Our 3/3 report over the weekend called Friday’s low a tradable bottom. We missed it by a day. Shoot us.

Nailing precise turns is never easy, and heading into month-end, the late-day ramp and rebalancing tricked us into looking for the turn prematurely. Lesson learned: bottoms rarely happen on a Friday. We’ve now written that on our office whiteboard 1000 times.

That miss is on us, and we’ll be better next time. The reality? We knew the turn was close but wanted more alignment before getting aggressive. We should have taken our own advice—because as the week progressed, we got exactly that: DeMark signal completions and more extreme internal readings that improved the risk/reward setup.

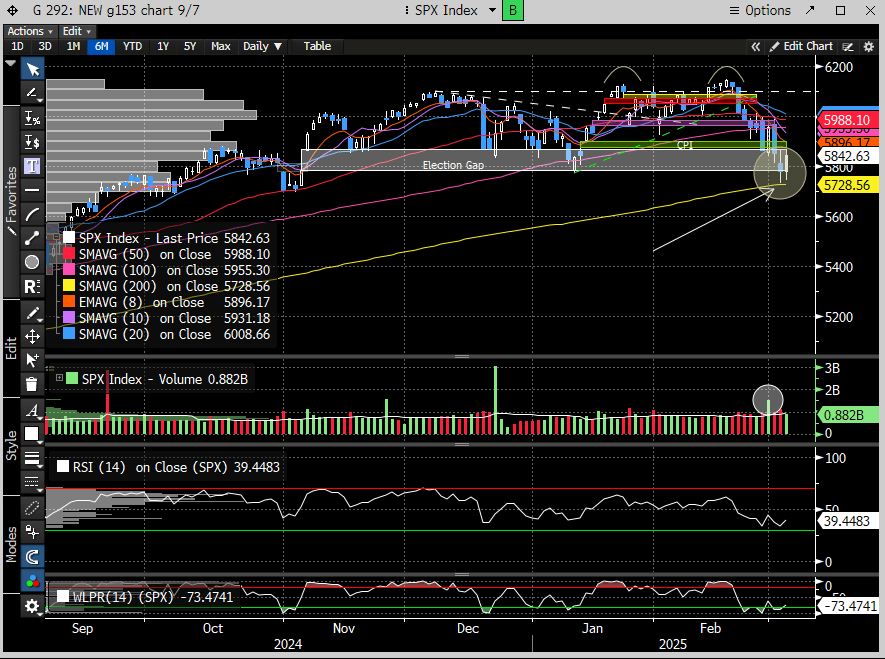

So what flipped the market? Trump. He reversed his tough tariff rhetoric. We’ve been saying a Trump pivot was likely around 5600-5700 on the SPX, but the 200-day loomed, his wealthy backers voiced concerns, and—right as the entire post-election rally vanished and the SPX kissed the 200-day MA—presto, a press release.

Coincidence?

It’s no secret that Trump sees the stock market as a scoreboard for his success. Combine that with abysmal approval ratings, and his fragile ego was never going to sit back and watch the market spiral into the abyss.

So, is the Trump put back in play?

It’s a tough call. Many have argued he wouldn’t cave so easily this time—his core base doesn’t exactly live and die by their brokerage accounts. But now we have our answer. Just ask yourself: How many billionaires are in Trump’s orbit? How many have cozied up to him since he took office? Do we really think they weren’t in his ear, warning that his policies would tip the economy into recession? The stock and bond markets were already flashing red. Maybe he finally got the memo.

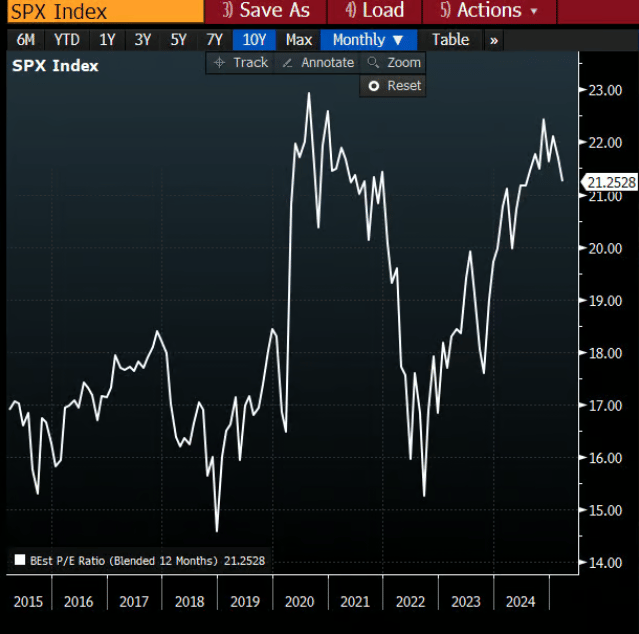

Philosophy aside, the market was primed for a bounce. The real question is: how much of one? Macro data is clearly starting to slow—something we highlighted in our last report—which could mean downward earnings revisions ahead. That’s a problem for a market already stretched at the high end of its valuation range.

Yes, valuations have come down a bit, but we’re still sitting near historical highs. That doesn’t leave much room for error. If earnings revisions start rolling in, the path of least resistance is lower.

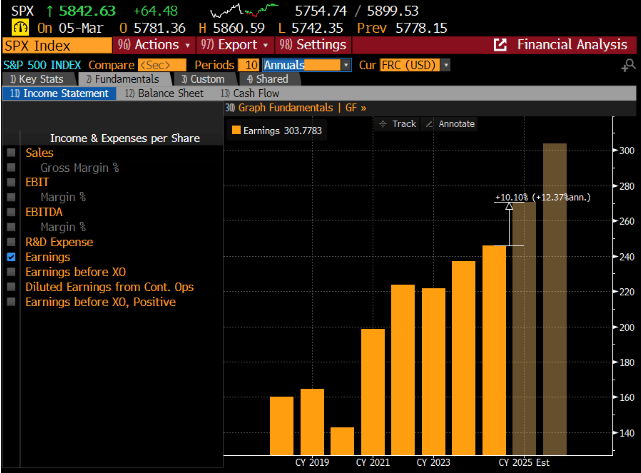

SPX earnings are still expected to grow 10% this year. That seems unlikely under the current political climate.

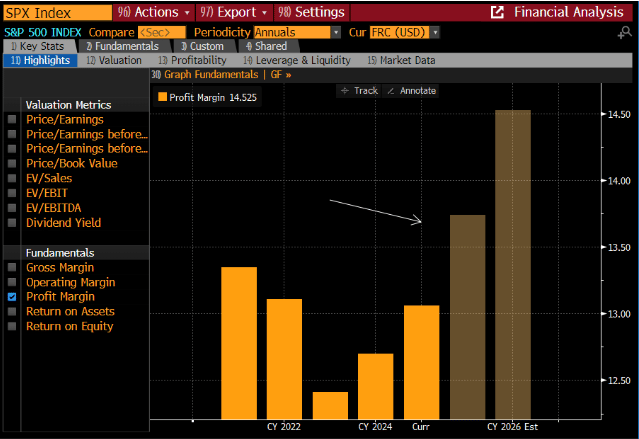

On Monday, we saw factory activity edge closer to stagnation as orders contracted, while prices paid for materials surged to the highest since 2022. This is not good for the profit margin picture, estimated to be the highest in years. If margins contract, so does EPS, and likely multiples. Comments in the ISM report encompassed tariff and geopolitical uncertainty as reasons for the newfound pessimism.

To add some concern heading into this week’s payroll report to be delivered on Friday, the ADP report today suggests a rapidly cooling employment picture, with only 77K net adds vs. expectations for 140K. This is the smallest gain since last July.

The market saw this slowdown coming—January’s gains have been wiped out, with growth stocks taking the worst of the beating. But has the potential slowdown been fully priced in? Probably not yet, given the factors at play.

That said, if Trump walks back his tariff rhetoric, any slowdown could prove temporary, setting the stage for growth to rebound in the second half. That may be exactly what the market was signaling today.

What do we mean by that?

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade