We wrote over the weekend that DeepSeek had the potential to Deep Six the market—and that’s exactly what happened. The SPX and NASDAQ opened Monday with heavy losses, ultimately finding support at the levels we outlined. More on that later.

The bigger question now: Did the market just top? From a technical standpoint, the island reversal off an ATH suggests a strong case. Climactic reversals from elevated levels often spell trouble, and the major indexes now face the challenge of repairing significant technical damage. That damage can be resolved through time or price—right now, we have neither, leaving the indexes vulnerable to further downside.

Enter Powell. While the initial FOMC statement read hawkish, his press conference struck a more measured tone, keeping the Fed put alive. After the bell, three Mag 7 constituents reported earnings—none were overwhelmingly bullish, but TSLA and META found enough support to appease investors, while MSFT slid 5% after hours.

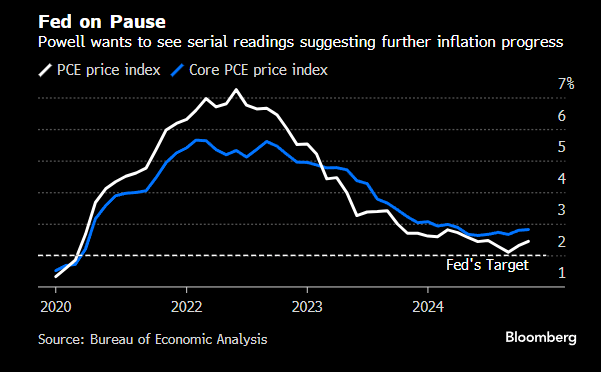

It’s only Wednesday, and the week is far from over. The Fed signaled rates will remain steady for the foreseeable future, citing Trump policy uncertainty, sticky inflation, and a resilient economy. But Friday’s PCE report could have an even greater market impact than today’s FOMC decision. Buckle up.

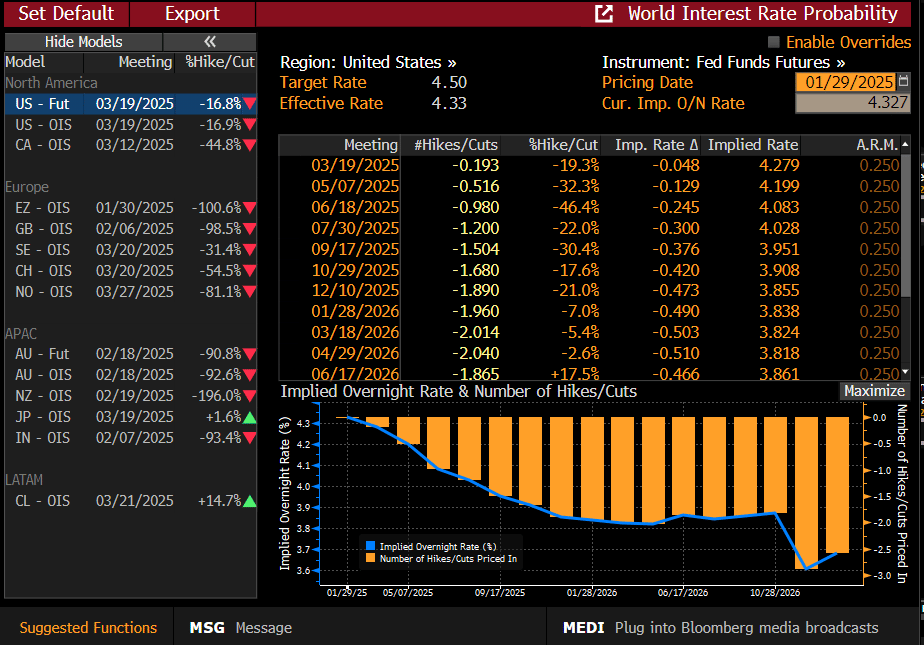

Heading into today, markets were pricing in nearly a 200% chance of two rate cuts by December. By the close, those expectations had been pushed out into 2026. Nothing alarming—if anything, this measured adjustment may be a positive. Shifts in rate cut/hike probabilities often shake up the market, but today’s move was more of a mild recalibration than a disruptive shock.

The other major development today came from META and MSFT, both of which reaffirmed that AI investment remains a top priority. META not only maintained its $60-65 billion capex guidance for 2025 but also signaled plans to spend "hundreds of billions" on AI infrastructure in the future. MSFT similarly reiterated its capex outlook, reinforcing that AI-related spending is far from slowing down.

This should help ease concerns that DeepSeek could disrupt the current AI spending cycle among major hyperscalers and provide some stability to an otherwise fragile market. Notably, MSFT stated that its cloud computing growth will slow this quarter—not due to lack of demand, but because it simply doesn’t have enough data centers to support its AI products. That’s a strong tailwind for infrastructure-leveraged names that were hit hard on Monday. While we don’t expect a full retracement to previous highs, this should establish a floor for the group in the near term.

From a broader market perspective, these developments are fundamentally supportive.

Circling back to the SPX, our 1/26 report accurately identified the support zone, with the index bottoming on Monday at 5962.

Here’s the excerpt:

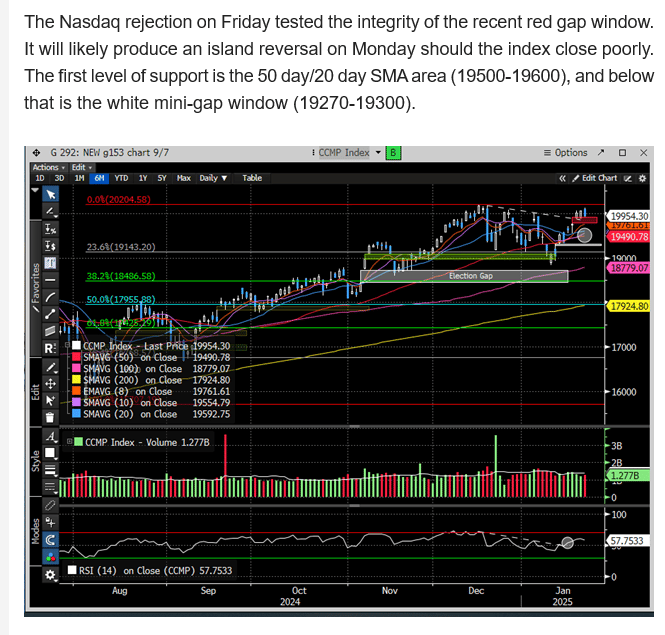

We also identified where the Nasdaq might find support. The index bottomed at 19204.

Here is that excerpt:

So, while we’ve seen solid rebounds off those lows, does that mean the indexes have officially bottomed and it's time to sound the all-clear?

Let’s take a closer look.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade