If you're as old as we are, you probably remember that classic Rolaids commercial from the 1970s with the tagline: “Rolaids spells relief.” Well, today the stock market finally got its dose of relief after a stretch of serious indigestion.

Midday, the Trump administration announced a major shift—rolling back tariffs to a blanket 10% for all non-retaliating countries (ex-China). As we’ve said repeatedly, this was the market’s biggest swing factor: if Trump showed flexibility and a willingness to compromise, the cloud of uncertainty could lift—and that’s exactly what happened. In effect, the “Trump put” is back on.

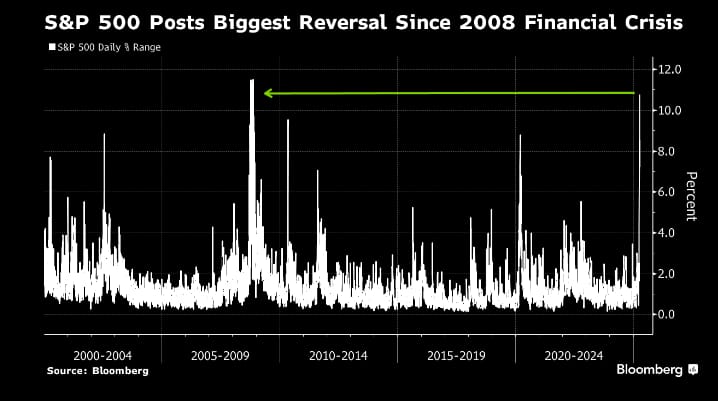

The result? The SPX soared 10%, and the Nasdaq rallied nearly 13%. These are massive, historic moves—essentially a full year’s worth of returns in a single session.

So, what drove the sudden about-face? Most likely, it was the bond market flashing warning signals. The 10-year yield spiked 65 basis points in just three days—an extraordinary move for what’s supposed to be one of the most stable instruments in the world. When Treasuries get that volatile, things break. It’s very likely the White House was hearing about growing collateral stress and acted to inject some much-needed confidence into the system.

Let’s call it like it is—our recent calls have been a grand slam. We pulled our tactical long bias in the 3/30 report just before the indexes shed another 10%, and this weekend, we flipped the script, recommending a return to risk in anticipation of a “sizeable counter-trend rally.”

Here’s the excerpt from our conclusion page:

You could call it luck—but we respectfully disagree. This is what we do. We’ve built our edge by identifying extremes and, more importantly, by waiting for signal alignment before pressing our conviction. As we noted over the weekend, we anticipated that alignment to materialize sometime this week.

Below is the excerpt outlining our expectation for the DeMark 13 buy signal to print:

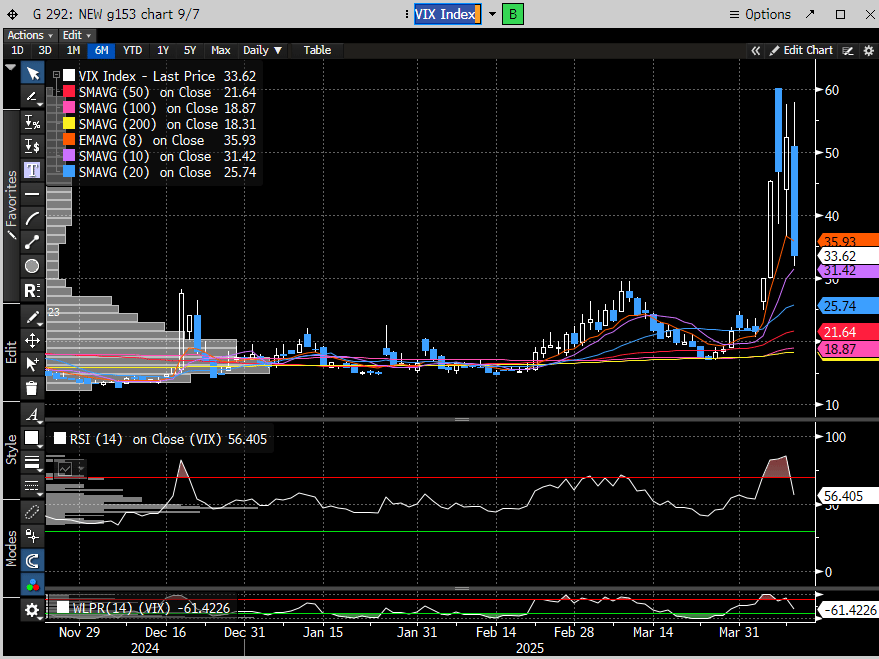

When markets reprice as violently as they did today, it often traps sellers and fuels additional upside. In our 4/6 report, we devoted significant attention to analyzing the VIX, noting it was due for a sharp reversal. This matters because volatility isn’t just a mood gauge—it’s a trigger. Quantitative and volatility-targeting funds use it to dictate exposure: as the VIX rises, they sell; as it falls, they buy. Nail the direction of volatility at inflection points, and you can front-run the market’s next move.

Today, the VIX posted the largest single-day decline in its history, plunging nearly 35%.

Does this mean the stock market is out of the woods? Probably not. The tariff relief is only temporary—just a 90-day reprieve—and China is still expected to respond to the recent hikes. But for now, the worst-case scenario has been taken off the table. That alone should help establish a floor under the market, at least long enough to enjoy a more peaceful Easter holiday.

Let’s review.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade