Last week in our midweek report we discussed how overheated the market had become and to start positioning defensively. That means tighten stops to protect gains and refrain from adding a lot of long exposure.

Here is an excerpt from the conclusion portion of that report.

We doubled down on getting defensive over the weekend in our weekly Macro Report and expanded on those thoughts. Here is the conclusion page from the report detailing that position.

The bout of weakness we are seeing is perfectly normal and should be considered healthy. If it turns into something bigger, we will address the weakness and turn even more cautious. For now, this still looks quite controlled.

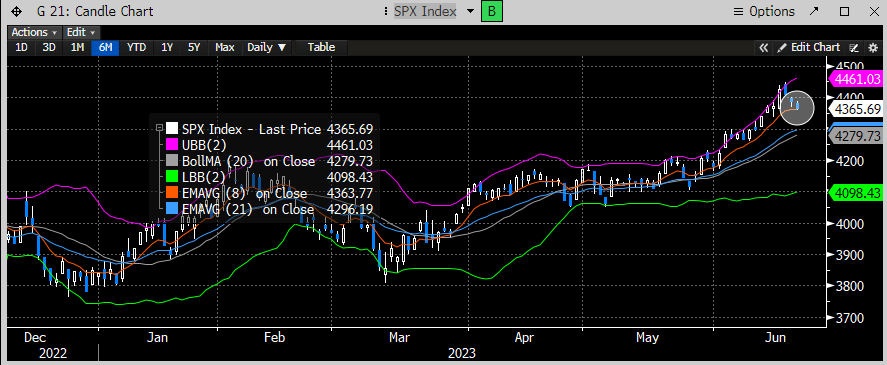

The SPX found support right at the 8 day EMA today.

The Nasdaq has been a bit weaker and lost the 8 day EMA.

Powell’s testimony was surely not going to change much, 1 week after giving it, so today’s reaction is just continuation of what we have been expecting. Currently the bond market is pricing in a 69% chance of a 25 bps hike next month and an 82% by Sept.

If this is just a controlled pull back, where do we think buyers will step in?