The CSC call to be cautious into Sept/Oct seems quite prescient. The SPX is now down almost -8% for the month.

Ned Davis now sees odds of a recession @ 98%, something we've been talking about all year. The only other times the model's been this high was during downturns in '20 and '08/'09, and we should expect more downside to equites in '23.

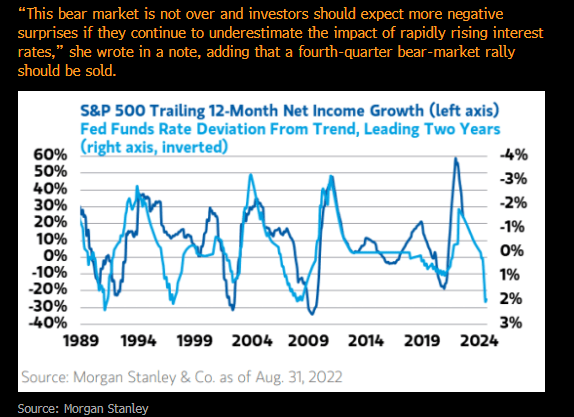

Morgan Stanley thinks earnings optimism is too high, something else we've also been discussing since mid-year.

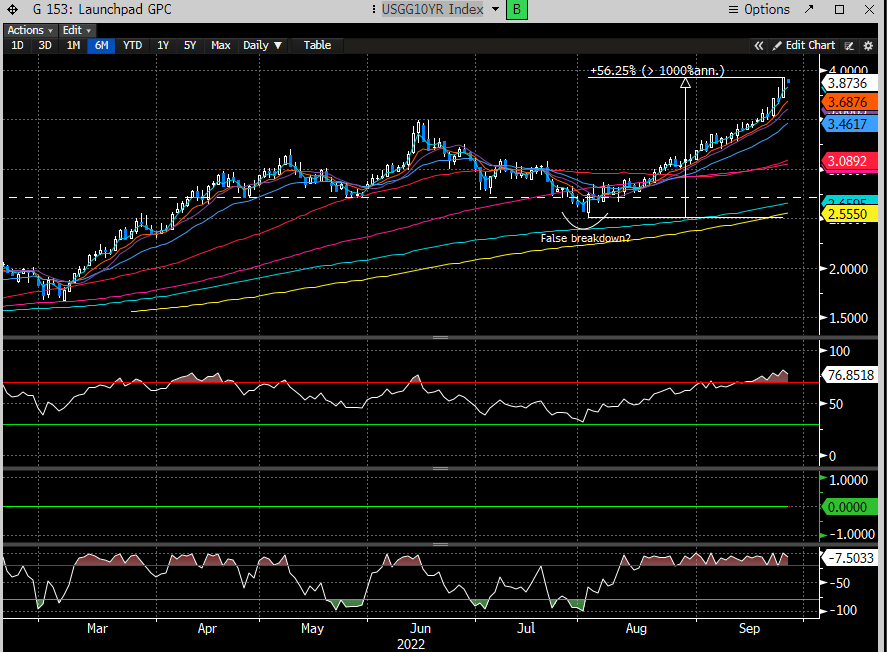

The fallout from a rapid rise in rates is starting to accelerate. A poor 2-year auction today triggered renewed selling in the treasury market. The 10 year was up by the most since the Mar '20 Covid crash, and now at the highest level since Apr 2010. The 10 year is now up +56% since the Aug 2nd low. Treasuries acting like tech stocks is not normal.

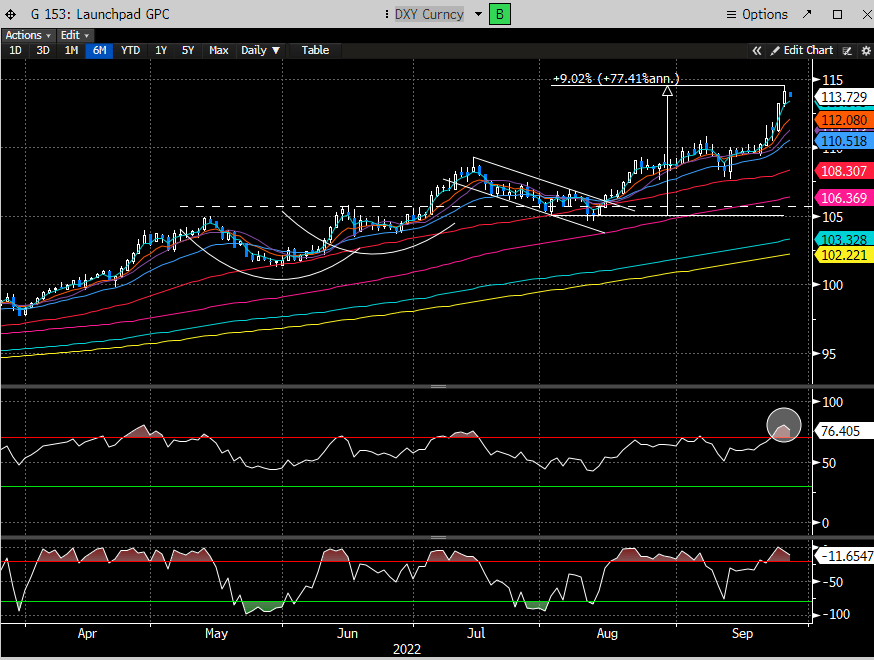

The strength in the $USD is related and also scorching risk assets, something else we've been talking about all year as a major risk factor. Now up +9% since Aug 2nd.

Keep reading for a couple of updates post our weekend Macro report.