Happy New Year and welcome to 2024! We wish all of our readers and their families a prosperous and healthy new year, and we thank you for being a part of our growing subscriber base.

We approach every report with the ultimate goal to help our subscribers make better decisions with their money when investing in the global markets. While we don’t ascribe to perfection, we think, our bigger inflection calls are as good or better than any publication out there for the price. We have our fundamental views of the macro-economic picture, but we also understand that the economy is not the stock market. This implies that just because the macro-economic picture is murky, that we won’t position long in the market’s instruments. We prioritize our signals before our opinions. Opinions don’t make you money in the stock market, being on the right side of the market does. We pride ourselves on identifying turning points at precise moments in major instruments. And because we are rooted in CMT theory, we believe that prices trend. Identifying and joining a trend as early as possible is how you make outsized returns.

The bottom line is we keep our readers on the right side of the market. Remember, making money in stocks is easy when you get the index direction correct.

In our Jan 2 report, we highlighted 3 major questions for the stock market:

Here is that excerpt:

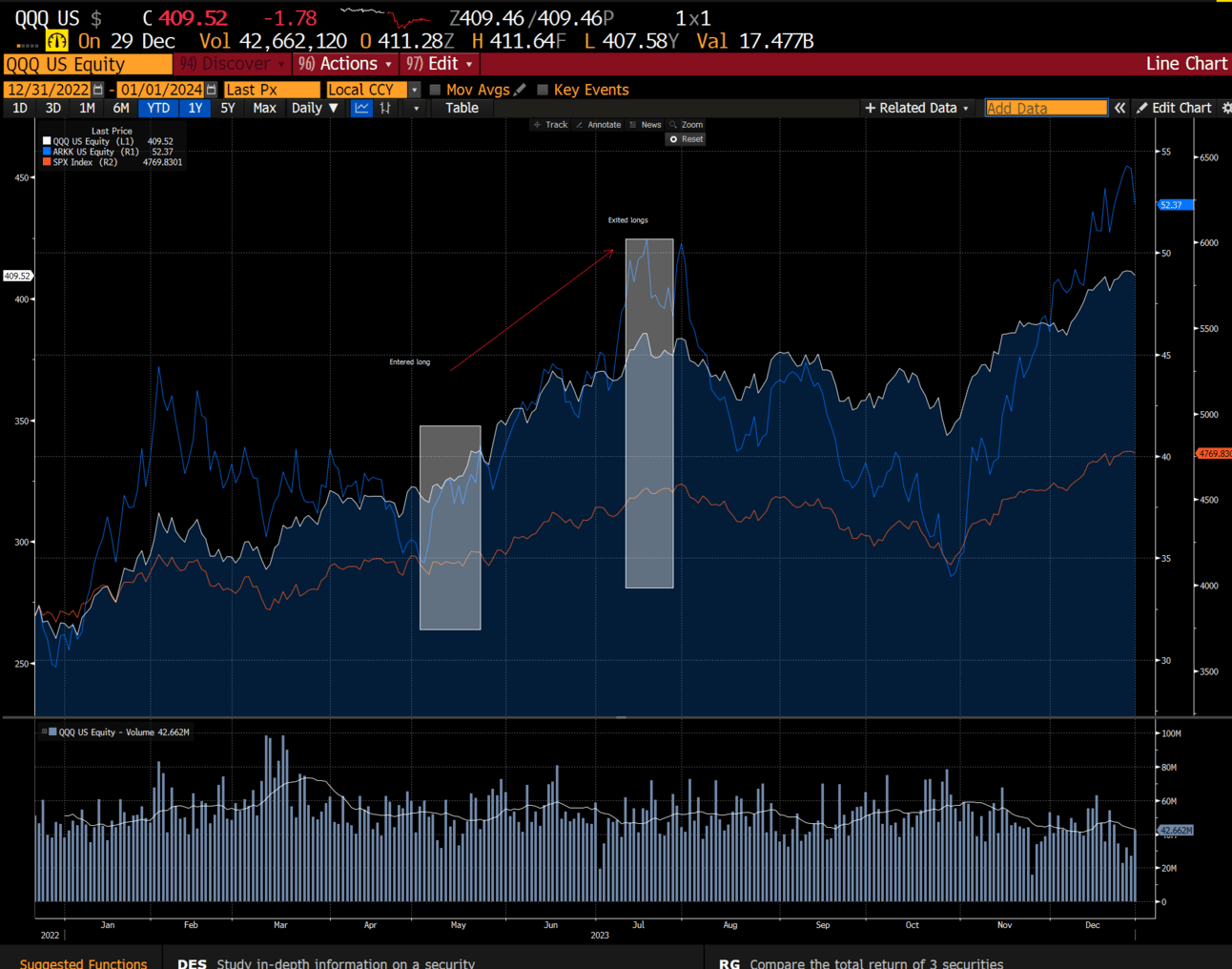

**Question 1: was answered at the last Dec FOMC meeting when Powell went full dovish and forecasted at least 3 interest rate cuts for 2024. Keep in mind the stock market is a discounting mechanism, so Powell’s actions were already being discounted in the market 6-9 months prior. This is a major reason why the stock market had such a banger year. Examining the chart below and you’ll notice the largest inflection in all the indexes occurred in the March-May time frame and in the 6-9 month discounting window highlighted above.

**Question 2: While we and most market participants believed a recession was imminent, that recession never came. The soft-landing narrative was debated all year as macro data continued to surprise to the upside. The end result was that the soft-landing theory had now become much more of a reality. This is something we’ve been discussing in recent reports as 6 month-inflation (PCE) is back to the Fed’s inflation target, while employment and personal spending remain strong. Recall our view isn’t to get the macro-economic picture right, it’s to define trend direction and profit from it, and that’s exactly what we did.

**Question 3: In our Jan 2nd report, we highlighted that forward SPX EPS estimates appeared too high and needed to be cut. This sets up a lower bar for exceeding those estimates, and actually can be considered bullish. Earnings estimates were being cut through Aug, and companies ended up surprising to the upside when they reported.

So now what? What are the biggest question marks for investors as we head into the New Year?

*The most glaring question is centered around the US presidential election and who will ultimately take the office?

Election years tend to be positive on an annual basis, but years where the incumbent is running are typically much more robust. This implies we should expect increased volatility as we exit Q1 and also as we approach the election in the fall.

*Will inflation reaccelerate forcing the Fed to question their interest rate path?

This is a CPI chart overlayed with DeMark signals, and one we have showcased many times and a reason we were leaning towards peaking inflation in the summer of ‘22. We are now possibly 3-4 months away from a combo 13 buy, implying the potential for a reversal.

If we apply a similar overlay to the PCE (Fed’s preferred inflation metric), we are actually 2 months away from a possible reversal signal (combo 13 buy).

*Will the last 2 years of interest rate hikes, that typically have a significant lag effect, create more macro-economic turbulence, forcing the Fed to cut rates faster than anticipated?

There is support to the notion that the current interest rate regime appears too restrictive.

We know that in the US there is an aggressive schedule of refinancing from companies rated B- or lower. The volume of loans increases notably from the 2nd Q of 2025, but corporate refinancing begins more than a year in advance to preempt the risk of rating downgrades. This gives the Fed more of a reason to cut faster as they want to desperately avoid a hard landing. Cutting rates much more aggressively than is forecast will certainly be a risk/off event.

Currently there is a 100% chance of 7 cuts (25bps for total of 1.75%) forecast for Jan ‘25. Thats quite the change of events from this past summer’s forecast. This is currently what the bond market is predicting, and certainly can be quite volatile and moves around with the macro data. What’s important to note is risk assets take their cue from the bond market, and thus any material change to this expectation will be met with increased volatility.

The 3 questions we posed above are very difficult questions to answer at the present time. This means, as typical, we should expect a higher volatility regime. Currently, the VIX is trading at multi-year lows, so there is obvious room for this to reverse.

But before we get into the meat of our analysis and how to be positioned into ‘24, let’s recap some of our barn-burner inflection calls this year:

*We went long in the late Dec ‘22 swoon into some of the large cap FANG+ names and other index/single stocks near the lows, positioning for a counter trend rally into Jan. As our tactically long bias was confirmed, we aggressively added more single stock positions as the month progressed. We then sold all of our exposure into the late Jan/Feb highs (20-50% returns on our allocation) and went tactically short.

Here are excerpts from our Feb 5th Macro Report:

Here is the SPX during that span. Remember, timing everything.

*Late Feb we closed out our tactical index shorts and started positioning long again in selective single stocks for presumed counter trend rallies. If you recall, March was the SVB crisis, which ultimately proved to be a buyable event. In mid-March, we also suggested buying money center banks ($XLF/$JPM/$BAC) which worked out handsomely.

*In early May we started positioning long back into growth names and did so up until early July. Coincidentally, we exited all of our acquired growth single stock exposure into the mid to end of July highs, while simultaneously repositioning into energy sector laggards.

And then exited those energy longs at the end of the summer.

*We called for the top in oil in September when the rest of the world was getting excessively bullish and suggested setting up short.

Here is the chart of oil:

*We called the top in rates in Oct when most of the world was calling for 6-7% Fed Fund rates.

Here is the 2-year treasury yield:

*We started positioning long equities into the late Oct weakness and pushed aggressively into the market after the Nov FOMC.

During that call to get long equities, we opted to buy into SMID caps, calling for the Mag7 to be a source of funds to fuel the rally. The Russell and the equal weight versions of the major indexes, outperformed by a wide margin with the Mag7/SPX pulling up the rear.

Here is the performance of the indexes over that time frame:

And a number of the single stock idea suggestions we presented since early Nov:

$DLTR +24%; $XLF +12%; $XBI +23%; $CHWY +19%; $JETS +15%; $TSM +7%; $SQ +32%; $FFTY +9%; $SMH +7.5%; $SMCI +10%; $BIDU -1%; $ARKK +23%; $BABA +7.5%; $AMD +20%; $ARM +25%.

Taking a step back and considering the outsized performance associated with these major inflection calls throughout the year; we have now confirmed that 2023 was the best year in our firm’s history. We take pride in being contrarian, which means we are not afraid to go against conventional wisdom, and taking these positions was anything but the consensus call you hear from most Wall Street firms, and big TV personalities.

We know you have a choice of what to read and the content you digest, and we can’t thank you enough for being a loyal part of our audience. Let’s make 2024 equally memorable and even more profitable.

If you are still considering whether our analysis provides enough value to be a premium subscriber, we hope this recap has helped frame the opportunity cost of abstaining. As we enter 2024, there will undoubtedly be increased cross currents and confusion associated with navigating the global markets. Our goal is to help you avoid landmines and be that voice of reason in a sea of mediocre analysis and forecasting. Please join us.