Introduction

The market is in Waiting for Guffman mode — pouring all its energy and expectations into Thursday’s CPI print. Just as the cast in the film pins its hopes on a star who never arrives, traders are assigning CPI the power to either validate the rate-cut narrative or expose it as wishful thinking.

And like Guffman’s no-show, the outcome may not match the buildup. CPI could surprise, disappoint, or simply muddle the picture — but with volatility on macro event days already running nearly 50% above average, the stakes couldn’t be higher.

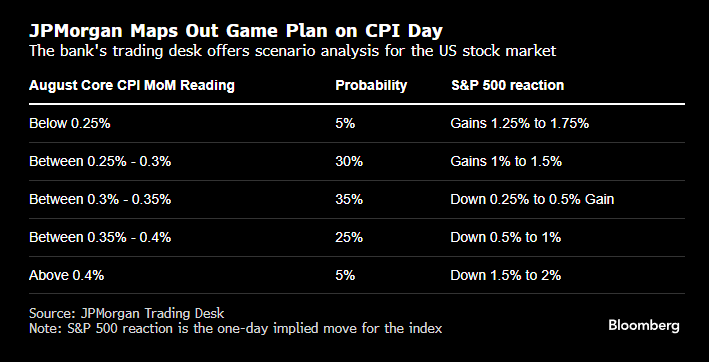

JPM neatly summarizes expectations and potential market impacts in a tidy table. Whether their framework has merit, we’ll soon find out.

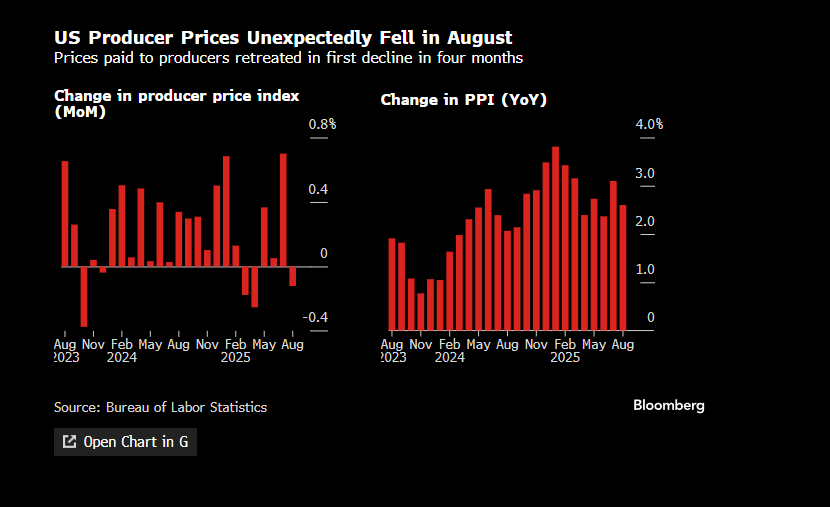

Half of the inflation picture arrived Wednesday morning, with PPI unexpectedly declining from the prior month — its first drop in four months. The move is notable given that several PPI components feed directly into the Fed’s preferred inflation gauge, the PCE.

Of course, Trump wasted no time calling for a “big” rate cut. One interesting takeaway from the softer PPI is that companies are still holding back on passing through tariff-related cost increases. Whether that restraint continues remains to be seen, but for now it’s welcome news.

Still, much to the frustration of the super-sized cut crowd, market probabilities have only inched higher. Fed Fund Futures now price in 112% for September — essentially a 100% chance of a 25 bps cut, plus a 12% chance of a second. Tomorrow’s CPI will go a long way in determining how those odds settle heading into next week’s FOMC.

A surprise downside in CPI could open the door to a 50 bps cut, but we view that as a low-probability outcome. Bloomberg’s economist team is looking for a modest month-over-month increase, and most investors surveyed by 22V Research expect an in-line print.

For equities, options traders are pricing in a 0.7% move in either direction — right in line with the macro-event volatility we highlighted in our 9/7 report. As we’ve noted, the stock market remains expensive, leaving little margin for error around key catalysts. One way to frame it: the equity risk premium has now turned negative, suggesting stocks are no longer compelling when compared to risk-free Treasury yields.

This leaves equities vulnerable if CPI disappoints. But if the data delivers, under-positioning remains large enough to fuel a continuation of the rally.

While CPI may be a binary event, our weekend work pointed to a market primed to push higher. Since then, the major indexes have indeed printed new all-time highs — even if they closed off those levels on Wednesday.

If Thursday’s CPI delivers enough to appease the market gods, we expect the upside ranges outlined in prior reports to be tested. But if it comes in too hot… look out below.

What does that mean for the market? Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade