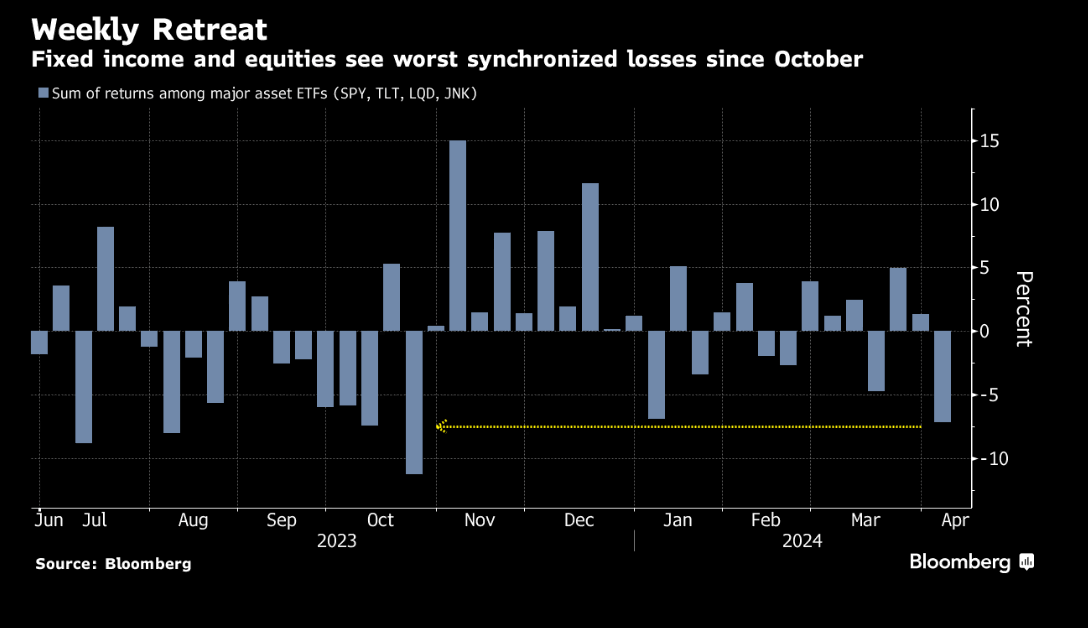

In our mid-week we talked about the erratic gyrations the macro was causing, with the rest of the week sending the stock markets on a wild roller coaster. Stocks and bonds saw their worst synchronized drop of the year on Monday and Tuesday, while Thursday saw the biggest reversal for an SPX rally since Aug. Meanwhile, treasuries yields are making new multi-month highs on the backs of some stronger than expected economic reports.

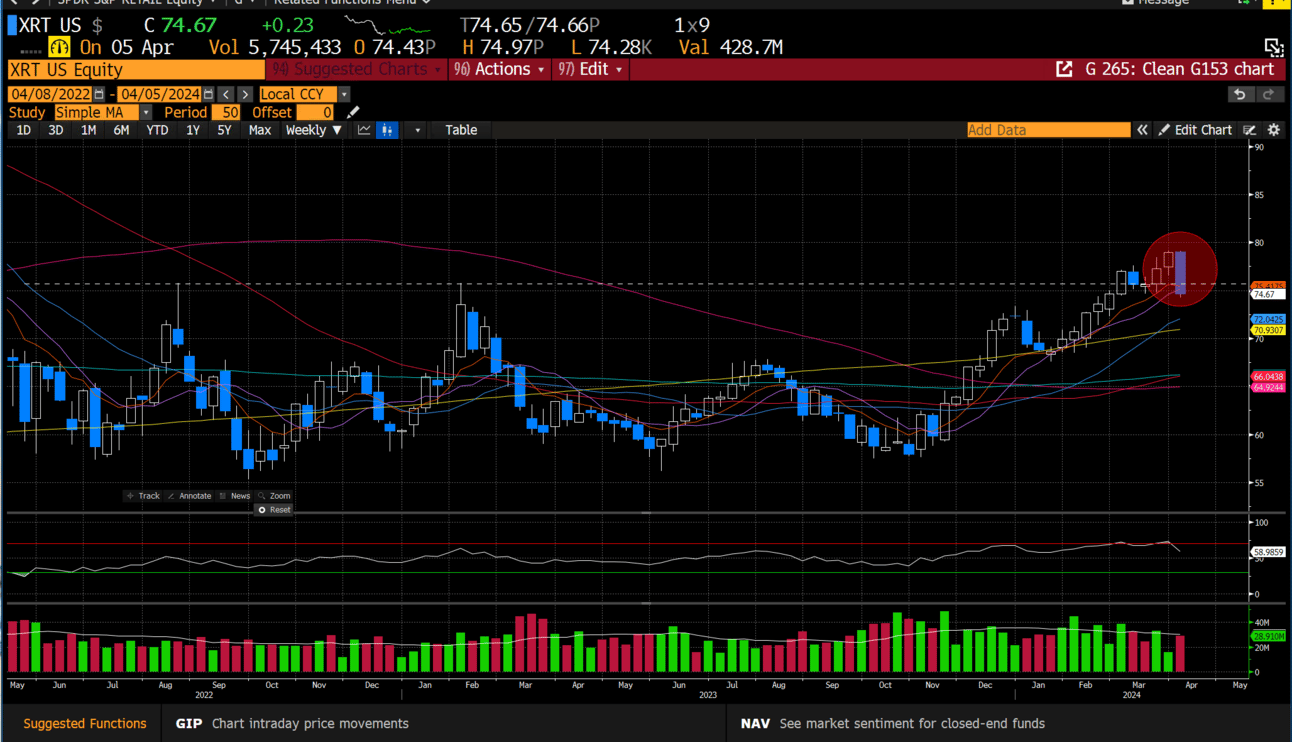

To make matters more macro focused, there was some geo-political risk sprinkled in with Israel/Middle East escalations, sending oil to levels not seen since last fall. This sort of macro-onslaught is wreaking havoc with positioning, and no better expressed by the carnage we are seeing in retail.

Here is a chart of the $XRT (retail ETF) which seemingly was breaking out of a multi-year base, only to be slapped back below the pivot with a damaging reversal candle.

The market celebrated that the economy was on strong footing with the robust payroll report on Friday, but interest rate cut predictions were pushed back to Sept. Fed Fund Futures are now pointing to a less than 50% chance of a rate cut in Jun, with higher probabilities (65%) for Sept.

The MOVE index, which measures treasury volatility broke this minor DTL that’s been in place for months and now its MACD is crossing up. This implies we should expect more volatility to ensure. The stock market does not like volatility in large macro inputs and poses a risk to th calm we’ve seen in the stock market since the Oct lows.

This is represented by the highest VIX (SPX volatility) close in 6 months. The breach of the recent gap window is a notable change in character and without dipping back below, we should expect more wild action in the indexes.

Adding to the plethora of items to be concerned about, the Citigroup Panic/Euphoria Model entered euphoria for the first time in more than 2 years, while Hedge Fund piling into short bets are rising the most in 6 months, per Goldman Sachs. To exacerbate the confusion and the fear, Powell was out last week suggesting the Fed is on the path for rate cuts while Kashkari suggested none this year.

This sounds like a Molotov cocktail of macro pressures to wade through, causing consternation amongst the institutional crowd and leading to a violent push and pull of the stock market this week. Markets don’t like uncertainty, and we sure seem to be in a period of opaqueness.

Here is the roller coaster that was the SPX this week. Confused much?

But as the employment report demonstrates, the economy is on fairly strong footing. This on the backs of strong manufacturing data earlier in the week.

So, then what gives? If the economy is strong, shouldn’t the stock market follow that trajectory? The answer is more complicated than that. On one hand yes, but on the other hand, how much has already been discounted? Recall some of the reasons for our favorite bearish prognosticators fighting the rally for the last 1.5 years: inevitable recession, restrictive rates and a slowing economy, yield curve inversion predictability, inflationary forces not abating. The reality is the stock market had been looking forward and correctly forecasting the strength in the economy the entire time. This is precisely why we follow price before our opinions. Price is truth, and in this instance, also proved to be very profitable.

So much so that we have decided to open up our position trading as an add-on tier to this subscription. We will only be offering an introductory rate (30%) for current premium subscribers, who will have one week to add the tier. We have tabulated and recorded every trade idea we have made over the last year and the results are nothing short of eye-popping, even for us.

The current statistics are below:

We should have the subscription details out this coming week. We hope you will consider joining us.