From the conclusion section of our 1/12 report:

Ready for another musical reference?

Voodoo Child by Jimi Hendrix, written in 1968, is an iconic song about belief in magic and superstitions. While we pride ourselves on the rigor of our analysis—anchored in data, not mysticism—there’s a faction of investors who dismiss technical and quantitative analysis as nothing more than “voodoo magic.”

We’ve heard it all before. Many investors, deeply entrenched in fundamental bias, are quick to scoff at our methodology. Conversations often circle back to the same skepticism: “How can charts and numbers predict market behavior?” Yet, our two-plus decades of experience have taught us one crucial lesson—to be open minded and accept that we can always improve our process: the market has a knack for humbling even the most self-assured. The moment you think you’ve cracked the code, the market will gladly serve you a hefty dose of reality. Careers—and markets—have crumbled under this hubris, as seen during the LTCM crash in the late '90s. We know our research creates alpha, and we only ask to invite our work into your process.

Let’s be clear: we’re not here to boast about our research, although perhaps we should. Few do as well as we do at forecasting market trajectory. The past six weeks have been tough since the SPX peaked in early December, but we called the dislocation, albeit two weeks early. Dislocations, while painful, serve a purpose: they clear excess, reset sentiment, and often pave the way for powerful counter-trend rallies at key inflection points. One such moment occurred on Monday.

In our last report, we discussed the likelihood of the election gap lows acting as a strong support level. We wrote:

“...before we get there, the SPX has to lose the election gap, which was tested pre-market on 12/20 but not during regular cash hours. The SPX is now ~50 points away from doing so, and any quick shot down to that level, we believe, will be bought. There is also positive RSI divergence into these lows, offering another reason to think a tradeable bottom is close.”

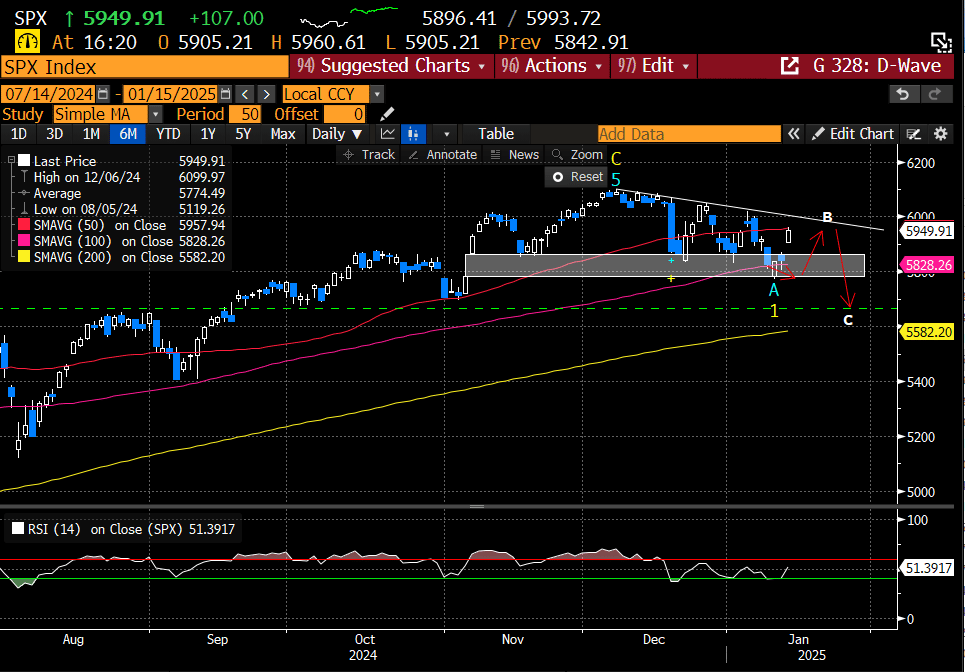

The market has so far followed the path we anticipated. Monday marked the completion of the wave A decline, setting the stage for the wave B counter-trend bounce we’re now experiencing. Below is the forecast we shared in that report, illustrating the SPX’s projected path.

Here is that same chart with this week’s updated prices.

We did the same for the Nasdaq.

Before:

And after:

Maybe it’s Voodoo?

If you read our report last week, you’re already familiar with the market setup heading into this week’s pivotal inflation reports. The conditions were ripe for a reversal, but something had to shift to disrupt the relentless trajectory of the rates complex. Enter PPI and CPI, the catalysts that cooled speculation about rates “going to the moon.”

Now, let’s be clear: rates could still rise further, and we’re not here to make definitive claims about their ultimate direction—that’s a job better left to economists (who often miss the mark). Instead, we focus on probabilities, not certainties. Last week, we pointed out that the rates complex was positioned for a reversal, supported by the presence of DeMark sell signals. While DeMark signals suggest the potential for a reversal, they often require a catalyst to trigger the move. CPI provided that catalyst.

We didn’t know CPI would deliver a moderating number; we only knew the probabilities favored a reversal in the stock market. And that’s the foundation of our analysis—probability-driven insights over speculative certainty.

The 10-year yield was sold aggressively as a result.

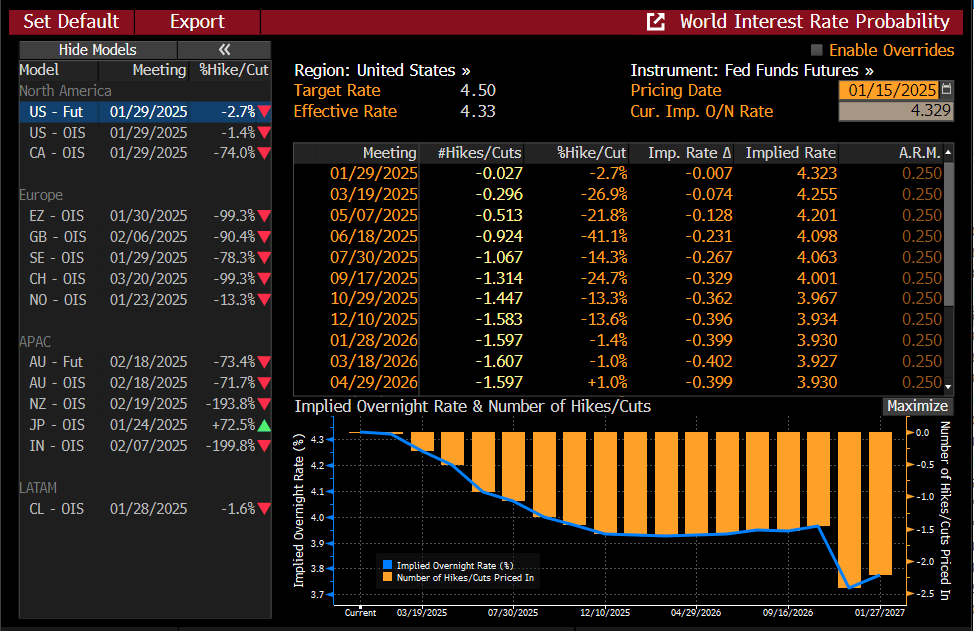

The probability of an additional rate cut in 2025 has jumped to nearly 60%, up from just 15% on Monday. This shift significantly alters the tone heading into the January FOMC meeting, increasing the likelihood of a dovish pause rather than a hawkish stance. This development should provide some support for the stock market in the near term—at least until the next disruptive data point emerges.

Retail sales data will be released tomorrow, and Bloomberg economists anticipate strong numbers. Holiday sales outpaced expectations, and increased car sales ahead of impending tariffs likely contributed to the strength. This robust spending trend appears poised to carry into the new year.

Historically, strong retail sales data has sometimes triggered selling pressure. However, with the latest inflation data showing signs of cooling despite robust consumption, we believe this dynamic will shift. Wall Street's narrative could pivot to a “good news is good news” stance, as a strong economy paired with disinflation represents a goldilocks scenario for markets.

This environment should bolster enthusiasm in the stock market, potentially sustaining the current momentum into next week’s inauguration, the heart of earnings season, and possibly the upcoming FOMC meeting.

Even if our musical references don't strike a chord with you, and you remain unconvinced about exploring our research, we hope you can still appreciate an iconic image of Jimi Hendrix masterfully shredding his guitar—a true legend whose brilliance transcends any debate. 🎸

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade