No, it’s not Halloween yet — but the market certainly delivered some scares this week. Volatility spiked, headlines turned ominous, and the doomsday crowd was out in full force, pushing their crash narratives. Even Bloomberg jumped in, running pieces on crash protection as sentiment turned defensive.

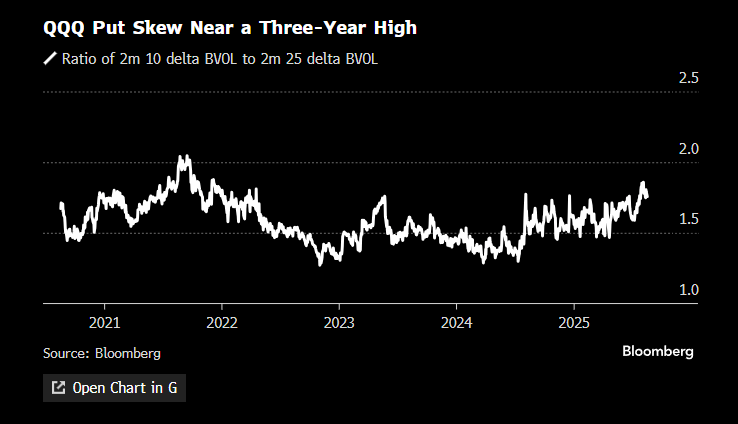

This surge in nervousness has pushed QQQ put skew to its highest level in three years, underscoring just how aggressively investors are seeking downside protection.

Hedging ETFs have experienced a notable surge in inflows, reflecting the heightened demand for downside protection.

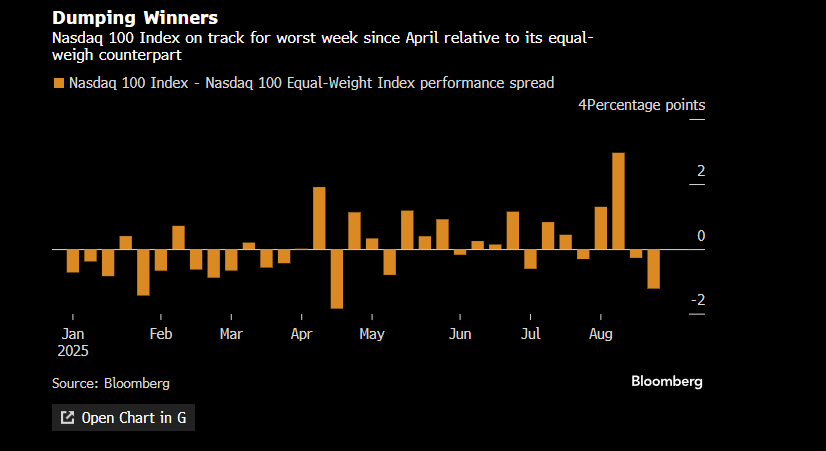

The Nasdaq 100 Index is on track for its worst week relative to its equal-weight counterpart since April. Investors who were crowding into the mega-cap leaders at the start of August have spent this week aggressively selling them. Whoever said the market was easy?

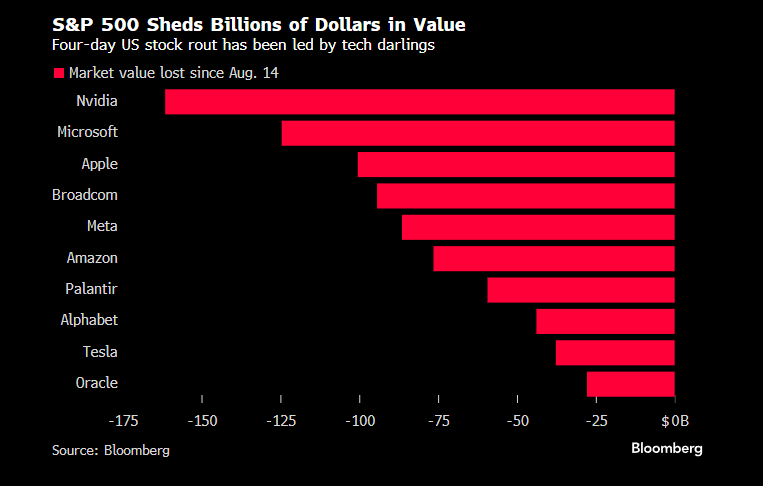

Since mid-August, the market’s biggest winners have quickly flipped into the biggest losers, highlighting how fragile momentum has become.

August — a month often marked by choppy trading and geopolitical landmines — has so far delivered a surprisingly respectable performance, even with the recent turbulence. Leadership remains with the Russell 2000 and the “Mag 7”, though the RTY has been steadily losing ground since peaking on August 13th.

In our 8/17 report, we dialed back our focus on small caps and urged caution as we exited OPEX week — a period that typically amplifies volatility — heading into the pivotal Jackson Hole Fed gathering. Our index analysis pointed to short-term DeMark sell signals, which have a strong track record of flagging near-term direction.

On the Russell 2000 (RTY), we wrote:

“…a TD REI sell signal (purple arrow) also printed on Friday. These signals have historically been reliable short-term predictors, suggesting additional downside pressure in the days ahead. Combined with the RTY’s failure to follow through, this adds weight to the view that near-term risks are skewed lower.”

Since then, the RTY has slipped another ~1.5% into Wednesday’s lows. While not dramatic in isolation, the week is far from over — and Powell’s remarks on Friday still loom large.

On the Nasdaq, we noted:

“The Nasdaq is also on track to print a new 9 sell tomorrow, after already registering a TD REI sell signal on Friday. Together, these point toward increased risk of near-term downside.”

The Nasdaq has since fallen ~3% into Wednesday’s lows, validating the caution.

We also flagged the potential for a VIX spike following the DeMark buy signal last week, adding yet another reason to remain defensive.

The VIX has climbed ~14% since our 8/17 report, peaking into Wednesday’s highs. The takeaway is simple: being prepared for volatility allows investors to re-allocate at more favorable prices — and Wednesday provided exactly that kind of opportunity.

We remain in a bull market, despite the growing chorus calling for a top. Maybe this is it, maybe it isn’t — but the bears appear to be losing their grip. The recent volatility spike has already begun to fade, leaving behind a “hammer parade” across multiple indexes. As followers of our work know, hammer formations at key junctures are one of our most reliable reversal indicators. They signal that panic selling has run its course and that buyers are willing to step back in.

That said, Friday still presents a binary event with Powell’s remarks. Until then, we view these episodes of volatility as periodic panic attacks within a broader uptrend — unsettling in the moment, but ultimately opportunities when cooler heads prevail.

Now, let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade