FOMC day is never easy to predict. In real time it seemed that Powell and co were not dovish at all. In fact, they were pretty clear about possibly doing another supersized hike in Sept. Thats worse than what was expected in the Fed Fund Futures. These didn't move very much post the meeting.

The implication is that the bond market doesn't believe The Fed will be as aggressive as suggested. This seems misplaced. Even if inflation has peaked, which we think it has, reverting back to a comfortable level may not occur for quite some time. There is lots of evidence suggesting the Fed is getting their desired response with a slowing economy, but they were quite clear that they think employment is too strong, and that inflation is stubbornly high.

They removed their guidance for the hike, but why is that dovish? It's not. They just said they are going to be data dependent, but whenever have they not been? And if you believe inflation will be stubbornly high, then the Fed will keep being aggressive. Does this commentary deserve the fanfare it received today in the market?

Here is a comment from the Barclay's economist:

Next up is the GDP report tomorrow, which could officially trigger a technical recession. Maybe bad news is good news?

The yield curve hit new lows this am before the FOMC, and was printing -32 bps. Thats not bullish. It did manage to rally off the lows but it's still quite inverted. If you are a bull, this has to concern you.

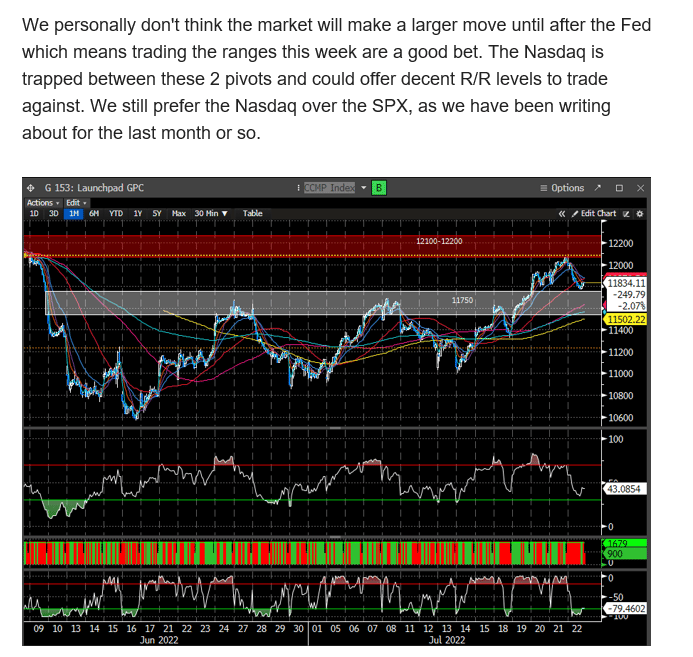

Last weekend we discussed the market would likely be range bound into the FOMC and if you were a technical trader, you could play the swings between the bands. Here is a quick excerpt from that report regarding the Nasdaq:

We have been favoring the Nasdaq and tech for weeks over the SPX and a dip buy into our support band would have yielded a nice trade. Now back into the resistance band where it was rejected before. This also coming on lower RSI momentum on ST TF's.

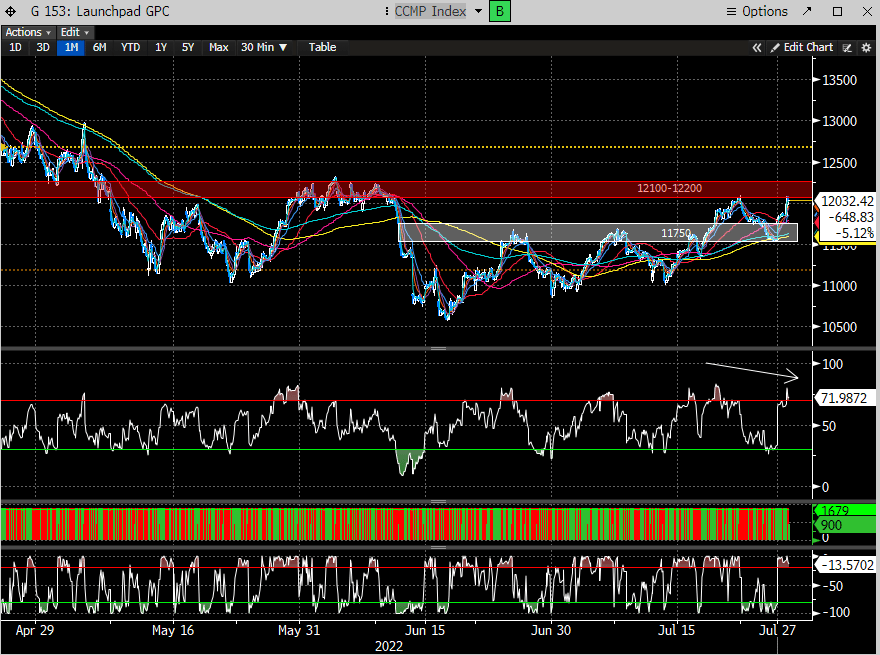

Here is the updated SPX chart, that for now, broke out post FOMC. IF the market can hold the trajectory, it's conceivable it could test the upper limits.

Please consider subscribing to see our premium content and how we think this plays out. Only $19.95/month with no contract.