We do hope our readers appreciate the nimble nature of our approach to the stock market. While we have our views, and those views can be supported by macro or fundamental analysis, we also know how to listen to what the stock market is telling us.

We had been fairly cautious for all of Aug, and rightfully so as the indexes saw their biggest monthly drawdown since Feb (coincidentally where we also turned bearish after being very bullishly positioned for late Dec into the Feb peak). We are not here to pat ourselves on the back but merely to point out the plethora of one-dimensional analysis that exists, typically making definitive conclusions based on one or two rudimentary signals. There is nothing wrong with this type of analysis, we just prefer to have a higher probability of success, which means we need to conduct a more rigorous approach to directional index calls to derive enough confidence to make our conclusions.

While our cautious view of Aug proved to be correct, we quickly flipped back positive last Friday, after the post NVDA reversal. We clearly were not positive enough, but more importantly, we were not negative. Being on the right side of the market is what we do, and if you struggle to understand why the market is always doing the opposite of what you think should happen, then we can provide answers, or possibly a complement to challenge your thinking.

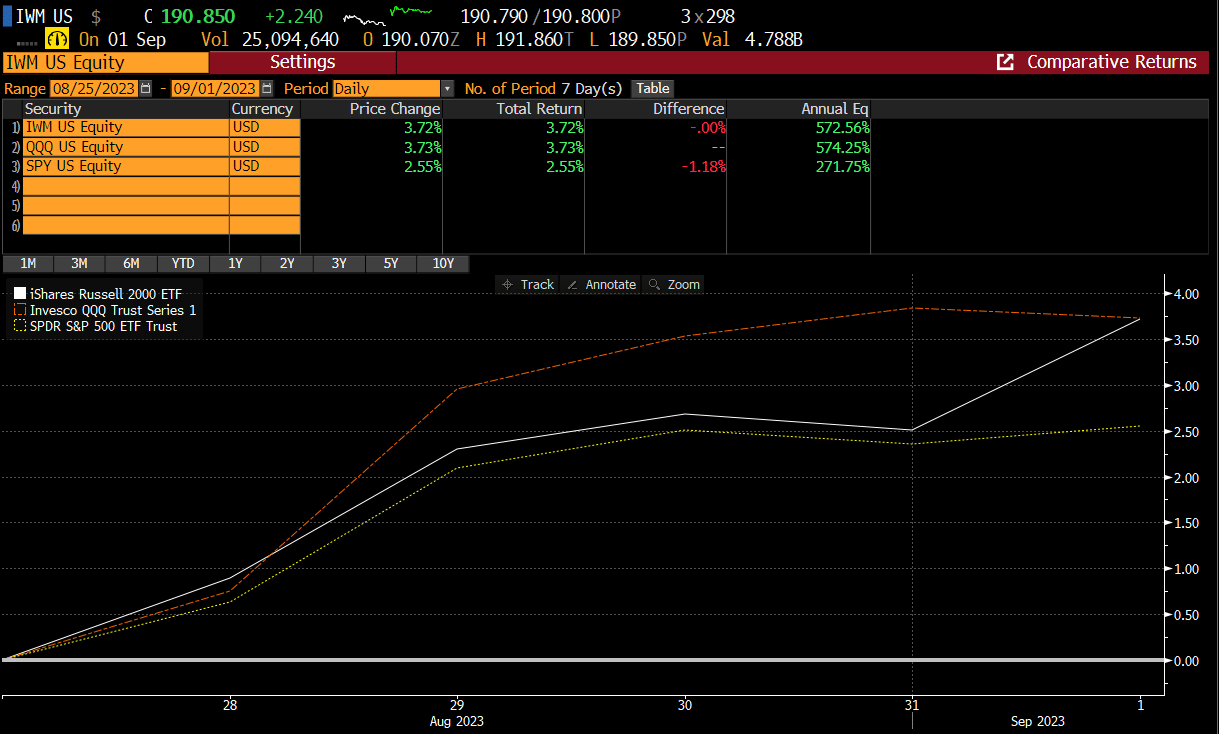

When we say we flipped positive, this means we started wading back into the long side of the market and expressed this through a long ($IWM) trade. While you could have chosen any of the index ETF’s last week and made money, we chose $IWM for what we perceived as the best R/R. That trade returned +3% in 1 week. For anyone that thinks a +3% index trade in 1 week isn’t a big deal, then they haven’t been doing this very long.

The index itself is only up +9% for the year, so last week’s gains are more than 1/3 of the entire years gain. This points to the importance of timing those swings, which we think we do as well as anyone.

We have a fairly strict methodology that helps us increase probabilities, but that methodology is centered around DeMarK analytics and reaching exhaustive levels before we feel more comfortable being a contrarian. We don’t always get those signals and thus have to readjust to more traditional methods to capture alpha. This implies we don’t catch every move, but we are adept enough to recognizing certain character changes in the market to still participate with most counter-trend direction.

Last week the macro data remained supportive for a future rate hike pause. We highlighted a number of the weaker than expected reports in last week’s mid-week report (link to the report: Coiled Spring Capital Mid-week report 8/30/23 (beehiiv.com))

We also got PCE and Payrolls last week, and both remained supportive of the soft-landing narrative. Narratives in the market are powerful as the market is always searching for one and until something changes to alter that narrative, it continues on, no matter how silly it might seem.

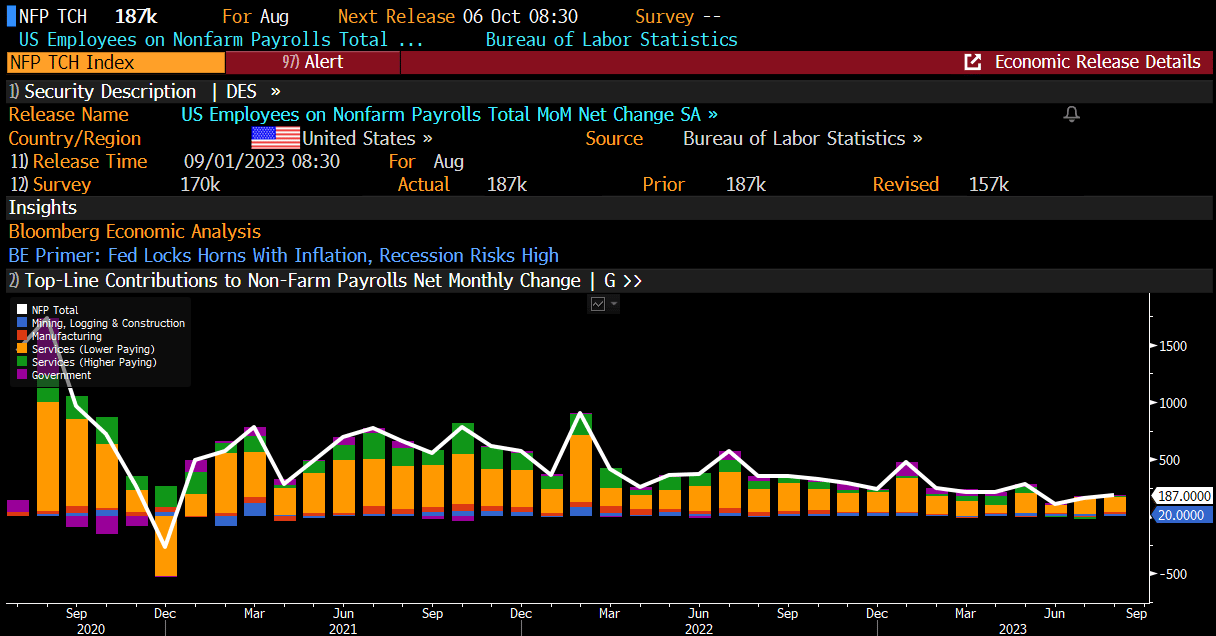

The PCE (Fed’s preferred gauge of inflation) report, was benign, with not enough movement to cause any hysterics, but the employment report was actually just what the doctor ordered. The 187K report was larger than expected but the 2 prior reports were significantly downgraded, leading to 110K fewer jobs being reported. This puts the 3-month average near 150K, and now below the Feb ‘20 level.

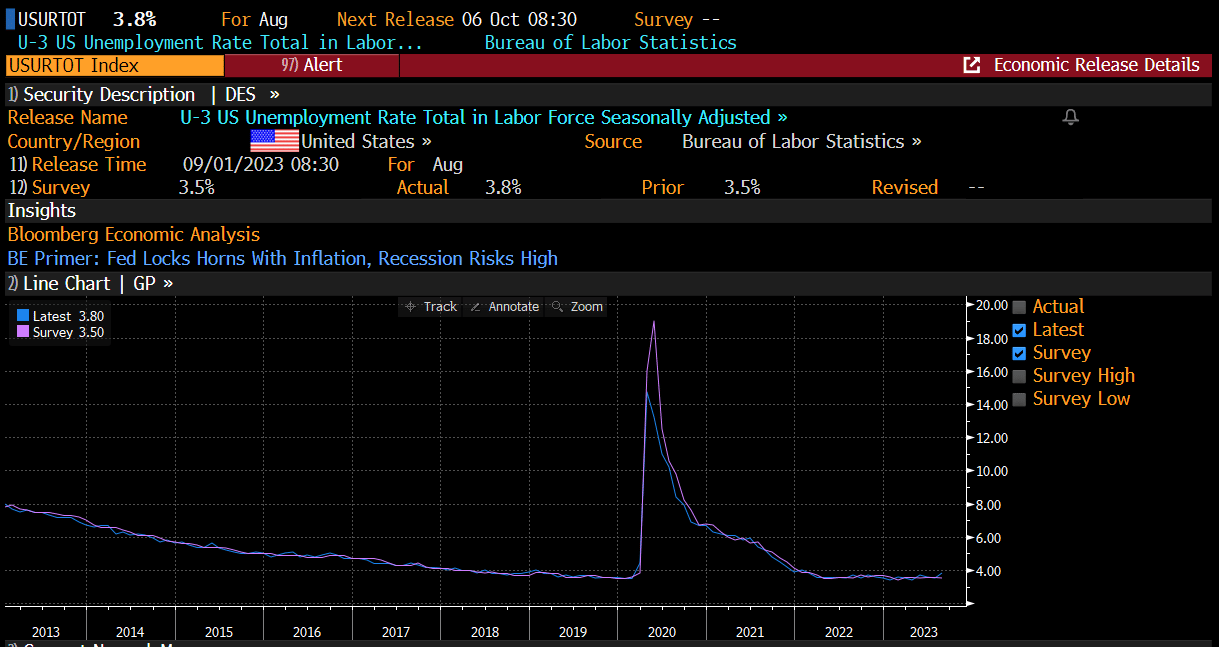

This caused the unemployment rate to jump to 3.8% from 3.5%, while labor force participation rose .2%, and its first increase since March.

In summary, this is a goldilocks scenario, with employment cooling and inflation subsiding. The US economy is still adding jobs, the labor supply is increasing, which means wage pressures should abate.

Remember the stock market is a discounting mechanism and the market started discounting the softer macro-economic data the day after the NVDA reversal. We don’t fight the market when it provides those clues, we aim to profit from them, but bears will fight those clues all the way to their own death, just to satisfy their own bearish bias. We think that is no way to live and we refuse to do it. We want to be on the right side of the market for as many days as possible, and that means being flexible and nimble when the market changes its tune.

Last week the indexes had one of their best weeks since June while Treasury yields retreated. This is no coincidence and one of the main reasons why the stock market powered forward. Ignore treasury yields, and you simply aren’t paying attention to what matters.

The 2 year notably broke down last week. This looks like a triple top with a UTL breach. Is it enough to make us think that rates can’t see a resurgence? Not yet, but it’s a start. Friday’s hammer candle to reclaim the 50 day does cast some doubt, so paying attention here is paramount. More on this in our premium section.

Bears will have you believe that higher interest costs will send corporate America into a tailspin of defaults, or at the very least dilute earnings and destroy business investment. While interest expenses are indeed on the rise, and it’s natural to make that assumption, the reality is interest expense for corporations are at the lowest levels since ‘09. I suggest you read that again because it dispels what some of the very well-known Wall Street Strategists and media pundits are out there publicly stating as key tenets to their bearish US economic narrative.

The truth is that interest-rate coverage ratios started from such a strong position in ‘22, that companies are not feeling the full effects of rising interest costs. If they manage to stay this elevated for the foreseeable future, then this will become problematic, but for now, it’s somewhat benign, as per Bloomberg economic analysis.

A big reason for this, is much of indebted corporate America took advantage of historically low interest rates over the past decade, and about 1/3 of investment grade corporate bonds have maturities of 10 years or more.

Similarly, many Americans did the same thing, locking in lower rates for cars and home loans. More than 40% of all US mortgages were originated in ‘20 or ‘21, when borrowing costs were at historic lows. Data from the NY Fed shows that 89% of consumer debt is shielded from variable interest rate fluctuations.

This explains quite a bit when you consider why the economy is still growing despite elevated borrowing rates.

This is also being evidenced in the forecasts for earnings. SPX 500 companies beat earnings by 3% during the 2nd Q, with margins driving beats across most sectors, according to Bank of America. Now these earnings estimates are inflecting adding credence to the notion that earnings have troughed.

Sure, these issues can become a problem at some point, but for now the draconian scenario that bears will paint with respect to corporate spending, bankruptcies, personal consumption falling off a cliff, seem misplaced.

For more analysis on how to think about the stock market and how to trade/invest, please consider subscribing below.