Quick pre mkt post.

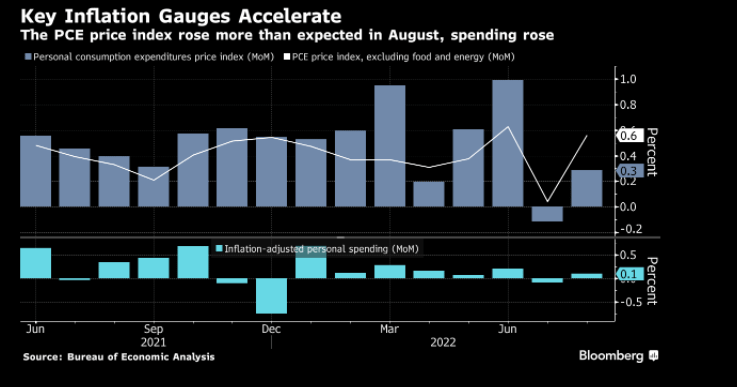

PCE is out and was higher than anticipated. Enough to keep the pressure on the Fed to raise rates, but this number is backward looking. Consumer sentiment gets reported at 10 am which has been in the dumps for quite some time.

The CPI which is reported in Oct typically runs hotter than the PCE price index, which sets up for another tough event.

Carmax and Nike reported numbers the last 2 days and they are were abysmal. We have been warning about estimates for companies being too high, since the beginning of summer, and now we are seeing large revisions. Nike is a big global brand and is struggling with burgeoning inventories. Carmax sells used cars and affordability and the higher cost of financing is causing volumes to plummet. Despite what the Fed doesn't see in the numbers, their desired effect is occurring on the fringe

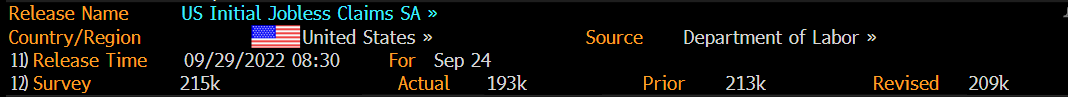

Some of the macro data remains stubbornly strong as jobless claims continues to surprise to the downside.

Part of the issue is the Fed continues to want to see more evidence of a weakening economy and it's not coming through in the numbers. All the perma bulls are fighting the Fed which continues to astound us. For 10+ years they have been telling their clients to buy all dips and to not fight the Fed, but now they are doing the opposite. The Fed has clearly put their sword in the sand and is pressing forward with their plans to fight inflation. See the recent week's Fed speak - nothing dovish mentioned during the parade of Fed members speaking publicly this week.

Brainard just out with the text for her speech today:

This is a very tough set up for bulls outside of some of the extremes that are present.