Introduction

The market’s resilience continues to impress—after all, we’re still in a bull market. Last Thursday’s abrupt reversal and gap down, which sliced through key momentum moving averages, looked like the start of something more serious. For a moment, it appeared the bulls had lost control. But that narrative didn’t hold for long.

Instead, the market roared back on Monday, defying a wave of weekend headlines forecasting doom and even whispers of a "Black Monday." What we got was anything but. Like any great magician, the stock market’s best trick is misdirection—sleight of hand, smoke and mirrors, and just enough confusion to fool the crowd.

The technical breakdowns we discussed over the weekend appeared ominous at first, but the lack of follow-through has left the bears scrambling. In our 8/3 report, we laid out three possible scenarios for where the market could head next—but so far, there's been no decisive resolution. That indecision, in itself, is a signal worth watching. More on that shortly.

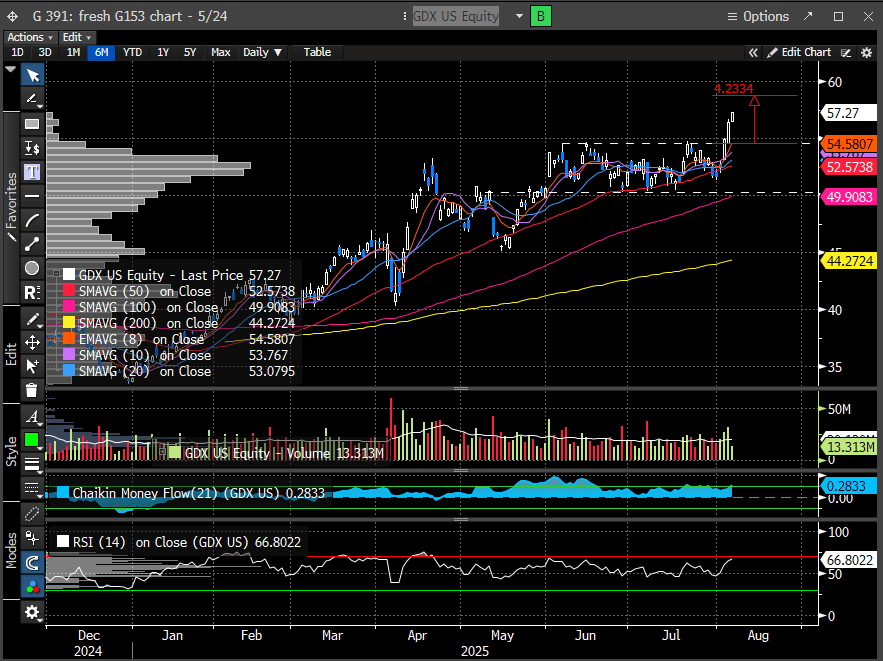

One bright spot we highlighted in that same report was precious metals. Since then, GDX (Gold Miners ETF) has broken out to new all-time highs. A reasonable near-term target for GDX is now $59–60.

When looking at sector leadership since the start of Q3, it’s no surprise to see technology at the front of the pack, driven by a strong post-earnings response from most of the Magnificent 7.

The Magnificent 7 have delivered returns nearly three times that of the S&P 500 since the start of Q3—and we believe this outperformance is likely to continue.

Utilities are also emerging as unexpected leaders, and there are two key drivers behind the move:

AI workloads are extremely energy intensive, creating electricity bottlenecks in certain regions and boosting long-term demand for power infrastructure.

A declining rate environment makes utility-sector dividends more attractive on a relative basis.

From a technical standpoint, the sector is breaking out from a massive three-year cup-and-handle base—a highly constructive pattern. The breakout is fresh, and the measured move target sits at 1,320, implying an additional 22% upside from current levels.

Needless to say, we continue to favor all three groups—the Magnificent 7, Utilities, and Precious Metals—as likely outperformers in the current environment.

The backdrop of falling rate expectations is helping keep a bid under risk assets, and those expectations have only strengthened since the weekend following a dismal ISM report. Fed Funds Futures are now pricing in a 95% probability of a rate cut in September. This growing conviction around lower rates should continue to support the relative strength of our favored sectors.

Apple (AAPL) helped buoy markets today after announcing a $100B domestic investment, sending the Mag 7’s biggest laggard up 5%—its largest gain in months. The move contributed to roughly 30% of the S&P 500’s return today, helping offset negative headlines, including Trump’s doubling of India tariffs to 50%.

This price action matters. If laggard names like AAPL begin participating, it could breathe new life into the broader indexes, reinforcing the bullish momentum and expanding the leadership base.

Despite what appears to be strength in the major indexes, the reality is that large-cap stocks are doing most of the heavy lifting. The McClellan Summation Index (MSI), which tracks market breadth, shows that most stocks actually peaked back on July 14th and have been trending lower ever since.

This growing breadth divergence is worth watching closely—it can often serve as an early warning sign of underlying market weakness if not reversed.

So, what gives? A weakening economy tends to hit most stocks across the index, while the Magnificent 7 are largely insulated from economic softness, thanks to their scale, pricing power, and global revenue streams. That’s a key reason we continue to view them as likely outperformers in an increasingly challenging macro environment.

Yesterday’s ISM Services report was a stark reminder of the pressures building beneath the surface. The headline reading fell below all estimates and marked the fourth contraction in five months, registering as one of the weakest prints since the pandemic. Rising input costs and tariff-related uncertainty appear to be freezing corporate spending, adding to the strain.

And then, after the bell, we were hit with more tariff talk, adding yet another layer of uncertainty to an already fragile macro backdrop.

So here we are—caught in a tug-of-war between a deteriorating macro backdrop, the Fed’s accelerating pivot toward rate cuts, and Trump’s unpredictable tariff rhetoric. Who wins out? That remains to be seen. But regardless of how this plays out, we believe the key groups highlighted above are best positioned to outperform across scenarios.

Let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade