What a reversal in the market today. This is exactly what we were alluding to in our post last night. The boat was too overloaded on one side and being short into the CPI was dangerous. While we did not expect such a rebound, we prepared our readers for how to play it.

Here is what we wrote last night:

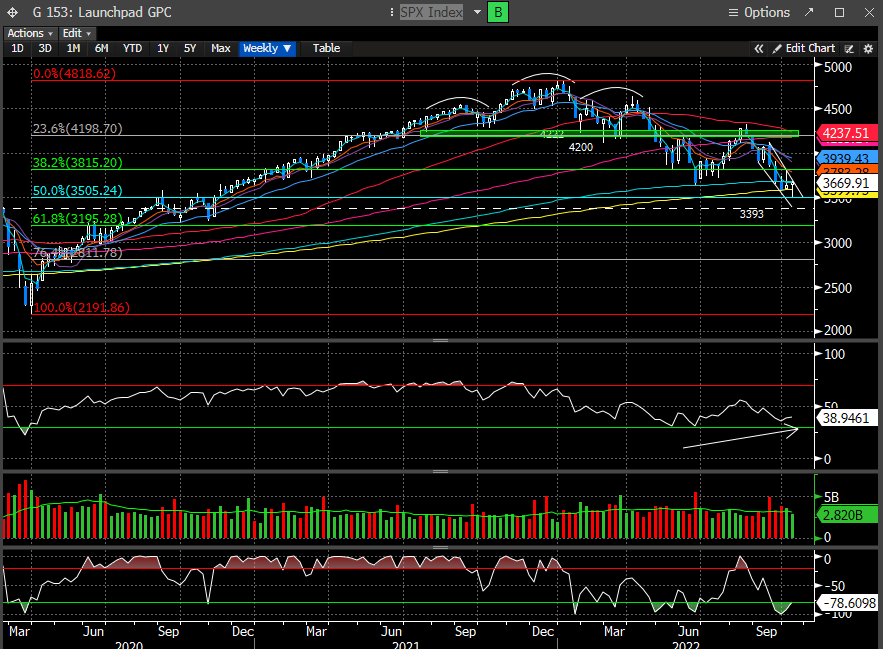

Here is our post on levels for the SPX. 3496 was the 1st level we cited that we thought would be defended.

We also discussed the importance of the 3500 level for the SPX in our last weekend report as it was the measured move target for the recent Head and Shoulders break.

And SPX 3500 coincided with the 50% retracement level (3505) of the entire covid crash.

It's no surprise that we like confluence and 3500 had quite a bit. The SPX weekly candle is now shaping up to be a hammer reversal, while also retaking the 200 weekly SMA. These are important considerations when thinking about the next move. Could everything come unraveled tomorrow? Sure, but we'd venture to say the bulls have cornered the bears, for now.

Let dissect today's index move today and if continuation is likely:

Please consider subscribing below to read the balance of the report.