The stock market continues its relentless grind higher—orderly, persistent, and increasingly divorced from the macro headlines. Volatility has collapsed, despite a looming August 1st tariff deadline, the July FOMC meeting, and the kickoff to earnings season. Performance anxiety is surging, and speculative excess is back in full force, with low-quality, heavily shorted stocks stealing the spotlight. Welcome to Silly Season.

The question now: is this the beginning of the end, or the start of a full-blown melt-up?

Case in point—$OPEN, a former SPAC darling left for dead, surged more than 10x in just a few weeks. Options activity exploded, with over 2 million contracts traded in a single day.

$KSS, a struggling off-price retailer with nearly half its float sold short, tacked on a casual 120% in a single session—pure panic-driven buying.

$GPRO, the former high-flyer in the camera space, surged nearly 160% this week before finally pulling back—another clear sign of frothy, speculative chase behavior.

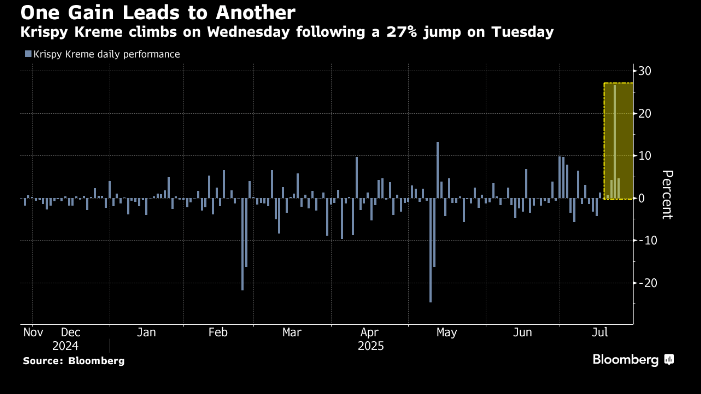

Even $DNUT joined the frenzy, catching a sugar rush of its own as traders piled into anything with a pulse.

As if professional money managers weren’t already under pressure to catch up to the benchmarks, now they’re facing a new headache: portfolios hedged with structurally broken companies are getting squeezed, echoing the post-pandemic MEME mania driven by WSB darlings like $AMC and $GME.

Retail remains firmly in the driver’s seat, buying every dip and powering stocks higher. According to Citadel, retail traders have been net buyers of equities for 19 consecutive sessions—the longest stretch since 2021. Even more eye-opening: the 10-day average of retail participation in non-profitable tech has surged to 23%, a level not seen since the speculative blow-off tops of previous cycles.

BofA notes that retail investors have been consistent net buyers, while institutions have quietly been distributing into strength. This growing divergence has the feel of a classic late-cycle setup—where retail enthusiasm runs hot just as professional managers begin to tread more cautiously. It's a dynamic that has many seasoned investors raising eyebrows, if not outright concern, about the durability of the current rally.

However, if you think the resurgence of meme stock mania signals an imminent market peak, history suggests otherwise. The original meme stock, $GME, topped out a full 48 weeks before the S&P 500 ($SPX) ultimately peaked—and during that stretch, the SPX climbed another ~26%. In other words, meme stock euphoria is far from a reliable timing tool. It may signal froth at the margins, but it’s not a sell signal on its own.

This chart from Bespoke offers valuable perspective on the current meme stock resurgence. The 100 most shorted stocks in the Russell 1,000 have surged 52% over the past three months, outperforming the index by a staggering 33 percentage points. While that spread is undeniably elevated, it’s worth noting that it still sits roughly 30% below the peak frenzy levels seen during the 2020–2021 cycle. In other words, short squeezes are back—but not yet at full tilt.

If this convinces you that this bull market is nearing its end, consider this: historically, the average bull market gains around 154% from its lows. As of now, we're only about halfway to that mark. While past performance is no guarantee of future results, this context suggests there's still meaningful upside potential left before this cycle runs its course.

Carson Research adds another compelling datapoint to the discussion: when the stock market grinds steadily above its 20-day moving average for 60+ consecutive sessions, the forward returns over the next 1, 3, 6, and 12 months have historically been strongly positive.

In other words, persistent strength tends to beget more strength — not immediate reversals. This type of price action is characteristic of healthy, trending markets, not ones on the verge of collapse.

In last weekend’s report, we explored the idea that market bears might actually be too complacent. This view is supported by a strong underlying demand for stocks, as buyers are consistently pushed into the market at ever-higher prices, driving new all-time highs.

To illustrate this, we shared a chart showing that there is no significant distribution visible through On-Balance-Volume (OBV) and Money Flow Indicator (MFI) readings, despite what some sentiment data (like the BofA chart) might imply. Notably, the OBV reached a new high alongside the SPX on Wednesday, indicating that institutional buying is still actively supporting the market at these elevated levels.

That said, markets never move in a straight line, and the next bout of volatility could be just around the corner. Our goal is to help you be prepared for that inevitability—and equipped with the insights and tools to turn those moves into additional gains.

So, is it time to get more cautious?

Let’s dive into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade