The month kicked off with a bang in true September fashion. As investors returned from summer break, their first instinct was to hit the sell button at the open, driving the SPX sharply lower—nearly wiping out all of August’s gains in a single session—before staging a rebound into the close.

The selloff halted right at the 50% retracement of the August 1st gap down, then reversed to fully fill the gap. Sound familiar? A nearly identical sequence played out on August 1st, only with more violence.

This 50% retracement also aligns with the mid-August dip, where buyers once again stepped in. If markets are going to turn decisively bearish, it will likely require a break below this pivot level.

Our 9/1 report struck a blatantly cautious tone—and for good reason. Not only did our analysis point that way, but the macro calendar is loaded with potential landmines, each capable of dousing cold water on a 30% rally off the April lows that, in many respects, feels built on fumes.

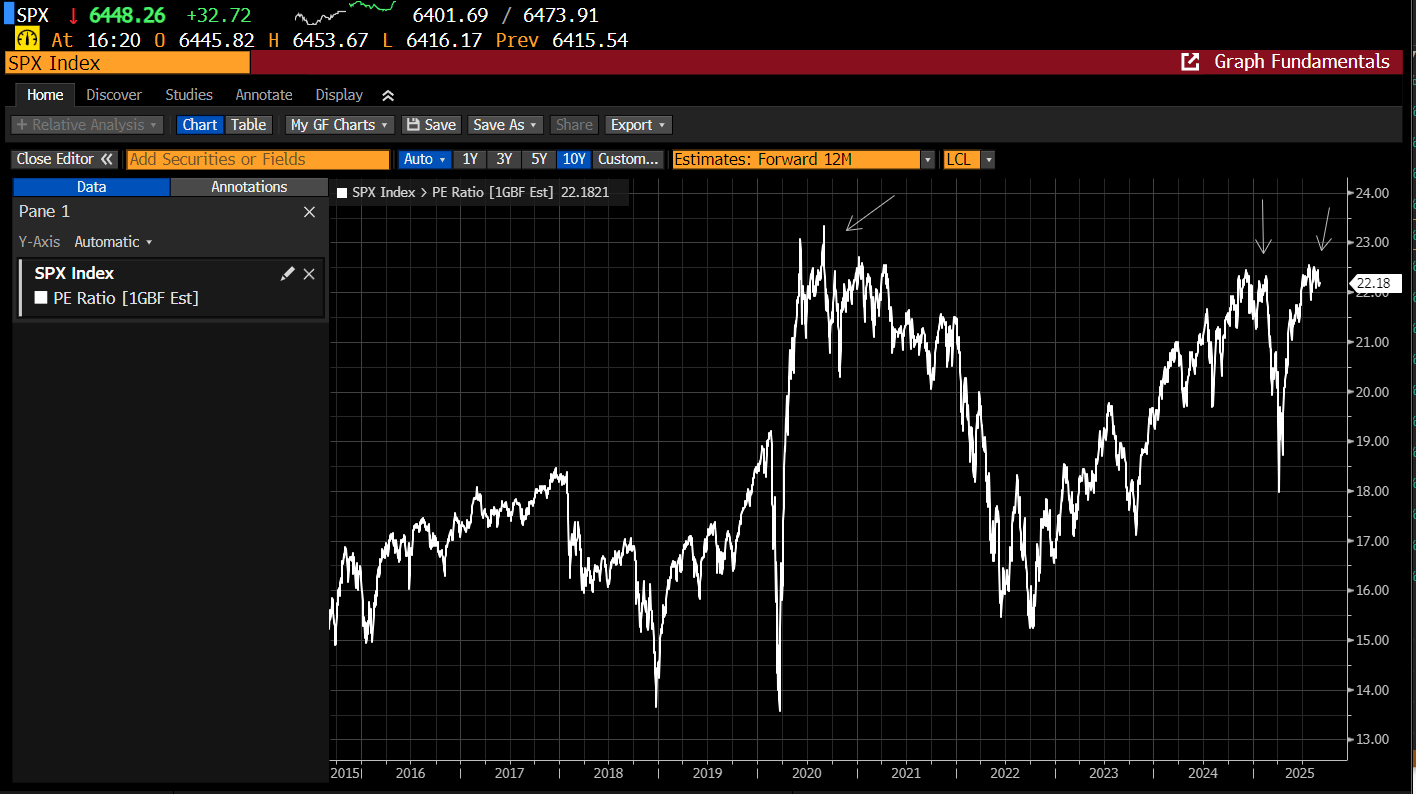

This doesn’t mean we’ve turned bearish—we haven’t. But there are times when the market’s trajectory is murky, and with stocks pressing against valuation ceilings, the margin for error is razor thin.

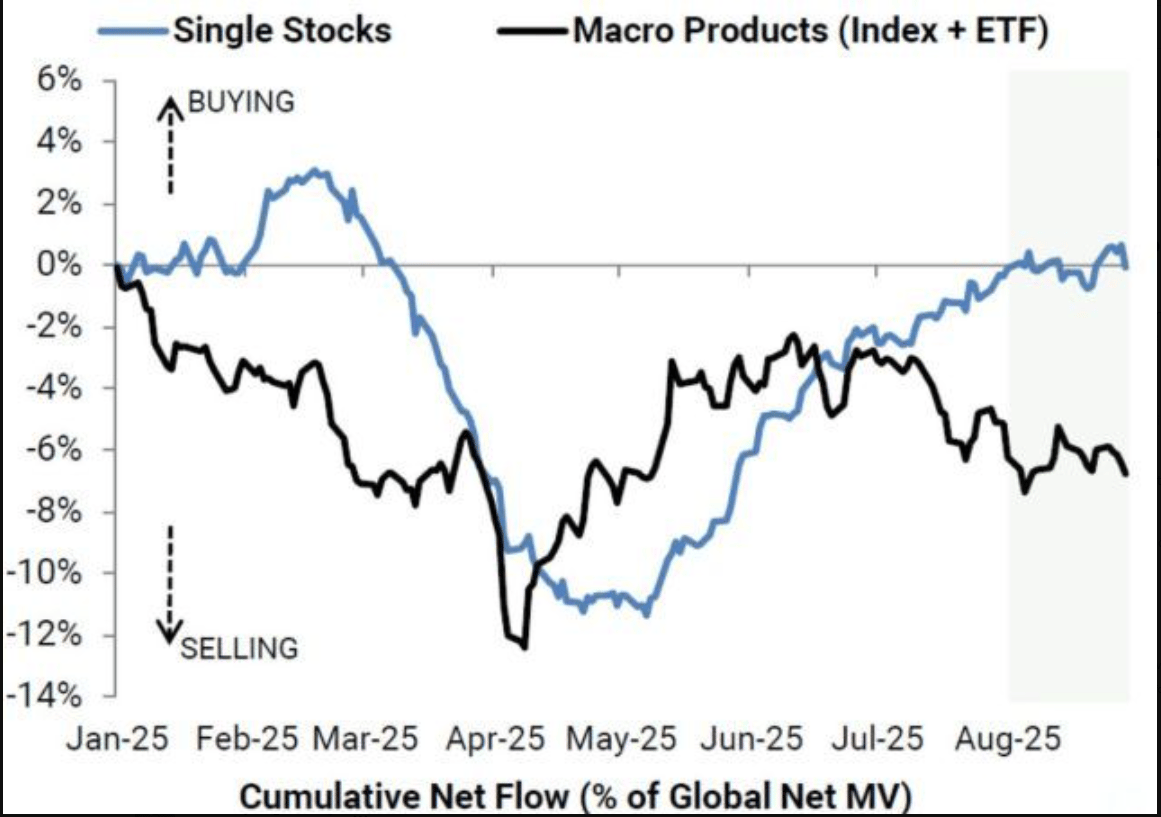

Hedge funds have been net sellers of equities for two straight months, using the rally to pare down exposure. This isn’t necessarily bearish—if anything, it can be viewed as bullish fuel. But the real question is: what brings them back to net buyers?

For that, the market needs a catalyst—and at this point, September feels like it has already priced in every known one.

It doesn’t help that September is historically the weakest month of the year—and in a post-election year it ranks just 10th. That backdrop only adds to the precarious nature of the current market setup.

Another dynamic not getting much airtime is the steepening of the yield curve. The 2s/10s spread is consolidating at its upper base, holding above the 61.8% Fib retracement from the ’21 peak, and looks poised to break higher. This steepening is largely a function of short rates pricing in near-term cuts while long rates aren’t falling as quickly—a classic bull steepener.

On its own, this isn’t inherently bullish or bearish—it’s about context. The key question is whether the Fed is ahead of the slowdown or already falling behind. This week’s payroll report may provide the answer. Stay tuned…

JPM clients are now holding one of their largest short bond positions in five years, reflecting a sharp shift toward expecting higher yields. That puts even greater weight on this week’s payroll report: if the jobs number materially undershoots the 75K estimate, it would bolster the case for more rate cuts and likely trigger an about-face in this trade.

Such a recalibration in the bond market wouldn’t happen in a vacuum. It could easily spill over into equities, fueling an outsized volatility episode and adding yet another layer of risk for investors this week.

This leaves equity investors in a holding pattern, which is why we’ve been urging caution and suggesting a lighter touch over the next few weeks.

That doesn’t mean there aren’t opportunities. For the past two months, we’ve emphasized overweighting uncorrelated assets—and those calls have delivered in spades. Materials, Precious Metals, Biotech and China have all trounced market returns, validating our framework and proving that alpha is still out there if you know where to look. We continue to support those ideas with conviction.

Now, let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade