Introduction

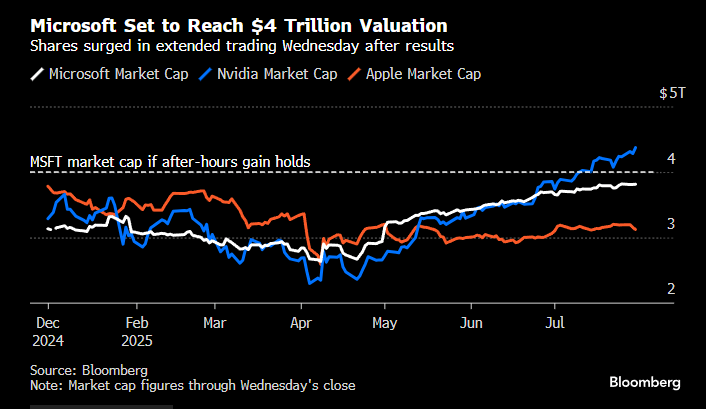

Remember when the consensus declared Big Tech is dead? That their outsized weight in the index would inevitably lead to underperformance? It turns out those calls were premature — and a bit simplistic. Just ask the management teams at Microsoft and Meta, who delivered a resounding rebuttal Wednesday night.

With earnings that crushed expectations, Satya Nadella and Mark Zuckerberg might as well be laughing in the face of skeptics. The narrative that massive infrastructure and AI investments wouldn’t yield sufficient ROI is being dismantled in real time. How can companies of this scale reignite growth so dramatically? Simple: business is booming.

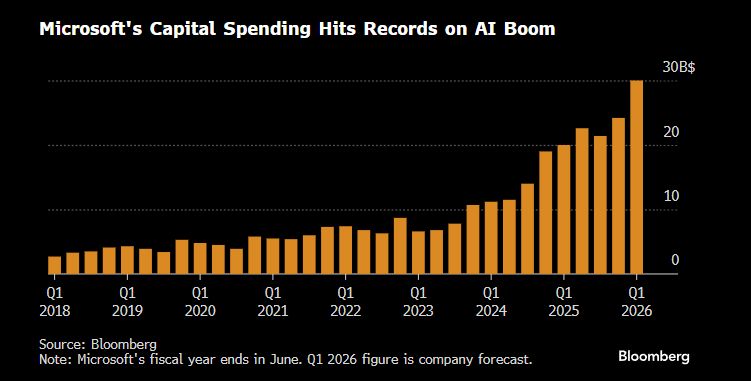

AI-driven improvements allowed Meta to significantly boost the average price of its ads — a key factor behind its blowout earnings. The company isn’t just beginning to reap the benefits of its earlier capex investments; it’s doubling down, accelerating spend into next year. Google echoed a similar sentiment on its earnings call, announcing increased AI capex for 2025.

Microsoft is also pushing aggressively. It continues to invest heavily in its own AI services while simultaneously benefiting from surging demand for AI applications — a key driver of Azure’s accelerating growth. Despite facing supply constraints in compute capacity, Microsoft is still gaining market share. Perhaps most notably, management highlighted quantum computing as a highly underappreciated growth lever for Azure.

If there was ever a comment to ignite animal spirits in tech, this might be it.

And everyone knows which of the Mag 7 sits at the epicenter of this AI-fueled capital spending spree: NVIDIA. But it’s not just the semis—energy and infrastructure companies are also integral to powering this revolution. The bottom line? Big Tech is steamrolling macro risks into irrelevance.

We knew this week was packed with event risk—the FOMC decision loomed large—but in our wildest expectations, we didn’t think the true showstopper would be earnings from Big Tech. The stunning outperformance is unfolding despite the macro overhang. For these companies, the direction of interest rates feels almost irrelevant. What we’re witnessing with AI could rival the dawn of the internet itself. Strap in—this could be the late ‘90s all over again.

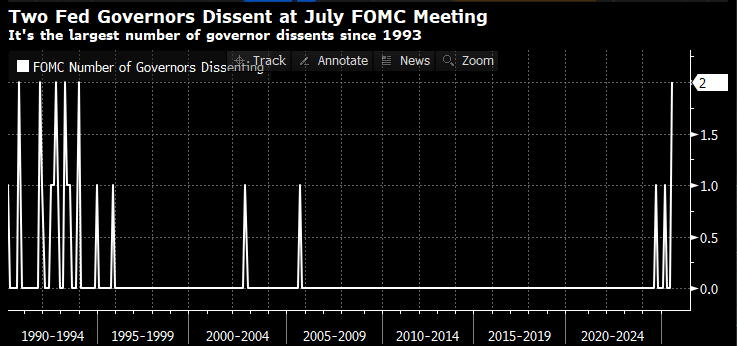

Which makes it almost deflating to pivot back to Powell, who managed to fumble the market’s initial enthusiasm during Wednesday’s press conference. The Fed’s statement leaned dovish, but Powell walked it back with cautionary commentary on inflation and tariff uncertainty. This, despite two dissenters calling for immediate rate cuts—the first such split in nearly 30 years. The market took notice. Powell’s delivery didn’t match the moment.

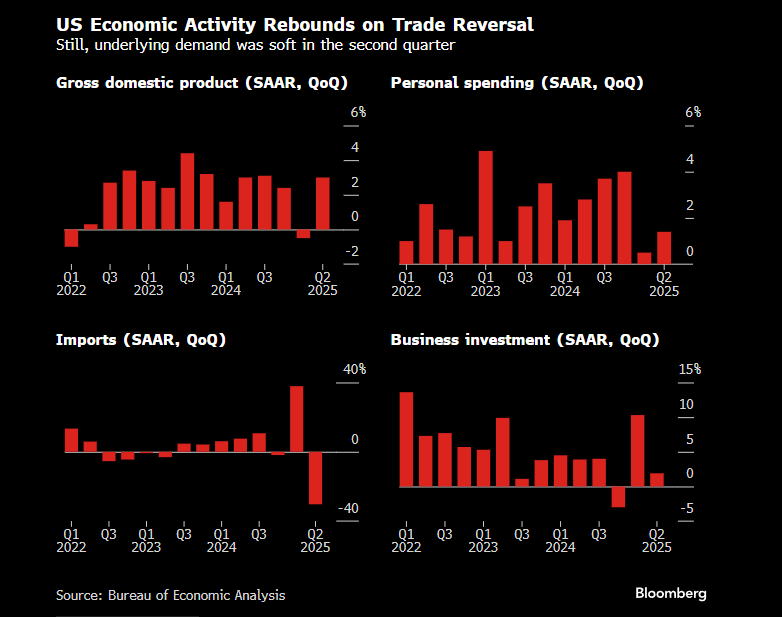

The FOMC downgraded its assessment of the U.S. economy, noting that activity had “moderated” in the first half of the year—largely due to softer consumer spending. Yet Powell muddled that messaging during his press conference, downplaying risks to the labor market ahead of Friday’s July payroll release. He remarked, “The economy is not performing as though a restrictive policy is holding it back inappropriately,” suggesting the Fed sees little urgency to pivot despite clear signs of deceleration.

The market didn’t take kindly to Powell’s remarks—stocks sold off almost immediately, as his tone undercut the initial dovish takeaway from the Fed statement.

We often highlight the 8-day EMA as a key barometer of buyer conviction—and once again, the SPX found support right there today. That makes three successful defenses of the 8-day EMA in just the past two weeks. It’s almost as if the market collectively anticipated that Big Tech would overpower Powell’s “party pooper” routine. As we’ve said before: as long as the 8-day holds, momentum buyers remain in control—and betting against them is usually a losing proposition.

The key takeaway: Powell’s hawkish tone flattened the yield curve and fueled another surge in the $USD, dragging equities lower into the close. But just as the market looked ready to break down from the bearish rising wedge we flagged in our weekend report, Mega Cap Tech (led by MSFT and META) threw on their Superman capes and pulled the market back from the brink. After-hours, the SPX has reclaimed all-time highs—now the question is: can it stick?

Let’s dive into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade