January has been a wild roller coaster ride for the stock market. Before last week’s CPI report, the SPX had surrendered all of its post-election gains. Fast forward to this week, and the SPX hit a new intraday all-time high on Wednesday. This surge in enthusiasm was amplified by Trump’s post-inauguration directives, particularly his Stargate initiative, which has further energized the already sizzling AI narrative.

Skeptics may argue that this rally is unsustainable—and perhaps they’re right—but for those who were caught flat-footed in mid-January (as suggested by the depressed NAAIM readings), the result has been forced buying at higher prices.

In our 1/12 report, we explicitly recommended buying the Monday dip into support. Since then, the SPX has climbed over 5%. That’s a substantial move for an index, especially in just over a week, and it highlights the prescient nature of our call.

Over the weekend, we argued that the rally would likely continue this week and advised buying any potential “sell-the-inauguration” dips. Those dips never materialized, and now the SPX is hovering near an all-time high.

The market is moving in response to last week’s inflation releases and Trump’s initiatives. While optimism is running high, we caution that the clouds haven’t completely cleared. As we’ve noted before, each macro release carries the potential to disrupt the market’s momentum and alter the trajectory of the rate complex. Next week’s FOMC meeting is another such powder keg. It could either undermine the recent enthusiasm or propel the market even higher. With inflation showing signs of moderation, Powell has some leeway to adopt a less hawkish tone, particularly if he aims to avoid market turbulence. Either way, next week is likely to bring more volatility.

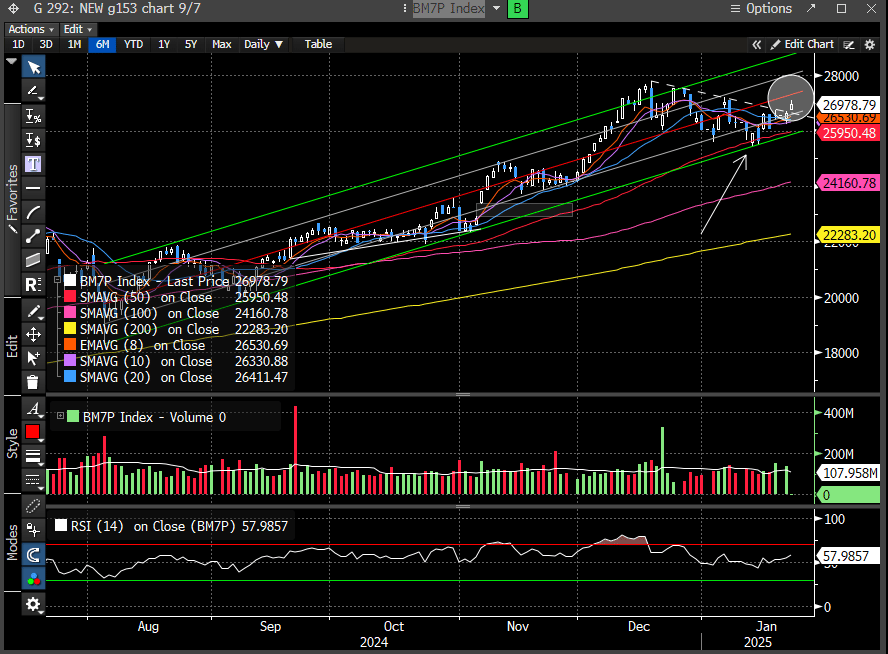

Earnings season has also provided support, with NFLX delivering stellar results on Tuesday, helping to buoy the Mag 7 Index and other large caps.

Last week, we projected the Mag 7 Index would test its neutral regression line after defending the lower bound—and it has nearly reached that level.

With MACD momentum turning bullish and breaking through the downtrend line (DTL), we see room for further upside.

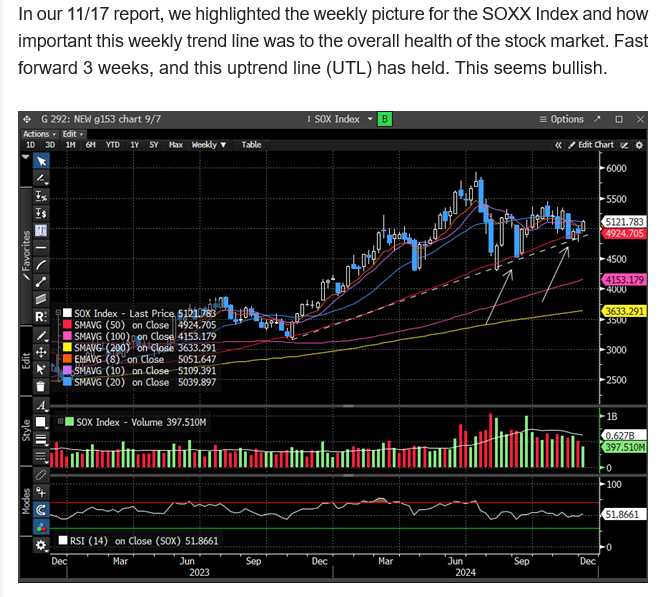

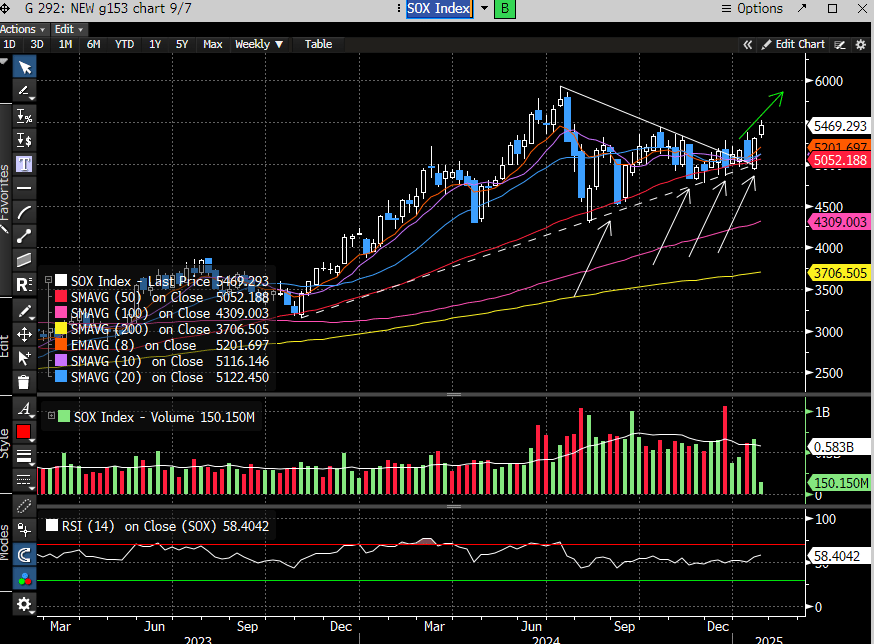

Semiconductors (SOX Index) have continued to recover, a trend we highlighted in our 12/4 report.

Here is an excerpt:

Six weeks later, the SOX Index is trading at its highest level since July, up nearly 7.5% during that span.

However, just because the stock market is back near all-time highs doesn’t mean the path forward will be easy. We believe the “easy money” has already been made off the recent lows. For the market to pull back, it will likely require a new catalyst—whether that comes from next week’s FOMC meeting or the upcoming payroll report remains to be seen.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade