JULY 4th FLASH SALE (25% off) - NEW OPTION TRADING PAGES ADDED

Happy July 4th!

This week, we saw unexpected new ATH's in the major indexes, a bullish sign that we were not anticipating. Our correct positioning in the Mega Caps has allowed us to participate despite the persistent negative breadth trend. Ignore the pessimistic voices trying to predict market peaks; ATH’s are bullish. We will maintain our long bias until we see enough evidence of trend deterioration.

It’s foolish to be bearish when the Nasdaq 100 looks like this:

We are ecstatic to offer more tools for our Idea Tier subscribers to trade and profit from the stock market. We just rolled out a new page for options ideas in our Google Sheets Document. The format is similar to the stock idea page, but the strategy is vastly different. Let us explain.

We analyze hundreds of stocks every night for our hedge fund clients. We have noticed a trend of stocks coming out of bases or showing bottoming signals on stocks that are out of favor. These stocks will never make our idea tier because stocks in downtrends are inherently vulnerable, and it is too easy to get stopped out. What makes this strategy interesting is that most of these stocks are not on anyone’s radar. This means that they typically have low implied volatility (IV); in other words, they are inexpensive. The downside is that they are usually illiquid. We call this list the “So Bad It’s Good List,” or the SBIG List.

We started paper trading this strategy over two months ago, and the results were so incredible that we decided to put capital behind our trades. Keep in mind that we are still fine-tuning this strategy, but because of the massive outperformance, we wanted to share it with all of you to assess and consider.

Here is our actual performance after one month of data:

+1400% Cumulative Returns (adding up all the gains and losses); 71% win rate (avg win 119%, avg loss 59%).

We used a theoretical value of $500 for each trade, and it netted almost $7200.

Some important considerations:

*This is a high volume/high turnover strategy

*Average trade size is meant to be small with a goal of capturing 100% trades quickly, selling 50% once that selling threshold is reached, and moving the balance to the original cost to lock in the gains.

*We are targeting at least 3 weeks to expiration, so if our idea doesn’t move quickly, we may look to exit to avoid too much time decay (theta). In that scenario, we may look to roll the options out further to allow more time for the trade to work.

*If the stock moves against us and breaks a key level, we will exit and move on.

*We also like this strategy for when the market is in a selling regime. In fact, our best option idea last month was in puts for TSCO (~330% in one day). We were fortunate enough to buy this right before LESL took down guidance, which also hit most stocks in this sector. Regardless, the chart was telling us something was amiss. This will hopefully allow us to capture lower-risk entries in single stocks when the market undergoes a correction.

Another example of what we are looking for is in VRT. This stock has been battling to recover the important 87.50 pivot, but it’s quite volatile and too easy to get stopped out. Thursday it did appear to find buyers at the 100-day MA, which was also in the vicinity of the earnings white gap window. Getting defended at important junctures is meaningful, and we assumed that this would rally in the ST. We didn’t think it would rally as much as it did, but nonetheless, this provided us with a low-risk entry and allowed us to sell our option position for +60% in one day.

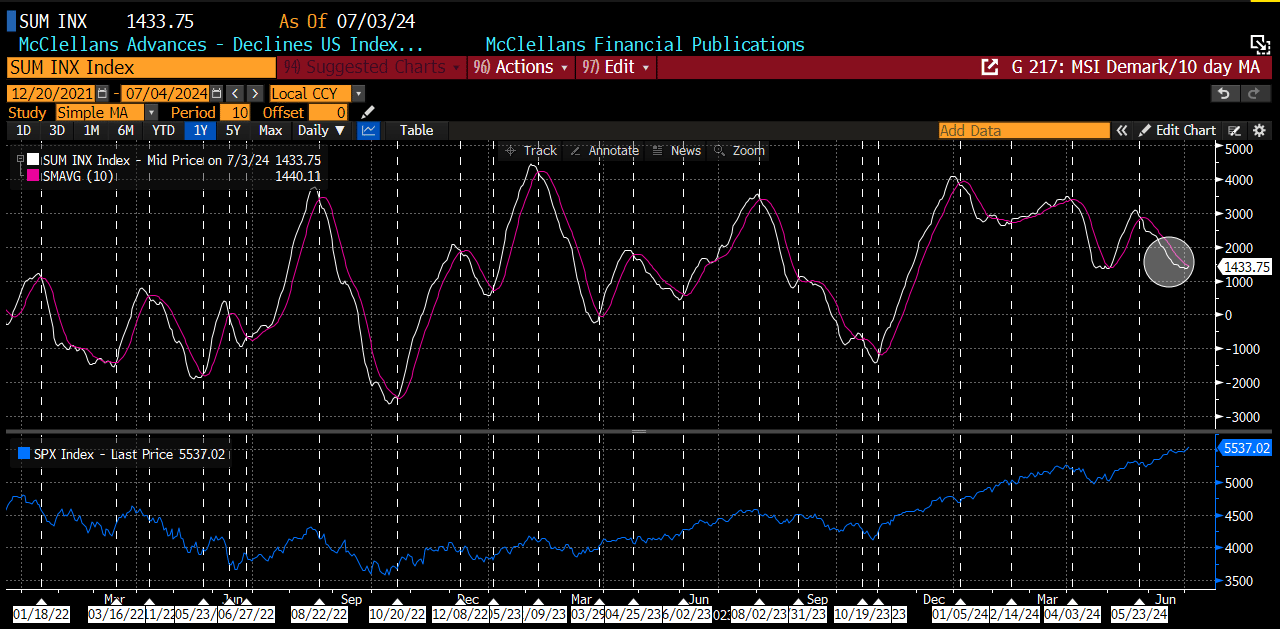

Lastly, and as we showcased in our last mid-week report, the market breadth is finally turning. This is evidenced by the McClellan Summation Index (MSI) about to cross the 10-day MA. Improving breadth means more participation and better outcomes for our idea performance.

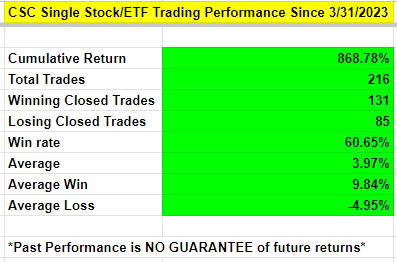

Here is the performance of the current stock idea tier (we added average gain/loss).

Here are the details of our sale:

If you are not a current member of our Idea Tier, we are offering a 25% discount to the annual plan only ($900). This discount is available only for 24 hours and for subscribers to our newsletters.

We hope you will consider joining us.

Have a great Holiday!

*For more information on TD Buy/Sell Set up, TD Sequential or Combo Countdown, Demark Propulsion, please visit www.Demark.com

CSC Team

Coiled Spring Capital LLC, Founder

http://www.coiledspringcapital.com

Terms of Subscription and Service of Coiled Spring Capital, LLC.

All subscribers (“You”) to Coiled Spring Capital, LLC (CSC) services hereby agree to the following terms of use of the services provided by CSC.

You acknowledge that CSC and all individuals or affiliates associated with CSC are not licensed nor serving as an investment advisor or broker dealer with respect to you. CSC does not recommend or suggest which securities You should buy or sell for yourself. You agree that CSC shall have no liability whatsoever for investment or other decisions based upon any content provided in the service or any contrarian view of any content. All investment decisions are solely made by You.

None of the information contained from time to time while You are a subscriber constitutes a recommendation of a particular security, portfolio, transaction or investment strategy is suitable for any specific person. You specifically agree by subscribing to this service that under no circumstances shall CSC be liable for any loss or damage of any kind whatsoever by your reliance upon information obtained from CSC’s website. You acknowledge the fact that stock trading involves risk and is not suitable for all investors, including You.

All opinions are based upon information considered reliable but

You acknowledge that CSC does not warrant the completeness or accuracy of such information. While efforts are made to ensure the accuracy of such information, CSC is under no obligation to update or correct any such information. All information is subject to change without notice.

CSC engages solely in general trading information and education and is not based upon any specific investment objectives of a particular subscriber. You should not rely solely on the information provided by CSC. Instead you should use the information as a starting point for doing additional independent research in order to form your own opinion regarding investments. You should always check with your licensed financial advisor, tax advisor or other professional in order to determine the suitability of any investment.

You must not assume that the information provided by CSC will be profitable or that the information will not result in losses. Past results of information provided by CSC are not indicative of future returns. Individual trading results will vary.

DISCLAIMERS AND MANDATORY ARBITRATION OF DISPUTES

CSC MAKES NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE INFORMATION PROVIDED. ALL INFORMATION PROVIDED IS ON AN “AS IS”, “AS AVAILABLE” BASIS, WITHOUT REPRESENTATIONS OR WARRANTIES OF ANY KIND WHATSOEVER TO THE FULLEST EXTENT PERMITTED BY LAW. CSC DISCLAIMS ANY AND ALL REPRESENTATIONS AND WARRANTIES, WHETHER EXPRESS, IMPLIED, ARISING BY STATUTE, CUSTOM, COURSE OF DEALING, COURSE OF PERFORMANCE OR IN ANY OTHER WAY. CSC DISCLAIM ALL REPRESENTATIONS AND WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OF THE INFORMATION PROVIDED OR THAT THE CONTENT OF THE INFORMATION PROVIDED IS ACCURATE, COMPLETE OR CURRENT. CSC DOES NOT REPRESENT OR WARRANT THAT THE INFORMATION AND ANY TRANSMISSIONS SENT FROM CSC IS FREE OF ANY HARMFUL COMPONENTS, INCLUDING BUT NOT LIMITED TO COMPUTER SOFTWARE VIRUSES. YOU HEREBY AGREE TO THE HEREINABOVE MENTIONED DISCLAIMERS.

TO THE FULLEST EXTENT PERMITTED BY LAW, CSC ON ITS OWN BEHALF AND ON BEHALF OF ITS OWNERS, DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, SUPPLIERS AND AFFILIATES EXCLUDE AND DISCLAIM LIABILITY FOR ANY LOSSES AND EXPENSES OF ANY NATURE WHATSOEVER, INCLUDING BUT NOT LIMITED TO DIRECT, INDIRECT, GENERAL, SPECIAL, PUNITIVE, INCIDENTAL OR CONSEQUENTIAL DAMAGES, LOSS OF USE, INCOME OR PROFIT, LOSS OF OR DAMAGE TO PROPERTY, CLAIMS OF THIRD PARTIES FOR INDEMNICATION OR SUBROGATION OR OTHERWISE WHETHER LIABILITY IS BASED UPON CONTRACT, TORT OR STRICT LIABILIY OR ANY OTHER BASIS. YOU AGREE TO THESE DISCLAIMERS BY USE OF THE WEBSITE SUBSCRIPTION.

APPLICABLE LAW IN SOME STATES MAY NOT ALLOW THE LIMITATION OF CERTAIN WARRANTIES, SO ALL OR PART OF THIS DISCLAIMER OF WARRANTIES MAY NOT APPLY TO YOU.

MANDATORY ARBITRATION AND WAIVER OF JURY TRIAL.

YOU AGREE THAT ANY AND ALL DISPUTES BETWEEN YOU AND CSC SHALL BE SUBJECT TO BINDING ARBITRATION PURSUANT TO THE FEDERAL ARBITRATION ACT OR COMPARABLE STATE ARBITRATION IF THE FEDERAL ACT IS FOR ANY REASON DETERMINED NOT TO BE AVAILABLE. IF NO STATE HAS SUCH ARBITRATION AVAILABLE THEN THE PARTIES HEREBY AGREE TO USE THE AMERICAN ARBITRATION ASSOCIATION SERVICES. THE VENUE FOR ANY SUCH ARBITRATION SHALL BE IN THE STATE OF TEXAS AND THE CITY OF AUSTIN.

YOU AGREE TO WAIVE YOUR RIGHT TO A COURT OR JURY TRIAL AND TO PARTICIPATE IN ANY CLASS ACTION.