APPLY TO YOU.

MANDATORY ARBITRATION AND WAIVER OF JURY TRIAL.

YOU AGREE THAT ANY AND ALL DISPUTES BETWEEN YOU AND CSC SHALL BE SUBJECT TO BINDING ARBITRATION PURSUANT TO THE FEDERAL ARBITRATION ACT OR COMPARABLE STATE ARBITRATION IF THE FEDERAL ACT IS FOR ANY REASON DETERMINED NOT TO BE AVAILABLE. IF NO STATE HAS SUCH ARBITRATION AVAILABLE THEN THE PARTIES HEREBY AGREE TO USE THE AMERICAN ARBITRATION ASSOCIATION SERVICES. THE VENUE FOR ANY SUCH ARBITRATION SHALL BE IN THE STATE OF TEXAS AND THE CITY OF AUSTIN.

YOU AGREE TO WAIVE YOUR RIGHT TO A COURT OR JURY TRIAL AND TO PARTICIPATE IN ANY CLASS ACTION.