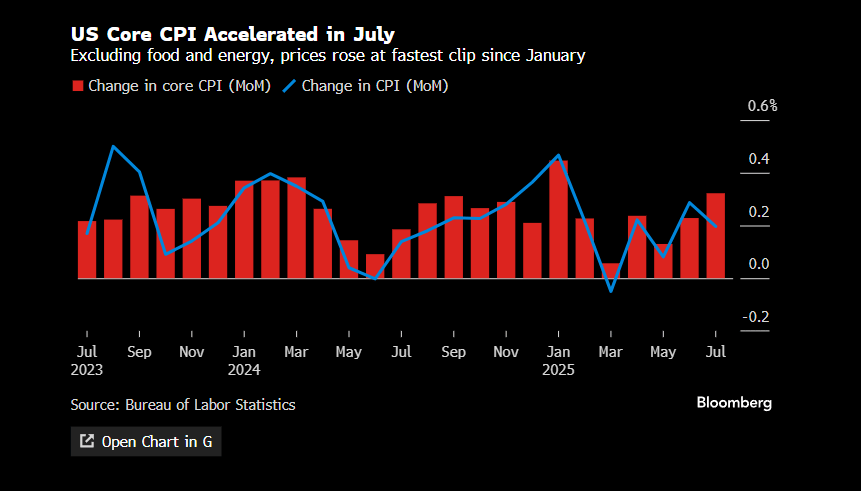

The stock market indexes surged to fresh all-time highs following Tuesday’s seemingly benign CPI report. While parts of the data actually showed inflation re-accelerating, the market shrugged it off. Bond traders instead zeroed in on the headline figure, quickly pricing in near-certainty of a 25 bps Fed rate cut in September.

As we noted in last weekend’s report, breadth has been deteriorating for weeks despite lofty index prices. We argued that a “catch-up” rally in laggard areas could unfold if the CPI gave the Fed enough cover to ease policy. That’s exactly what played out — cyclicals, small caps, and rate-sensitive sectors rallied as fears of a stagflationary drag gave way to hopes of fresh stimulus.

Core inflation did tick higher, but markets decided it wasn’t enough to derail what appears to be a politically-pressured path toward rate cuts. Barring a disastrous PPI reading on Thursday, Powell now has the runway to concede to easing — and may signal as much at next week’s Jackson Hole meeting.

Fed funds futures are currently pricing in more than 100% odds of a September cut, with a 50% probability of a third cut before year-end. Notably, Bessent has argued rates should be 150 bps lower already, calling for a 50 bps move in September.

We’re not economists, so we won’t opine on whether Bessent’s forecast is realistic — but peeling back the layers of the CPI report makes rate cuts of that magnitude sound wildly irresponsible.

Core CPI, excluding food and energy, rose 0.3% from June — the fastest monthly pace this year. Goods inflation remained muted, suggesting tariffs are still being absorbed by companies… but for how long? The real driver of the uptick was services inflation, with airfares posting their largest increase in three years.

CPI appears poised to reaccelerate into year-end if companies begin passing along their rising costs to consumers. That scenario could quickly temper the market’s enthusiasm for a September rate cut. Remember — there’s still another CPI print due in September before the Fed meets, along with a PCE report in late August. Declaring victory on inflation now feels premature.

Below is Hedgeye’s CPI projection, which calls for precisely this reacceleration into year-end. Their track record on these forecasts is strong, so we’ll lean on their work here.

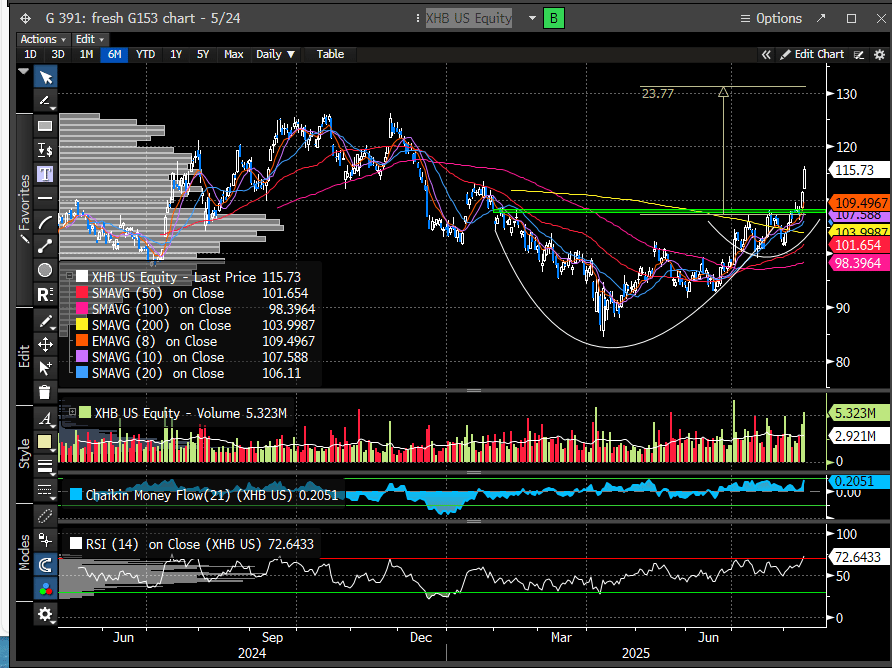

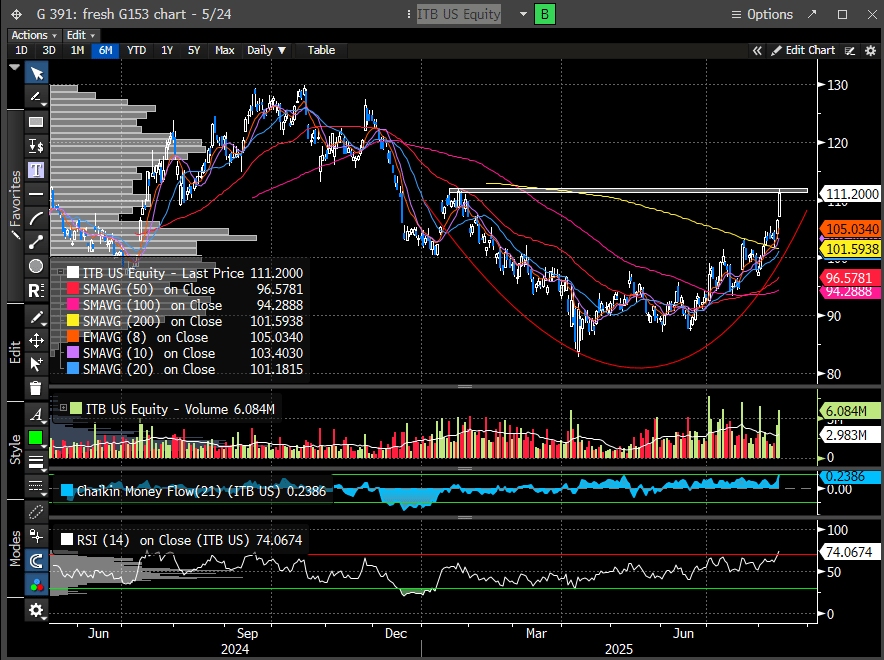

Nonetheless, that’s a battle for another day. For now, cyclical sectors most sensitive to falling rates — particularly housing — are ripping higher.

The Homebuilders ETF (XHB) has surged, completing a textbook cup-and-handle breakout with a measured-move target north of $130. The pattern is supported by strong volume on the breakout, adding conviction to the upside scenario.

The Home Construction ETF (ITB) is showing a similarly constructive setup, with a rounded base formation now pressing against its breakout pivot. A clean move through this level could confirm the pattern and open the door to further upside.

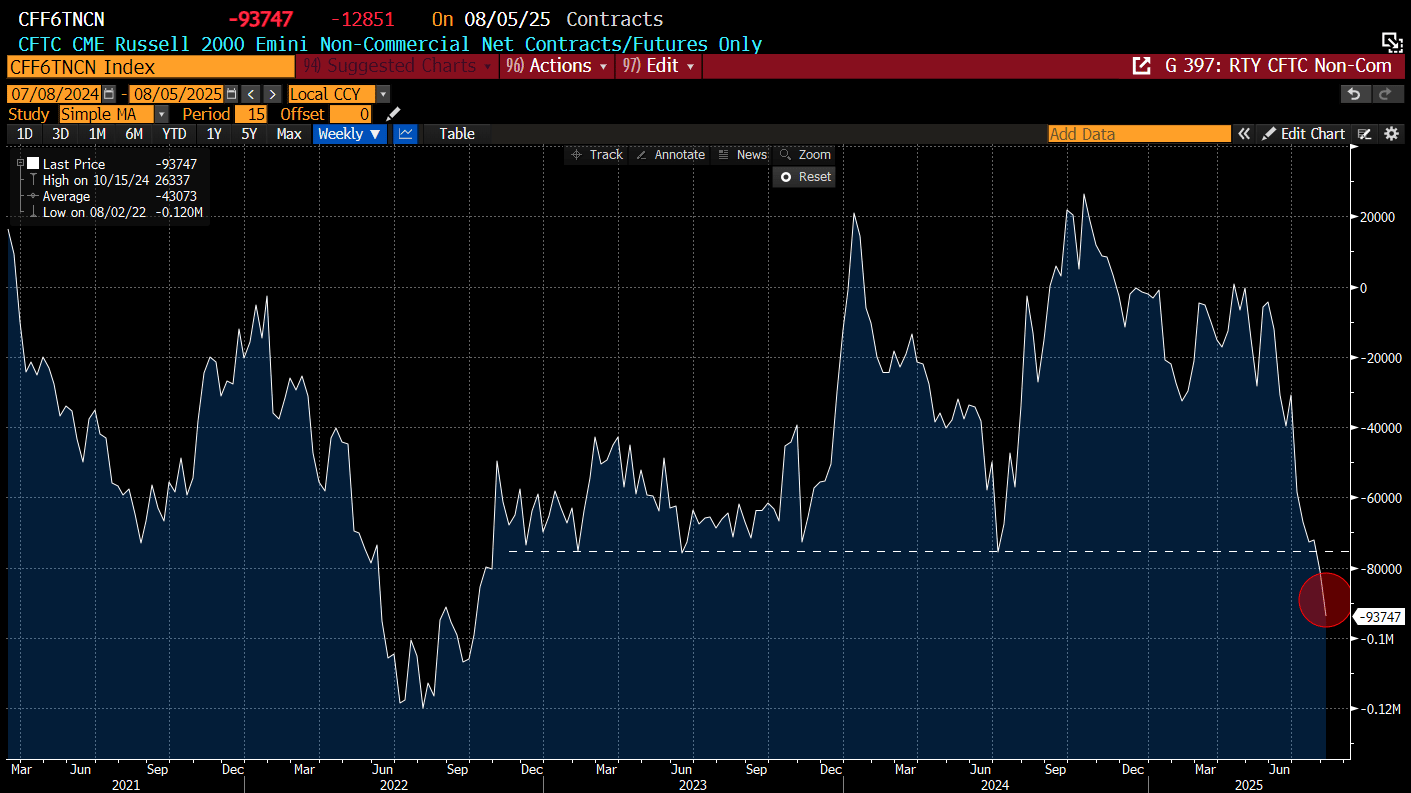

The Russell 2000 Small Cap Index (RTY) has finally broken above the election gap window for the first time since it lost that level back in February — a meaningful technical shift. This breakout signals that small caps, which had lagged significantly through Q2, are now participating in the rally and beginning a catch-up phase. If the move holds, it could invite further momentum-driven flows into the segment, especially given its sensitivity to rate expectations.

]

Recall the slide we’ve highlighted in prior reports showing the outsized short futures positioning in the Russell 2000. The “pain trade” here is clearly to the upside, with most market participants positioned short. As of the latest CFTC data, that net short exposure actually increased month-over-month — pushing to its most extreme level since October 2022. The result? A violent squeeze: RTY has surged +5% in just the past two sessions, and +8% off its early August lows. That’s the type of move that leaves short sellers saying, ouch.

The SPX Small Cap 600 (SML) has flipped the script from our 8/10 report. What looked like a developing bear flag has been forcefully negated, with the index ripping higher and reclaiming the 200-day MA in decisive fashion.

We were early in calling for a rotation into laggards back in early-to-mid July, but that thesis is now playing out in rapid fashion. The RTY has officially overtaken the SPX in Q3 performance — a leadership shift we expect to persist as the catch-up trade gains momentum.

Much like the SML, the S&P Mid Cap 400 (MID) also broke out, erasing its bear flag and pushing to test the July highs. Together, these moves mark the clearest confirmation yet that the rotation into laggard stocks we called for in mid-July is finally in motion—one we expect to continue.

As we stated in our 8/10 report on the CPI setup:

“This dynamic sets the stage for one of two outcomes: a catch-up in most stocks as discretionary managers are forced to rotate into underperforming sectors to generate alpha, or a catch-down in the indexes if leadership falters.”

“While we can’t say for certain which way the pendulum will swing, we can say this: a powder keg of risk is building, setting the stage for a binary outcome—either a melt-up or a melt-down in equities.”

The stage was set, and CPI delivered—bolstering the case for rate cuts and igniting a risk-on rally in the lagging areas of the market. The reaction was swift: cyclical sectors, small caps, and rate-sensitive groups all surged as capital rotated into beaten-down corners.

So now the question becomes: is it time to lean further into the laggards?

Let’s go to the charts and see what the market is telling us.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade