Quick Reminder: We will be traveling for another week so our reports will be truncated as a result.

“Tops are process.”

“The market is acting a bit erratic, which is typical at turning points.”

“..we are seeing enough momentum breaches to make us cautious.”

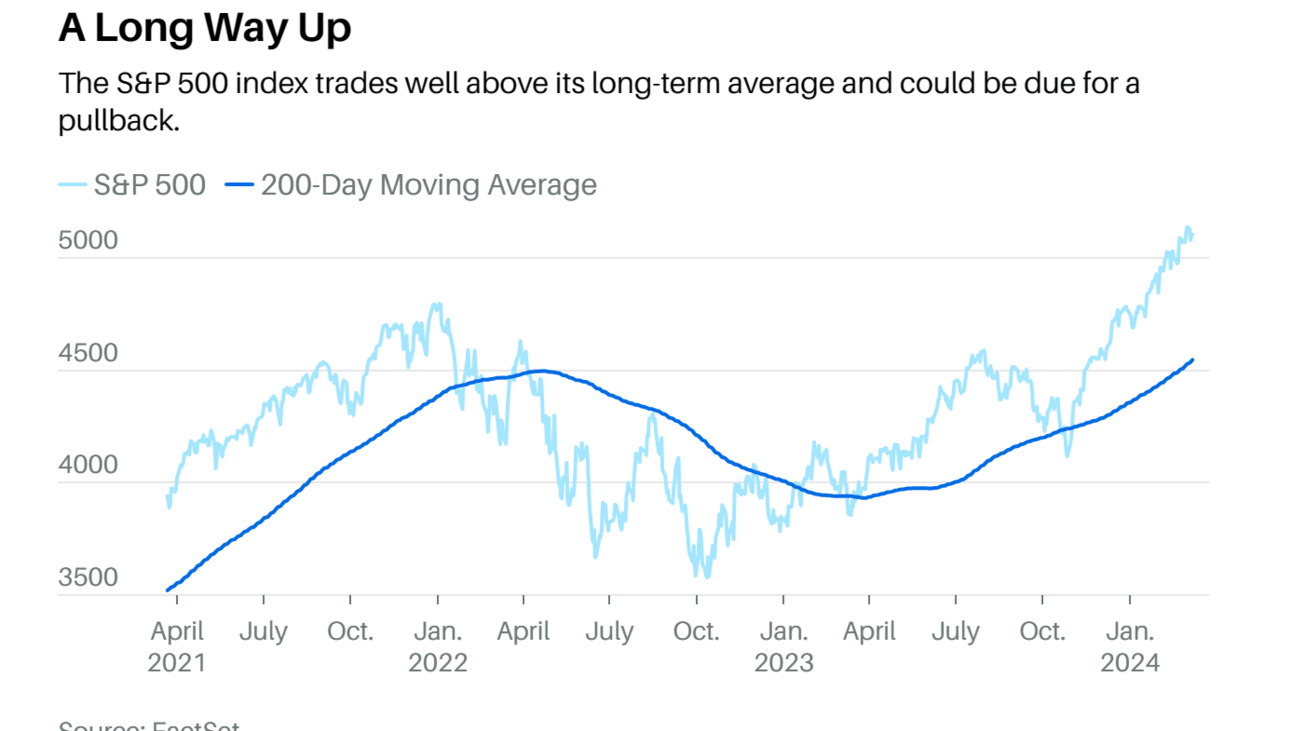

These are all quotes taken directly from our recent reports. Last week seemed to have all the markings of an exhaustive top. Does this mean we are going to revert all the way down to SPX 4100 like some of the incessant bearish analysts continue to suggest? No. To make that claim signals to us that they have absolutely zero handle on how market construction works. This is not to say that the SPX can’t get there. Thats not our message. Anything can happen in the stock market, and we are always open to all possibilities. It’s just that something quite unforeseen would have to occur to shift the narrative to push the indexes down over 20%. This could come in the form of a significant news event that drastically shifts the current narrative (i.e. war escalation, bank failure), or a series of horrific macro-economic reports that point to a significant slowing in the economy forcing the Fed to accelerate rate cuts. Whatever it is, it’s not because the market is overvalued, or there is some technical breakdown in the charts. Thats foolish.

There has been significant buying that has taken place since the Oct’22 low and even the Oct ‘23 swing low, that would need to be unwound to get there. For it to get unwound, the narrative that is currently pushing institutional money into the market has to do an “about face.” This mathematically cannot happen quickly and usually takes place over weeks and months. Thankfully, our system of identifying trend change will signal when it’s time to exit.

So where does that leave us today?

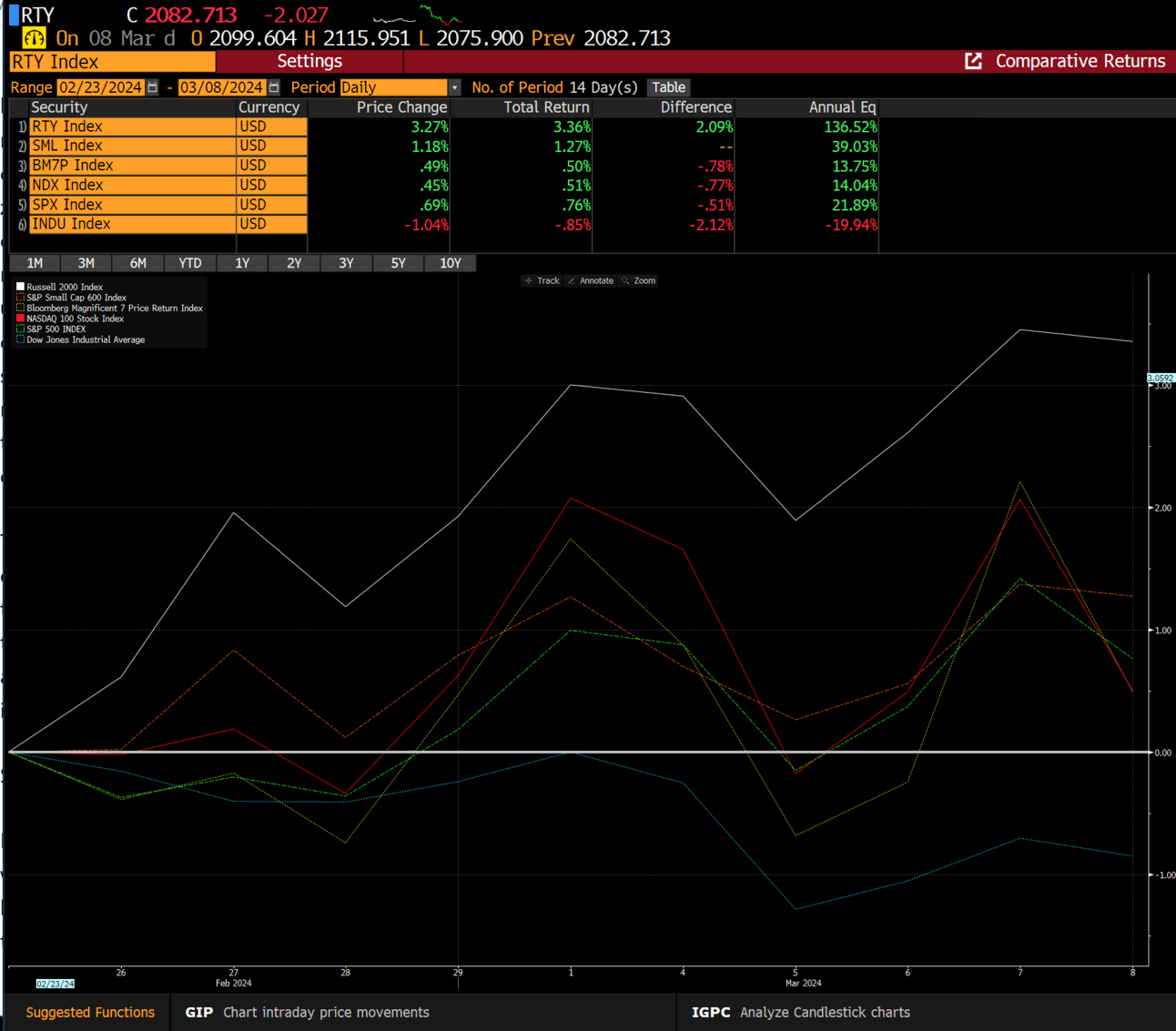

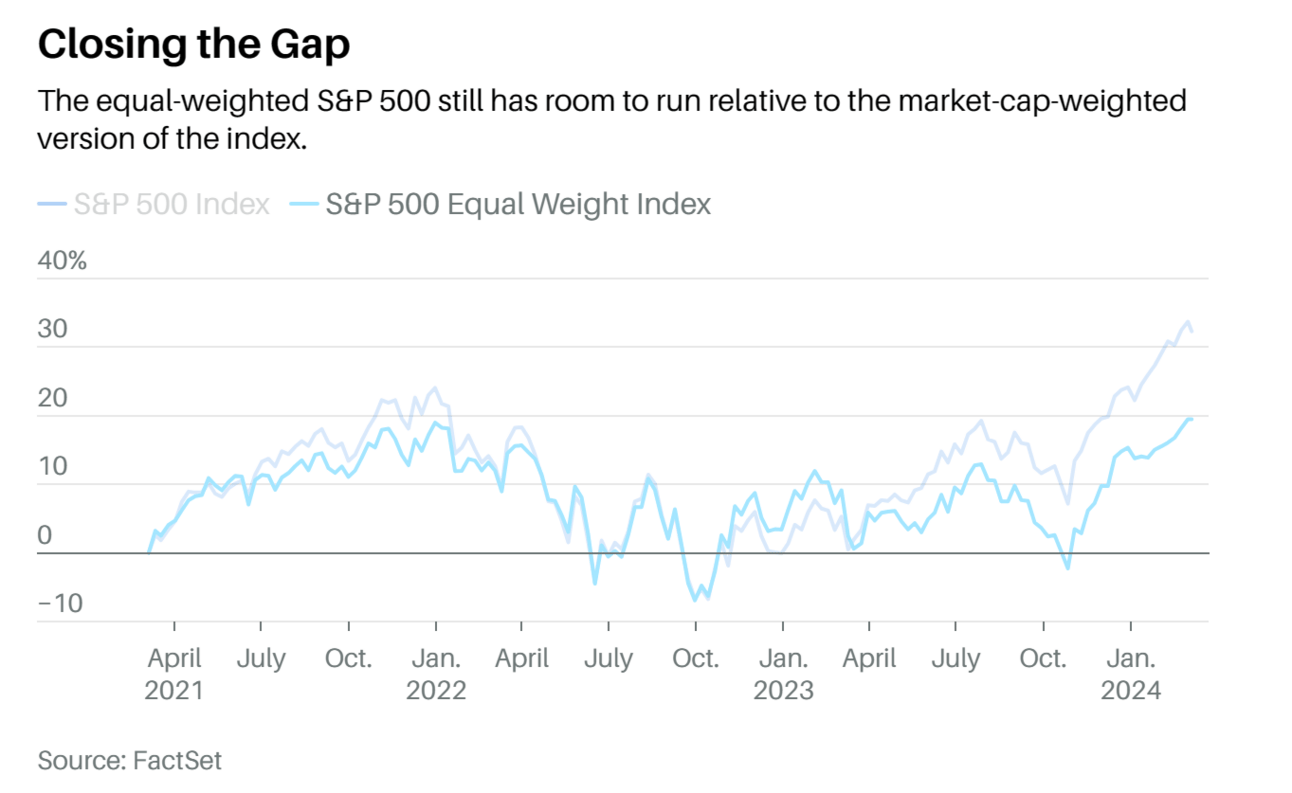

In our mid-week report we talked extensively about momentum breaches that were occurring in the large cap space, but that the SMID cap stocks seemed to be catching the rotation. This is a call we made 2 weeks ago as likely to happen at the expense of the larger cap growth stocks. So far that trade has held up quite well.

The Russell Small Cap Growth Index is outperforming almost 300bps when compared to the Nasdaq 100. If you are an institutional manager, 300bps of outperformance can make your year.

Last week we highlighted a number of large cap momentum breaches in our mid-week report. That weakness has spread:

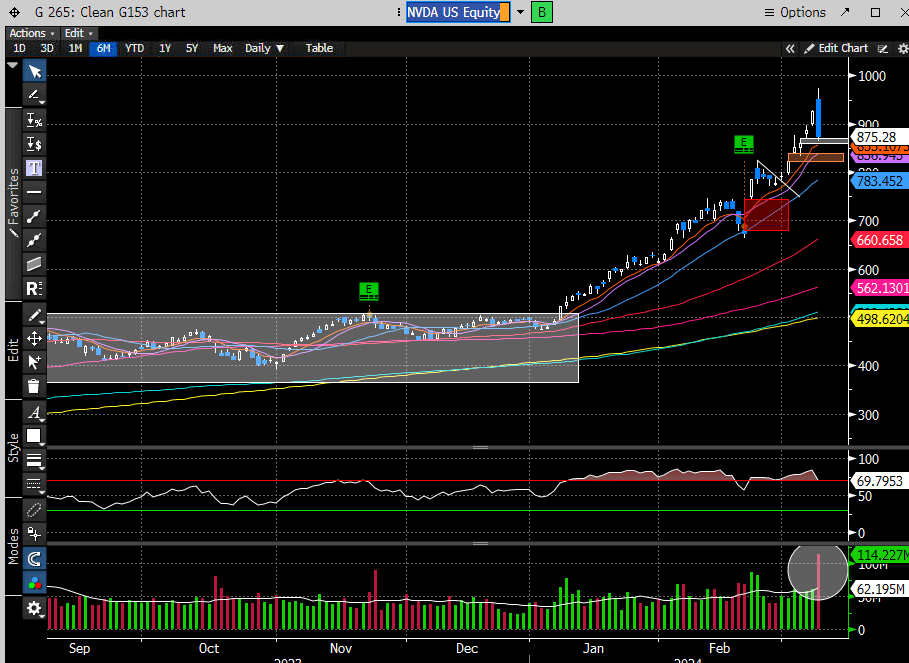

NVDA, which has propelled the stock market to new heights, abruptly reversed on Friday to close near the lows. Friday’s candle is considered a bearish englufing candle and occurred with the highest volume in almost a year.

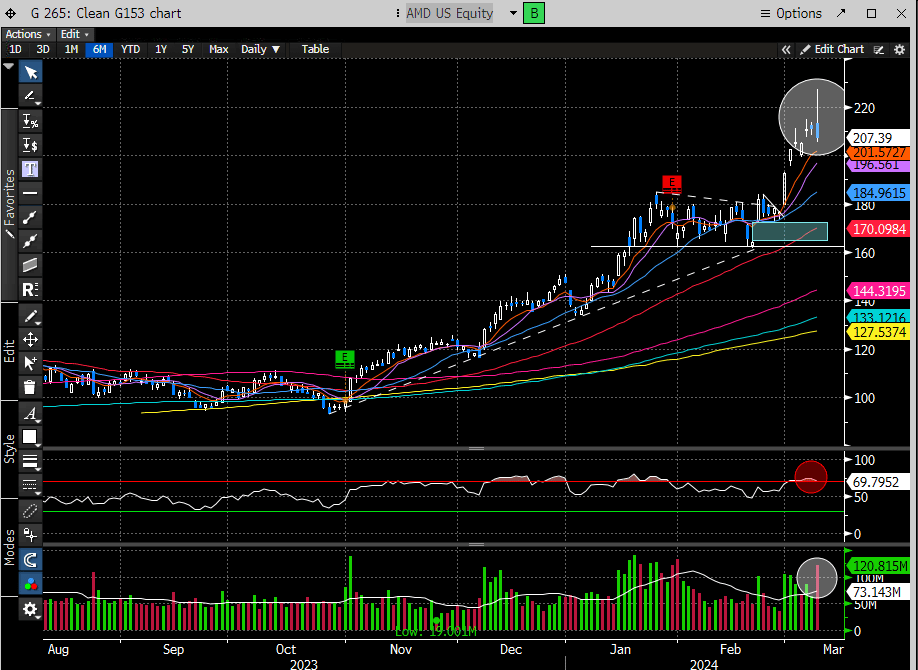

AMD has been riding it’s AI coattails and similarly reversed.

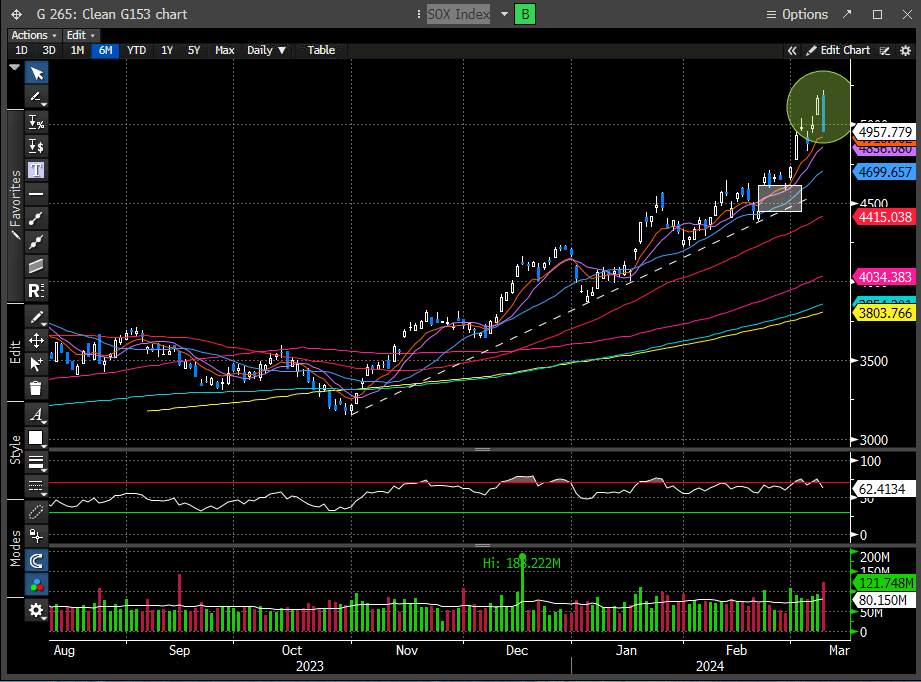

The SOX Index (Semis) also with a bearish engulfing candle on heavy volume.

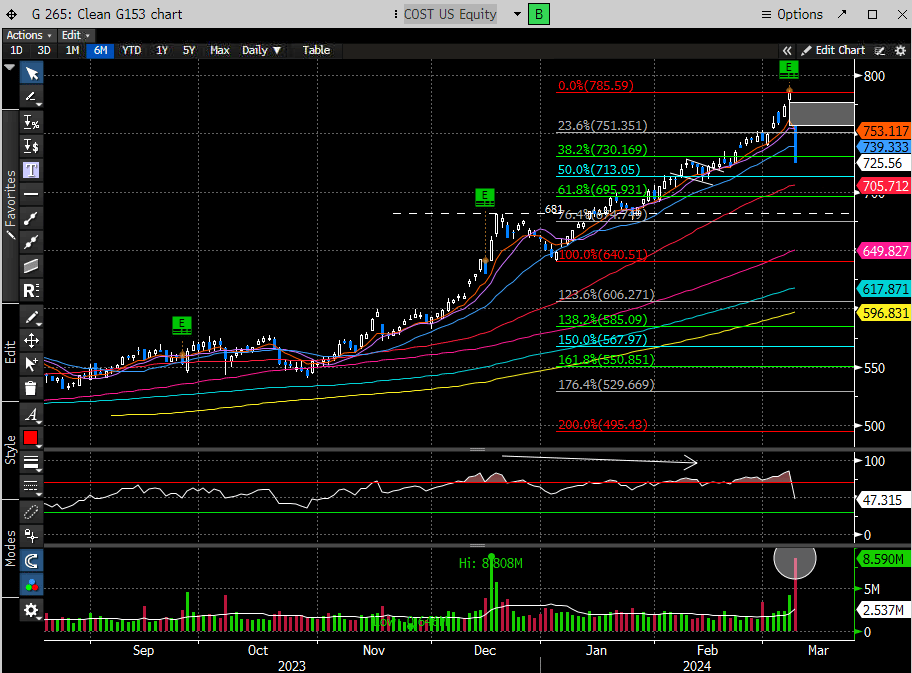

Even COST took quite the beating after its earnings report.

Meanwhile, you have to admire how late to the party this magazine cover is:

Magazine covers are typically big reversal signals. Why? Because they are the bastions of consensus, and the stock market doesn’t reward those that are all standing on one side of the boat.

This doesn’t mean the ultimate top is upon us or that this signals the end of the bull run. But what we can assure you is that magazine covers like this are meant to sell you subscriptions, not be forward thinking. How many of these magazine covers did you see back in Oct ‘22 when this newsletter got bullish? We’d ventures to say zero.

We will spare you from wasting your time. There is very little that’s interesting or even useful in the article, it literally is a synopsis of all the reasons we have been bullish over the last year.

Interestingly, they are advocating rotation, which is something we discussed in our Feb reports.

They also make multiple mentions that the market needs to pull back. This is not a heroic statement and quite logical given the recent trajectory and embullient sentiment.

While explicitly stating that the market is ahead of itself and needs to pull back sounds astute, it’s not. What’s more academic is developing a framework for measuring buyer exhaustion vs making a blanket statement. The good news is this is what we do.

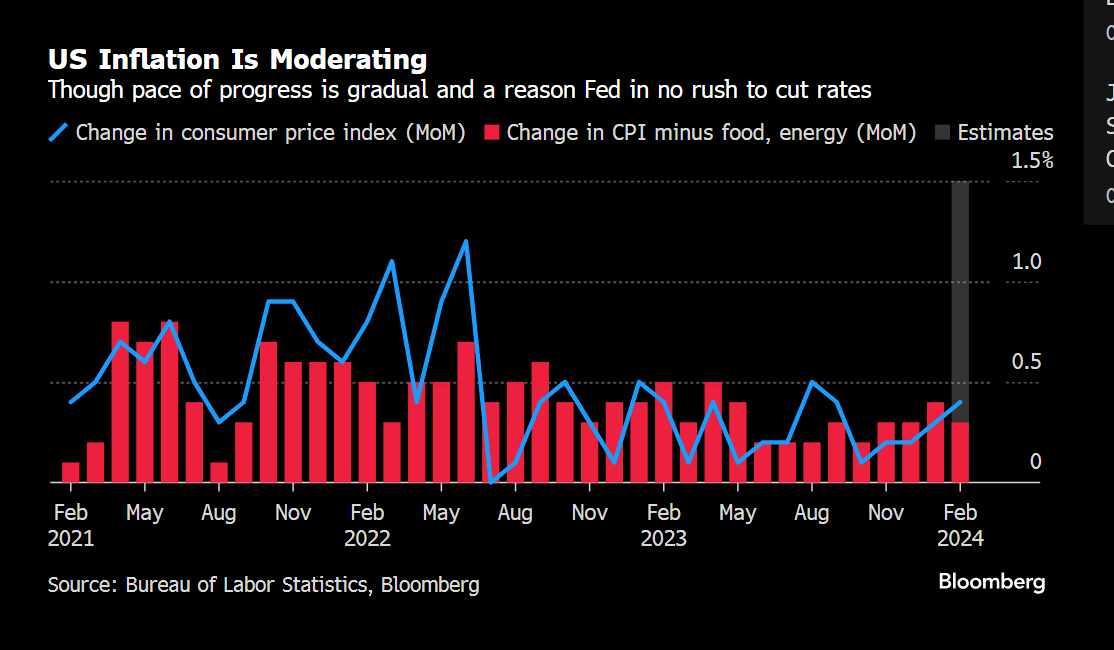

This Tuesday we will get CPI which is forecast to rise .3% in Feb. This is still the slowest advance since Apr ‘21, where the pace of disinflation has slowed markedly.

Here is Bloomberg’s Economist view of the report:

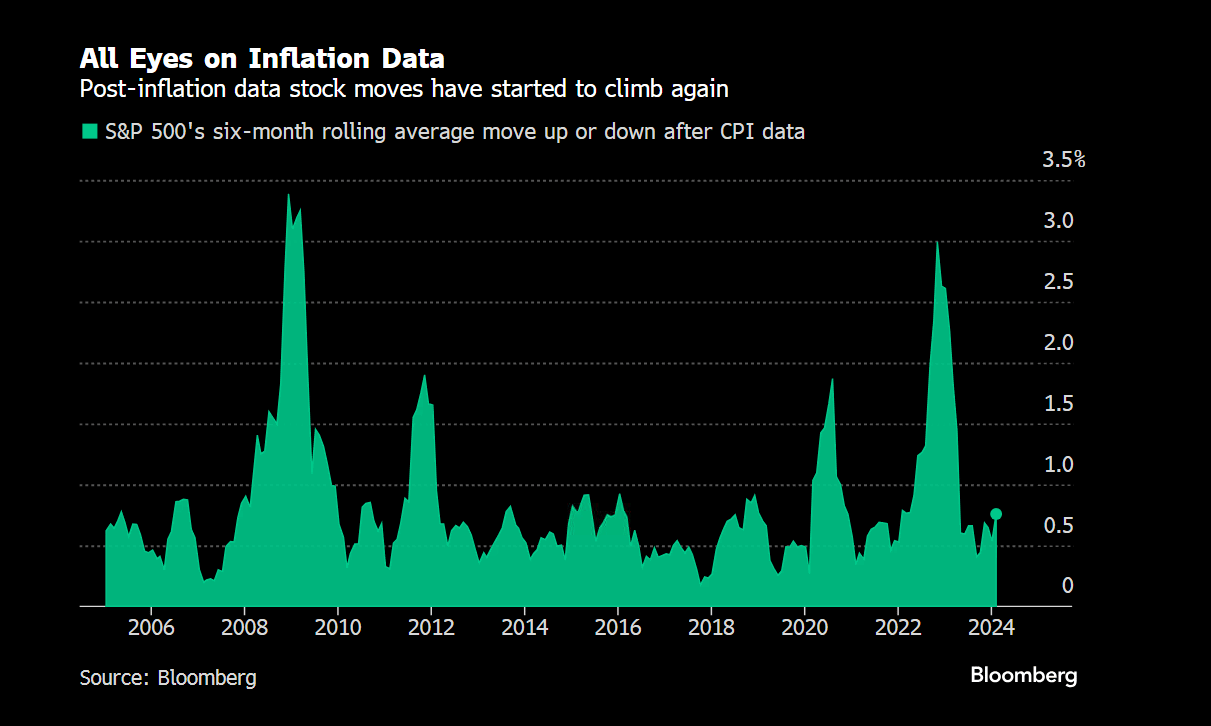

Does the CPI have the power to create increased volatility? Of course, but we think inflationary readings, as long as somewhat in line and moving in the right direction are not enough to push the market meaningfully lower. That said, they are starting to cause more volatility as evidenced by the chart below.

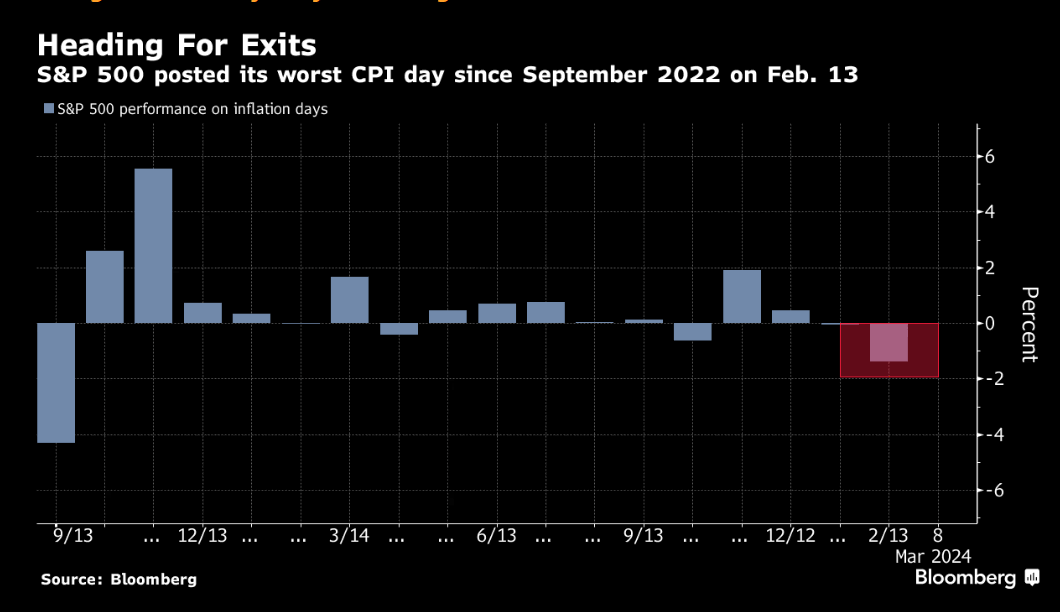

And we should remember the last CPI report in Feb was not received well.

CPI aside, what’s of more interest to us is to the timing of interest rate cuts.

Why? Subscribe below to find out.