Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Introduction

O Brother, Where Art Thou? is a brilliant Coen brothers satire — quirky, unpredictable, and full of misdirection. While the movie has nothing to do with markets, it felt like the perfect reference for how surreal the current setup has become, with so much of the market’s fate seemingly tied to a single stock: NVIDIA.

In the film, Everett (George Clooney) and his crew are on a winding quest for treasure, facing obstacle after obstacle, never quite sure if the payoff is real or an illusion. It’s not far from how traders feel in the run-up to NVDA earnings:

The Quest: Like Everett chasing gold, investors are chasing clarity on whether NVDA can keep powering the AI growth story. The “treasure” is expected, but reality may not match the hype.

The Waiting: The movie drags its characters through delays and diversions, just as traders sit anxiously ahead of the report, knowing the path could twist violently either way.

The Reckoning: In the end, Everett’s treasure isn’t what he imagined. Likewise, NVDA could confirm the AI gold rush — or underwhelm and spark a reckoning.

That’s the gravity of NVDA today. Not only is it the largest weight in the SPX (8%), but it’s also the locomotive pulling the entire AI trade. If NVDA stumbles, the market stumbles.

So, did it deliver? Yes — but with nuance. NVDA met elevated expectations, though the pace of growth is clearly decelerating from the last two years. Guidance excluded H20 chips to China — a timing issue more than a structural one. The stock dipped ~2% in after-hours, hardly concerning given it’s still up +18% in Q3.

Will this stumble anger the market gods and trigger a major retracement? We doubt it. CEO Jensen Huang struck a distinctly bullish tone on the future of AI, and any meaningful dip in NVDA will likely be met with buyers.

That said, the short-term wobble could spark rotation within tech, particularly into lagging areas. Software (IGV) is still posting a negative return this quarter, while Semis (SMH) are up nearly 7%. That divergence sets the stage for potential catch-up — and we’ll dig deeper into that later in this report.

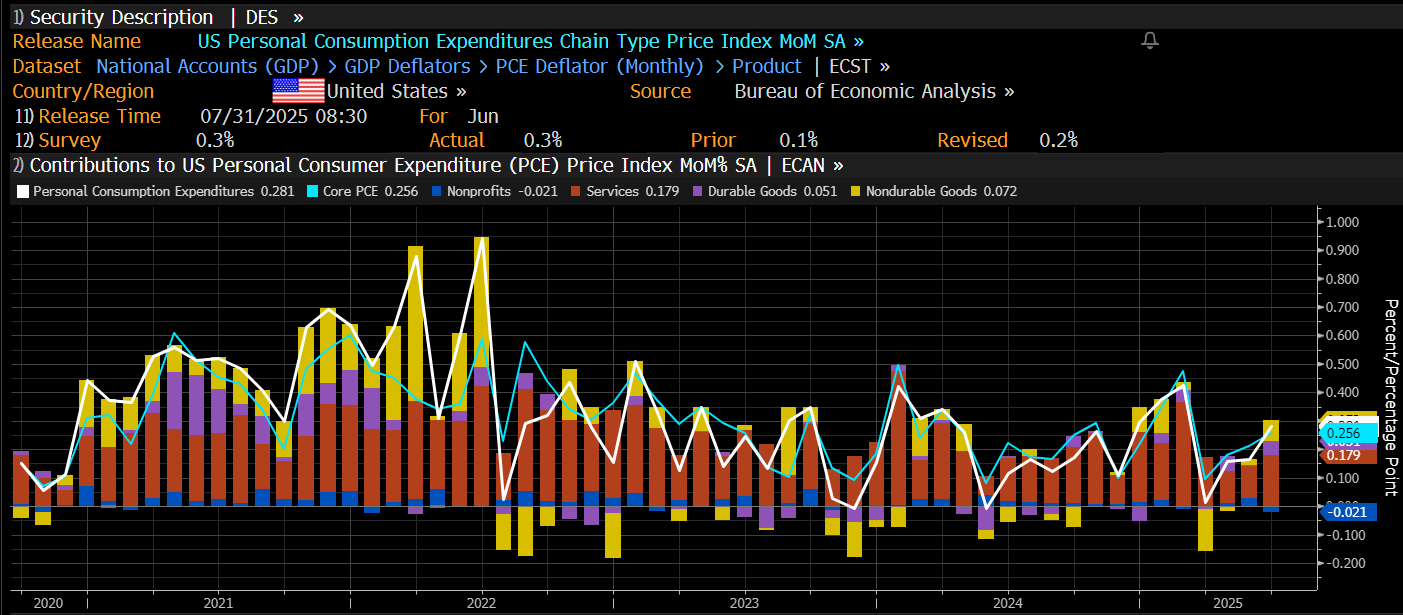

On a separate note, PCE data drops this Friday — and it may pack a bigger punch for markets than NVDA’s earnings. This report matters because it will either calm, or embolden, the bond hawks who argue inflation is re-accelerating. Powell’s Jackson Hole remarks leaned on the idea that inflation is “anchored” and should drift lower over time — but we’ve heard similar “transitory” lines before.

If the print comes in too hot, expect the market to unwind some of its post-JH enthusiasm. Bloomberg economists are projecting persistence in inflation, with PCE likely posting its hottest reading since February.

Economists see the expected July pickup being driven by services prices, particularly financial services. While the consensus still leans toward a rate cut later this year, a stronger underlying economy raises another risk: companies could begin passing tariff-related costs through to consumers.

If that dynamic shows up in the upcoming August CPI and jobs reports, it could undermine the case for a cut — and set the stage for the classic September swoon in equities.

As of today, the Russell 2000 (RTY) is outperforming the broader indexes, while the Mag 7 still hold the lead for Q3. If you’ve been following our work, you’ll recall that at the start of Q3 we recommended rotating into laggard SMID-cap sectors while overweighting exposure to the Mag 7 in August to help buffer against seasonality and macro turbulence.

That approach wasn’t without its tests — choppy trade required patience — but so far the strategy has proven prescient.

Whether this outperformance holds into September will largely hinge on the upcoming macro releases. It’s also possible that NVDA’s stumble accelerates rotation away from the Mag 7 and toward more rate-sensitive areas of the market.

With that in mind — let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade